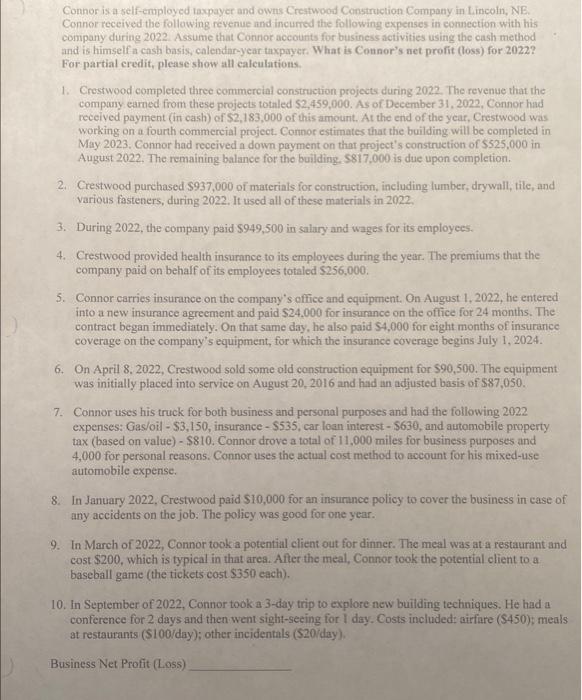

Connor is a self-employed taxpayer and owns Creatwood Construction Company in Lincoln, NE. Connor received the following revenue and incurred the following expenses in connection with his company during 2022 . Assume that Connor accounts for business activities using the cash method and is himself a cash basis, calendar-year taxpayer. What is Connor's net profit (loss) for 2022? For partial credit, please show all calculations. 1. Crestwood completed three commercial construction projects during 2022. The revenue that the company earned from these projects totaled \$2,459,000. As of December 31, 2022, Connor had received payment (in cash) of $2,183,000 of this amount. At the end of the year, Crestwood was working on a fourth commercial project. Connor estimates that the building will be completed in May 2023. Connor had received a down payment on that project's construction of $525,000 in August 2022. The remaining balance for the building, 5817.000 is due upon completion. 2. Crestwood purchased $937,000 of materials for construction, including lumber, drywall, tile, and various fasteners, during 2022 . It used all of these materials in 2022 . 3. During 2022, the company paid $949,500 in salary and wages for its employees. 4. Crestwood provided health insurance to its employees during the year. The premiums that the company paid on behalf of its employees totaled $256,000. 5. Connor carries insurance on the company's office and equipment. On August 1, 2022, he entered into a new insurance agrecment and paid $24,000 for insurance on the office for 24 months. The contract began immediately. On that same day, he also paid $4,000 for eight months of insurance coverage on the company's equipment, for which the insurance coverage begins July 1, 2024. 6. On April 8. 2022, Crestwood sold some old construction equipment for $90,500. The equipment was initially placed into service on August 20, 2016 and had an adjusted basis of $87,050. 7. Connor uses his truck for both business and personal purposes and had the following 2022 expenses: Gas/oil - $3,150, insurance - $535, car loan interest - $630, and automobile property tax (based on value) - $810. Connor drove a total of 11,000 miles for business purposes and 4,000 for personal reasons. Connor uses the actual cost method to account for his mixed-use automobile expense. 8. In January 2022, Crestwood paid $10,000 for an insurance policy to cover the business in case of any accidents on the job. The policy was good for one year. 9. In March of 2022, Connor took a potential client out for dinner. The meal was at a restaurant and cost \$200, which is typical in that area. After the meal, Connor took the potential client to a baseball game (the tickets cost $350 cach). 10. In September of 2022, Connor took a 3-day trip to explore new building techniques, He had a conference for 2 days and then went sight-seeing for 1 day. Costs included: airfare ($450); meals at restaurants ( $100/ day); other incidentals (\$20/day). Business Net Profit (Loss)