Question

Consider a bank that holds government bonds and consumer loans as assets. In particular, the bank holds a zero-coupon government bond with maturity of 10

Consider a bank that holds government bonds and consumer loans as assets. In particular, the bank holds a zero-coupon government bond with maturity of 10 years that promises to pay 15m in year 10. The banks loan portfolio matures in 2 years: it pays 2m in the first year and 12m at the end of the 2nd year.

Consider a bank that holds government bonds and consumer loans as assets. In particular, the bank holds a zero-coupon government bond with maturity of 10 years that promises to pay 15m in year 10. The banks loan portfolio matures in 2 years: it pays 2m in the first year and 12m at the end of the 2nd year.

The bank has 20m (present value) worth of liabilities with an average duration of 4 years.

The risk-free interest rate is 5%.

a) What is the (present) value of banks assets? What is the value of banks equity?

b) What is the average duration of the banks assets?

c) What change in the interest rate would make the bank insolvent?

d) How can the bank eliminate interest rate risk? Explain the possibilities in this case. Keeping everything else the same, what should the duration of the banks liabilities be to make the banks value insensitive to changes in the interest rate?

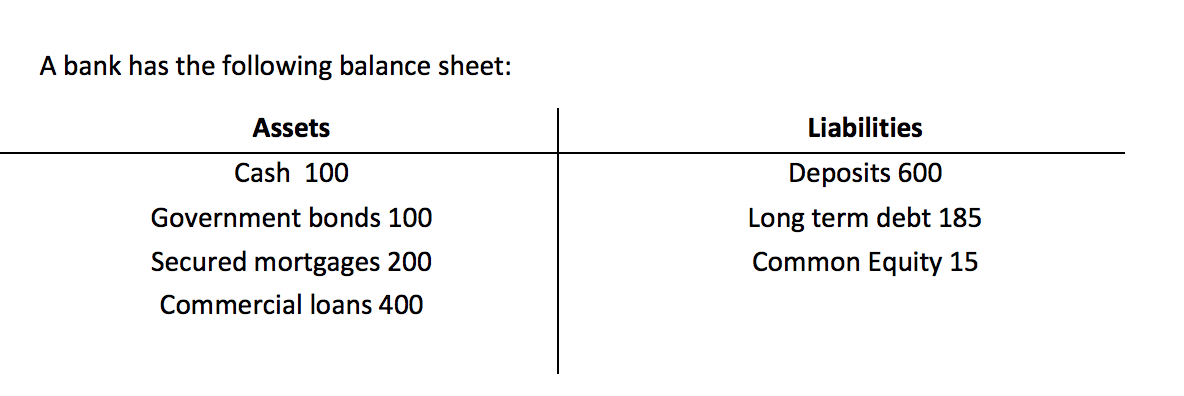

A bank has the following balance sheet: Assets Cash 100 Liabilities Deposits 600 Long term debt 185 Common Equity 15 Government bonds 100 Secured mortgages 200 Commercial loans 400 A bank has the following balance sheet: Assets Cash 100 Liabilities Deposits 600 Long term debt 185 Common Equity 15 Government bonds 100 Secured mortgages 200 Commercial loans 400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started