Answered step by step

Verified Expert Solution

Question

1 Approved Answer

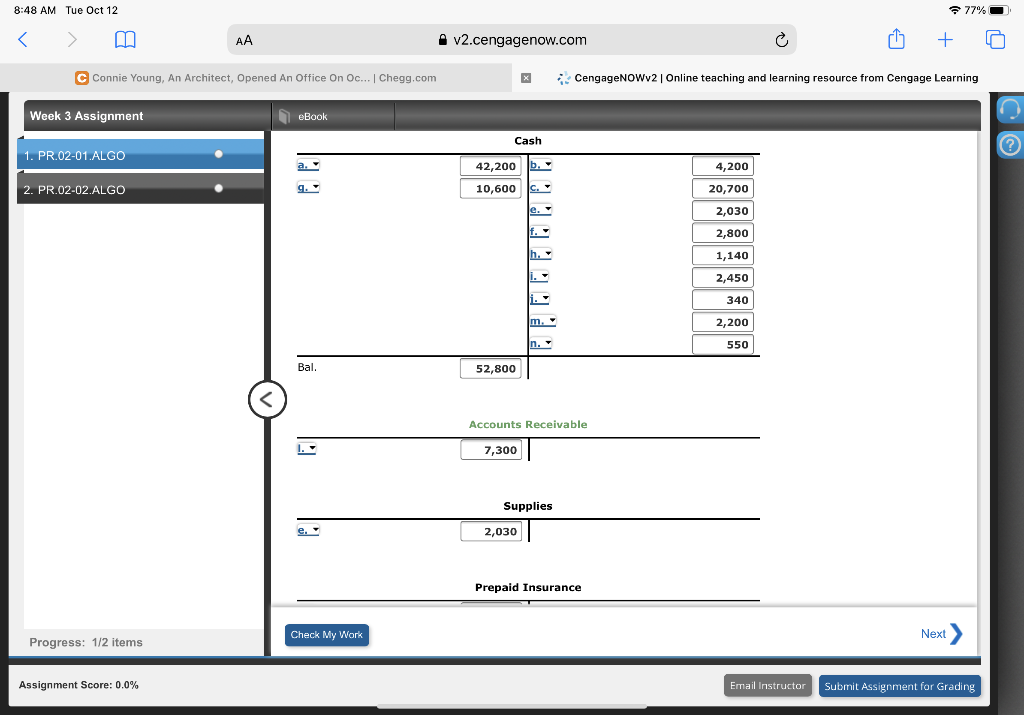

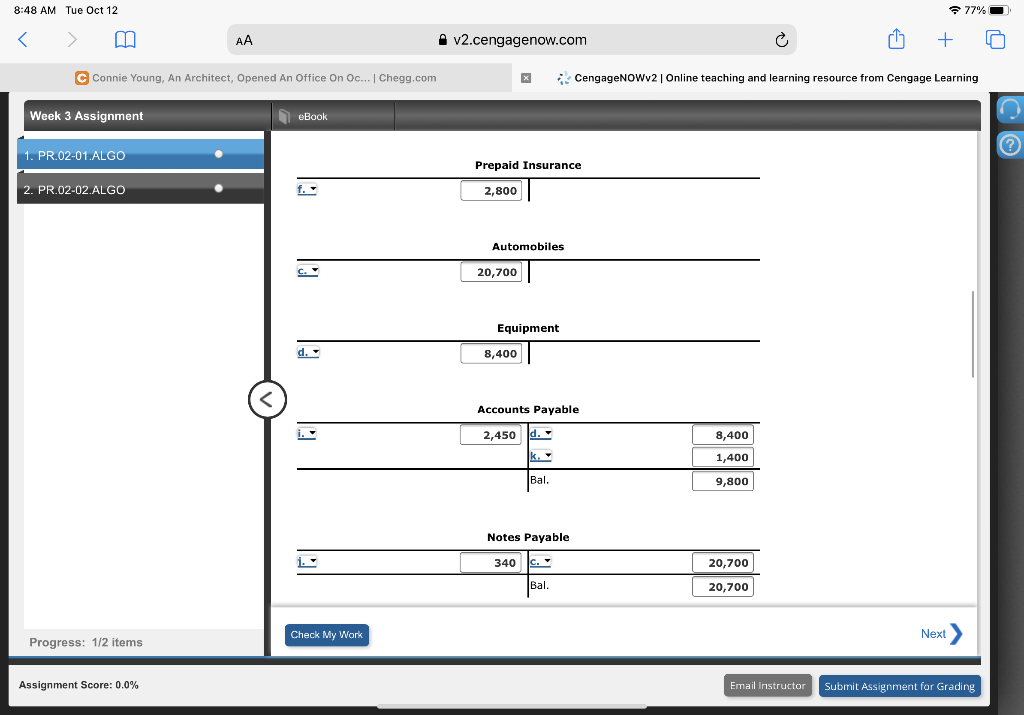

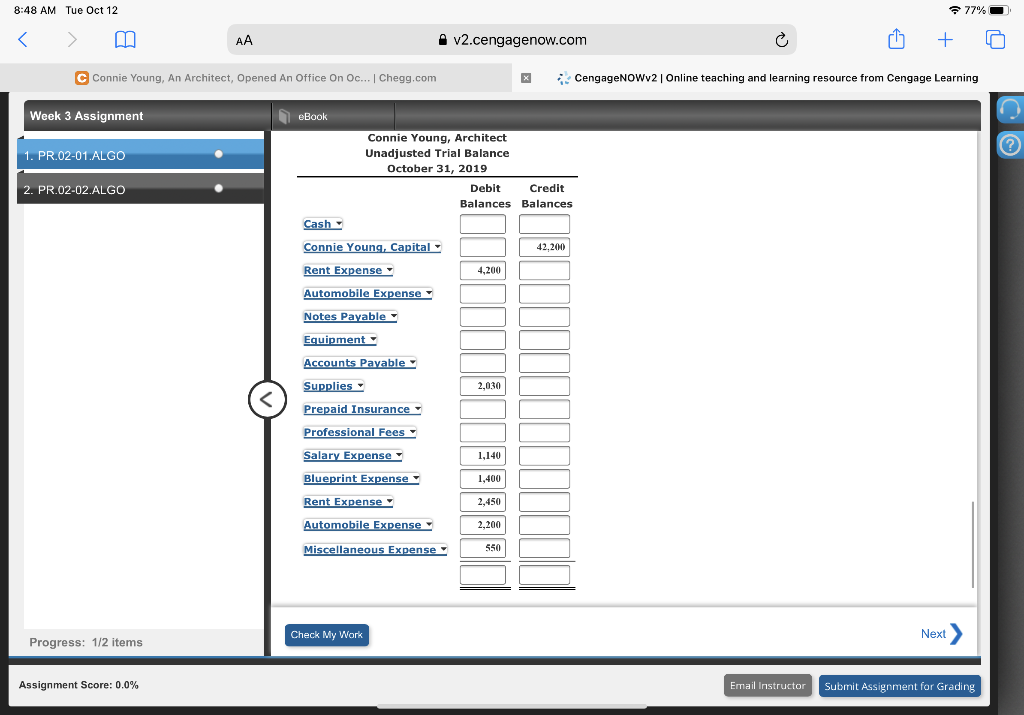

Connie Young, an architect, opened an office on October 1, 2019. During the month, she completed the following transactions connected with her professional practice: Transferred

Connie Young, an architect, opened an office on October 1, 2019. During the month, she completed the following transactions connected with her professional practice:

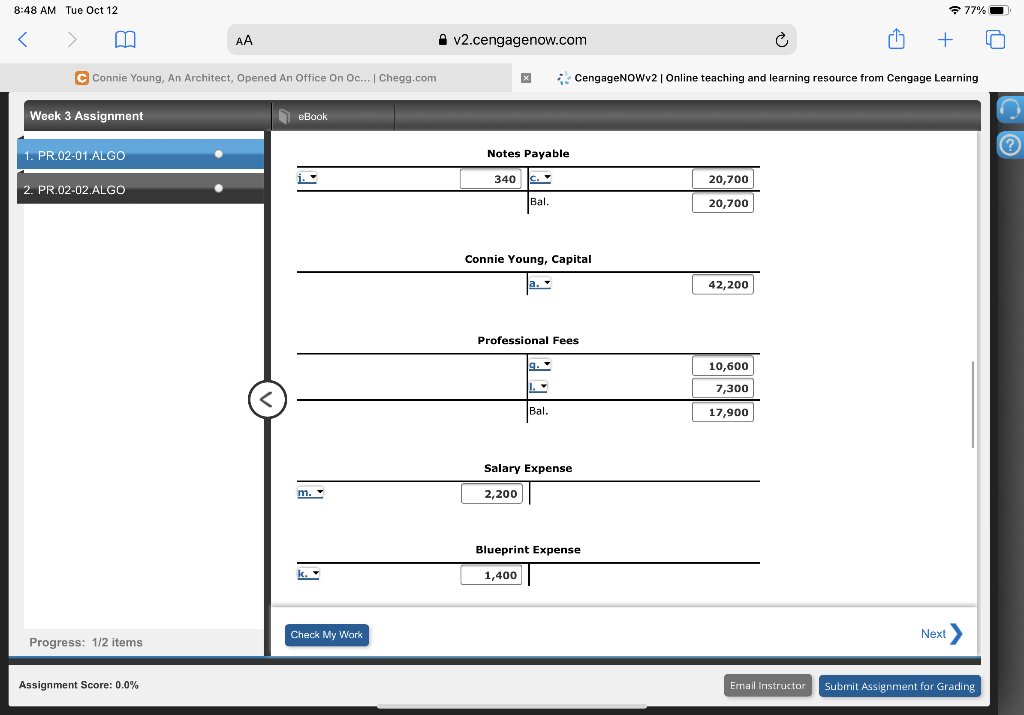

- Transferred cash from a personal bank account to an account to be used for the business, $42,200.

- Paid October rent for office and workroom, $4,200.

- Purchased used automobile for $27,000, paying $6,300 cash and giving a note payable for the remainder.

- Purchased office and computer equipment on account, $8,400.

- Paid cash for supplies, $2,030.

- Paid cash for annual insurance policies, $2,800.

- Received cash from client for plans delivered, $10,600.

- Paid cash for miscellaneous expenses, $1,140.

- Paid cash to creditors on account, $2,450.

- Paid $340 on note payable.

- Received invoice for blueprint service, due in November, $1,400.

- Recorded fees earned on plans delivered, payment to be received in November, $7,300.

- Paid salary of assistants, $2,200.

- Paid gas, oil, and repairs on automobile for October, $550.

Required:

1. Record the above transactions (in chronological order) directly into the T accounts. To the left of the amount entered in the accounts, select the appropriate letter to identify the transaction.

2. Determine account balances of the T accounts. Accounts containing a single entry only (such as Prepaid Insurance) do not need a balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started