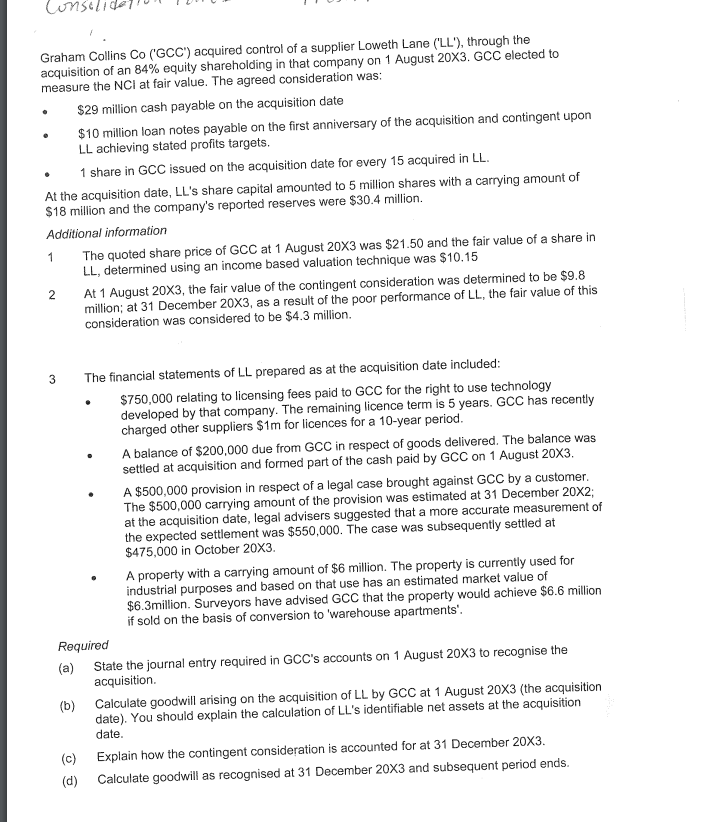

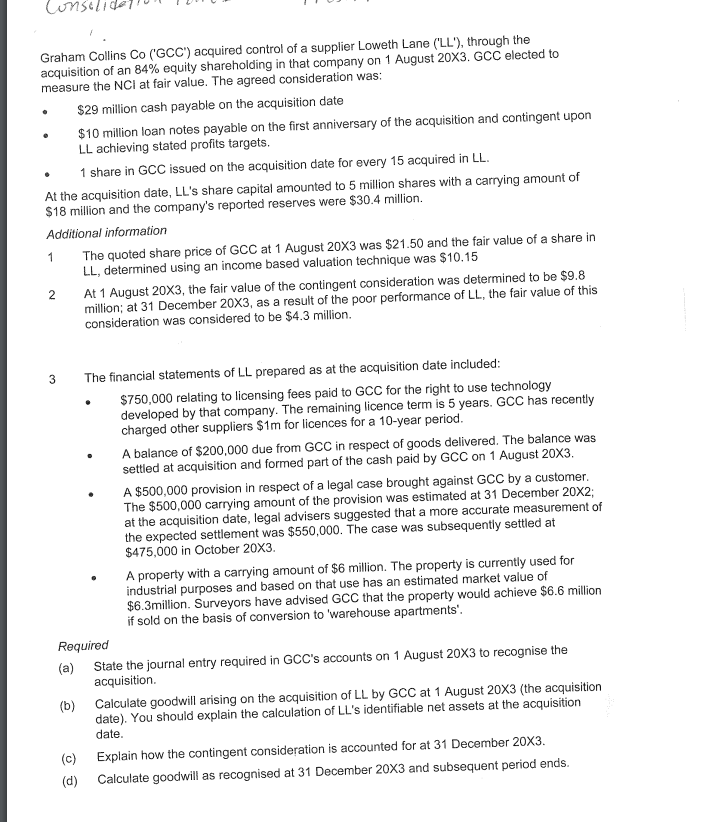

Consell Graham Collins Co ("GCC") acquired control of a supplier Loweth Lane ('LL"), through the acquisition of an 84% equity shareholding in that company on 1 August 20X3. GCC elected to measure the NCI at fair value. The agreed consideration was: $29 million cash payable on the acquisition date $10 million loan notes payable on the first anniversary of the acquisition and contingent upon LL achieving stated profits targets. 1 share in GCC issued on the acquisition date for every 15 acquired in LL. At the acquisition date, LL's share capital amounted to 5 million shares with a carrying amount of $18 million and the company's reported reserves were $30.4 million. Additional information The quoted share price of GCC at 1 August 20X3 was $21.50 and the fair value of a share in LL, determined using an income based valuation technique was $10.15 2 At 1 August 20X3, the fair value of the contingent consideration was determined to be $9.8 million; at 31 December 20X3, as a result of the poor performance of LL, the fair value of this consideration was considered to be $4.3 million. 1 3 The financial statements of LL prepared as at the acquisition date included: $750,000 relating to licensing fees paid to GCC for the right to use technology developed by that company. The remaining licence term is 5 years. GCC has recently charged other suppliers $1m for licences for a 10-year period. A balance of $200,000 due from GCC in respect of goods delivered. The balance was settled at acquisition and formed part of the cash paid by GCC on 1 August 20x3. A $500,000 provision in respect of a legal case brought against GCC by a customer. The $500,000 carrying amount of the provision was estimated at 31 December 20X2; at the acquisition date, legal advisers suggested that a more accurate measurement of the expected settlement was $550,000. The case was subsequently settled at $475,000 in October 20X3. A property with a carrying amount of $6 million. The property is currently used for industrial purposes and based on that use has an estimated market value of $6.3million. Surveyors have advised GCC that the property would achieve $6.6 million if sold on the basis of conversion to 'warehouse apartments'. Required (a) State the journal entry required in GCC's accounts on 1 August 20x3 to recognise the acquisition. (b) Calculate goodwill arising on the acquisition of LL by GCC at 1 August 20X3 (the acquisition date). You should explain the calculation of LL's identifiable net assets at the acquisition date. (c) Explain how the contingent consideration is accounted for at 31 December 20X3. (d) Calculate goodwill as recognised at 31 December 20x3 and subsequent period ends