Question

Conor turned 48 years old in July this year and owns Kelly's Bar & Grill (known as Kelly's). Conor is in fairly good health, despite

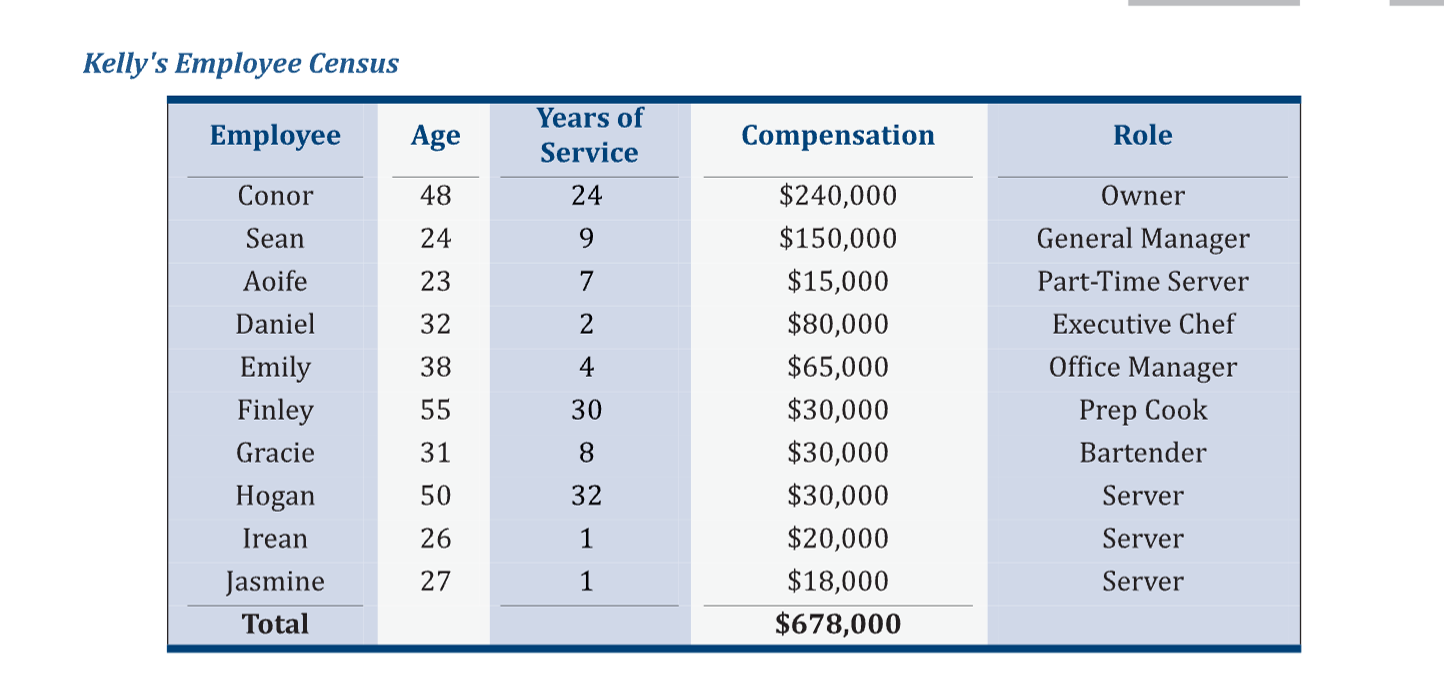

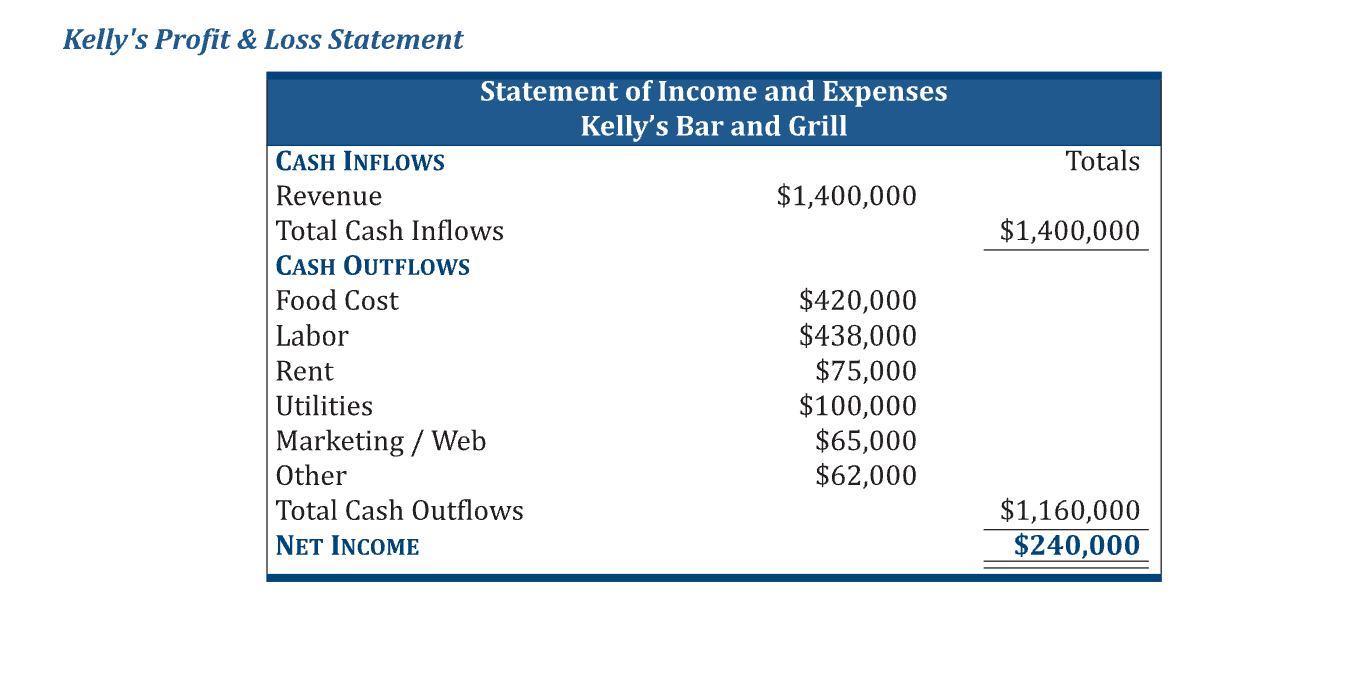

Conor turned 48 years old in July this year and owns Kelly's Bar & Grill (known as "Kelly's"). Conor is in fairly good health, despite drinking too much alcohol. He enjoys running Kelly's, which produces a healthy profit. Cara is 47 years old, as of January, and is a speech therapist at a Catholic elementary school making $75,000 per year. She has worked there for the last 20 years. Cara has diabetes but is otherwise in reasonably good health. Conor and Cara have been married for 22 years. Although Conor never went to college, Cara graduated from the Ohio State University. They have two children, Sean age 24, and Aoife, age 23. Sean is working at Kelly's and recently got married to Sam. Aoife is studying nursing in graduate school. Sam is 26 and working as a chemical engineer at Shell, after graduating with from USC. Sean and Sam met while at Mardi Gras in New Orleans a few years ago. Conor's parents died in a small airplane crash while vacationing in Ireland. Conor's dad was a pilot in the U.S. Air Force and flew as a hobby. It was a tragic death. Cara's parents, on the other hand, are healthy and are expected to live to be 100 years old. They decided to move in across the street from Conor and Cara. Being in the "bar" business much of his life, Conor has developed a love for music and has amassed quiet a collection of music and guitars.

Kelly's Bar & Grill (Kelly's)

Conor bought Kelly's 24 years ago when Sean was born. He realized he needed a steadier source of income and has worked to improve it over the years. Conor never incorporated the business but does have a separate checking account that he manages for the business. Sean started working as a bus boy at Kelly's when he was 15 years old. He started full time at Kelly's after dropping out of his first year of college. Sean has made dramatic improvements to the bar over the last two years. He has upgraded the inside and outside of the building and, most importantly, brought in a young, energetic chef who