Question

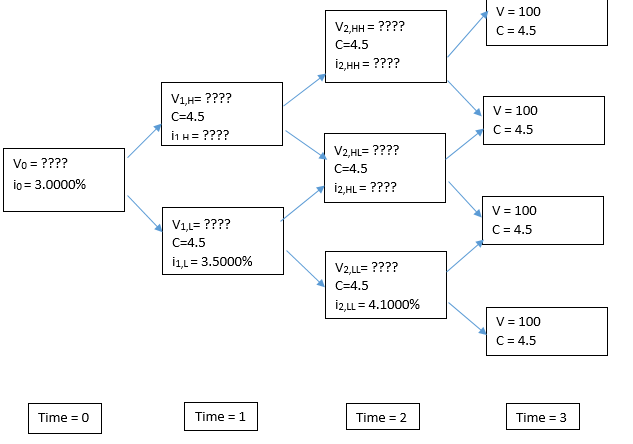

Consider a 3-year, 4.5% annual coupon bond represented by the binomial interest rate tree on the following page. The bond is put-able at par starting

Consider a 3-year, 4.5% annual coupon bond represented by the binomial interest rate tree on the following page. The bond is put-able at par starting at the end of year 1. The one-year benchmark implied forward rates are provided for one node of each year of the bond. The bonds OAS is 40 basis points. Assume that the interest rate volatility = 10%. Please complete the tree, filling in the interest rates and the value of the bond at each node (wherever a ???? occurs, fill in an answer). Remember to adjust the benchmark rates with the OAS after all of the benchmark rates in the tree have been determined. Note that each node except the one at time=0 represents the payment of a 4.5% coupon, so be sure to include that in the valuation. Show your supporting work in the space below.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started