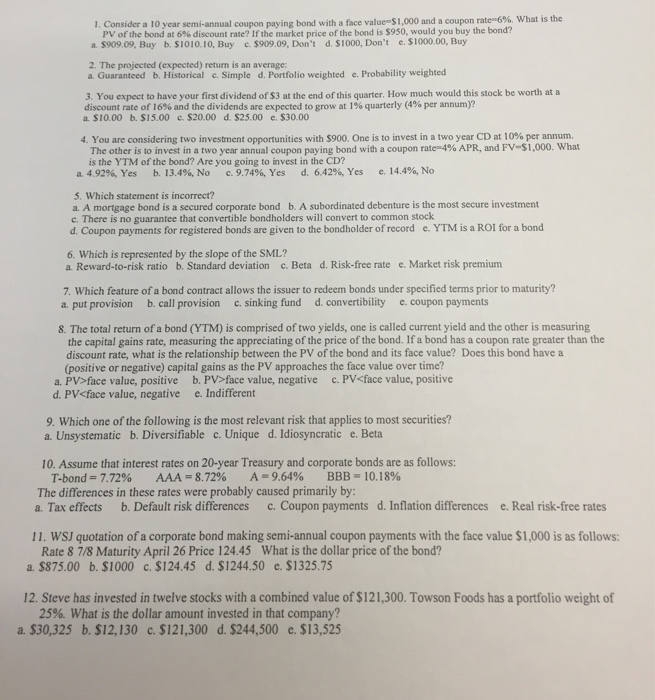

Consider a 10 year semi-annual coupon paying bond with a face value-$1,000 and a coupon rate=6%. What is the PV of the bond at 6% discount rate? If the market price of the bond is $950, would you buy the bond? The projected (expected) return is an average: Guaranteed Historical Simple Portfolio weighted Probability weighted You expect to have your first dividend of $3 at the end of this quarter. How much would this stock be worth at a discount rate of 16% and the dividends are expected to grow at 1% quarterly (4% per annum)? $10 00 $15.00 $20.00 $25 00 $30.00 You are considering two investment opportunities with $900. One is to invest in a two year CD at 10% per annum. The other is to invest in a two year annual coupon paying bond with a coupon rate=4% APR, and FV=$1,000. What is the YTM of the bond? Are you going to invest in the CD? Which statement is incorrect? A mortgage bond is a secured corporate bond A subordinated debenture is the most secure investment There is no guarantee that convertible bondholders will convert to common stock Coupon payments for registered bonds are given to the bondholder of record YTM is a ROl for a bond Which is represented by the slope of the SML? Reward-to-risk ratio Standard deviation Beta Risk-free rate c Market risk premium Which feature of a bond contract allows the issuer to redeem bonds under specified terms prior to maturity? put provision call provision sinking fund convertibility coupon payments The total return of a bond (YTM) is comprised of two yields, one is called current yield and the other is measuring the capital gains rate, measuring the appreciating of the price of the bond. If a bond has a coupon rate greater than the discount rate, what is the relationship between the PV of the bond and its face value? Does this bond have a (positive or negative) capital gains as the PV approaches the face value over time? Which one of the following is the most relevant risk that applies to most securities? Unsystematic Assume that interest rates on 20-year Treasury and corporate bonds are as follows: The differences in these rates were probably caused primarily by: Tax effects Default risk differences Coupon payments Inflation differences Real risk-free rates WSJ quotation of a corporate bond making semi-annual coupon payments with the face value $1,000 is as follows. Rate 8 1/8 Maturity April 26 Price 124.45 What is the dollar price of the bond? $875.00 $1000 $124.45 $1244.50 $1325.75 Steve has invested in twelve stocks with a combined value of $121,300. Towson Foods has a portfolio weight of 25%. What is the dollar amount invested in that company? $30,325 $12,130 $121,300 $244,500 $13,525