has drastically improved the food menu. Kelly's was more of a bar for locals but is now more of a "grill" with great drinks and great food. Sean even helped Kelly's get the attention of several TV food shows. The expanded building now includes a snooker room and an area for darts. The new snooker league and a dart league helps increase nighttime customers.

Retirement Planning

Conor inherited a Roth IRA from his mom when she died in 2019. At the end of last year, the IRA had a balance of $255,000. Conor also started contributing to his first Roth IRA three years ago. That account has a balance of $20,000. Cara has a 403(b) plan at school. The balance in the account is $350,000. She has not contributed the maximum every year but is now contributing $15,000.

1. Sean implemented an HSA for Kelly's a couple of years ago. If Sean had $15,000 in the HSA, could he use it as part of a down payment on a house?

2. If Kelly's set up a profit-sharing plan and contributed 25 percent for the employees, how much would Sean and Conor receive?

3. If Kelly's set up a profit-sharing plan, could they exclude the servers from the plan?

4. If Kelly's adopted a qualified plan, would vesting begin as of the adoption date?

5. Describe the minimum distribution requirements for Conor for the inherited Roth IRA. How are distributions from the Roth IRA taxed?

6. Could Conor take a distribution from his Roth IRA? How much could he take and how would it be taxed?

7. There was a fight in the bar about a year ago and one of the two people involved was severely injured. Sean called the police as soon as the altercation started and there did not appear to be any fault on the bar. As is common, Kelly's was also named in the lawsuit as a defendant. Discuss the credit risks Conor faces, including his IRAs and Cara's retirement plan.

8. One of Conor's neighbors asks him if he set up Roth IRAs for his kids when they started working at Kelly's when they were around 16 years old. What would you tell Conor about whether that is possible or not?

Kelly's Employee Census Kelly's Profit \& Loss Statement Kelly's Employee Census Kelly's Profit \& Loss StatementStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started