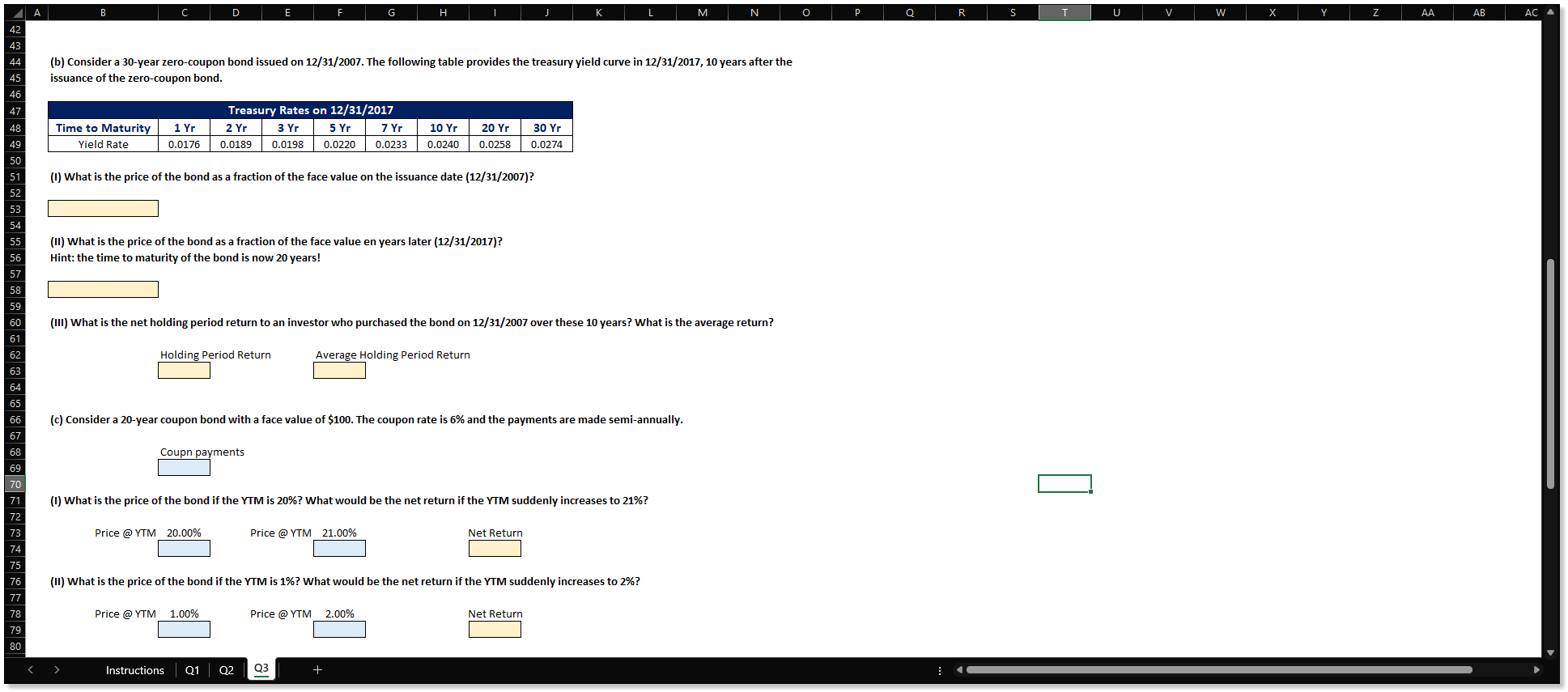

Consider a 30-year zero-coupon bond issued on 12/31/2007. The following table provides the treasury yield curve in 12/31/2017, 10 years after the issuance of the zero-coupon bond.

(I) What is the price of the bond as a fraction of the face value on the issuance date (12/31/2007)?

(II) What is the price of the bond as a fraction of the face value en years later (12/31/2017)? Hint: the time to maturity of the bond is now 20 years!

(III) What is the net holding period return to an investor who purchased the bond on 12/31/2007 over these 10 years? What is the average return?

(I) What is the price of the bond if the YTM is 20%? What would be the net return if the YTM suddenly increases to 21%?

(b) Consider a 30-year zero-coupon bond issued on 12/31/2007. The following table provides the treasury yield curve in 12/31/2017, 10 years after the issuance of the zero-coupon bond. (I) What is the price of the bond as a fraction of the face value on the issuance date (12/31/2007)? (II) What is the price of the bond as a fraction of the face value en years later (12/31/2017)? Hint: the time to maturity of the bond is now 20 years! (III) What is the net holding period return to an investor who purchased the bond on 12/31/2007 over these 10 years? What is the average return? Holding Period Return Average Holding Period Return (c) Consider a 20-year coupon bond with a face value of $100. The coupon rate is 6% and the payments are made semi-annually. Coubn bavments (I) What is the price of the bond if the YTM is 20% ? What would be the net return if the YTM suddenly increases to 21% ? Price @YTM 20.n0\%_ Price@YTM 21.00\%_Not Ratrn (II) What is the price of the bond if the YTM is 1\%? What would be the net return if the YTM suddenly increases to 2\%? Price@YTM 1 nn\% Price @YTM 2.00\% Nat Ratrn (b) Consider a 30-year zero-coupon bond issued on 12/31/2007. The following table provides the treasury yield curve in 12/31/2017, 10 years after the issuance of the zero-coupon bond. (I) What is the price of the bond as a fraction of the face value on the issuance date (12/31/2007)? (II) What is the price of the bond as a fraction of the face value en years later (12/31/2017)? Hint: the time to maturity of the bond is now 20 years! (III) What is the net holding period return to an investor who purchased the bond on 12/31/2007 over these 10 years? What is the average return? Holding Period Return Average Holding Period Return (c) Consider a 20-year coupon bond with a face value of $100. The coupon rate is 6% and the payments are made semi-annually. Coubn bavments (I) What is the price of the bond if the YTM is 20% ? What would be the net return if the YTM suddenly increases to 21% ? Price @YTM 20.n0\%_ Price@YTM 21.00\%_Not Ratrn (II) What is the price of the bond if the YTM is 1\%? What would be the net return if the YTM suddenly increases to 2\%? Price@YTM 1 nn\% Price @YTM 2.00\% Nat Ratrn