Answered step by step

Verified Expert Solution

Question

1 Approved Answer

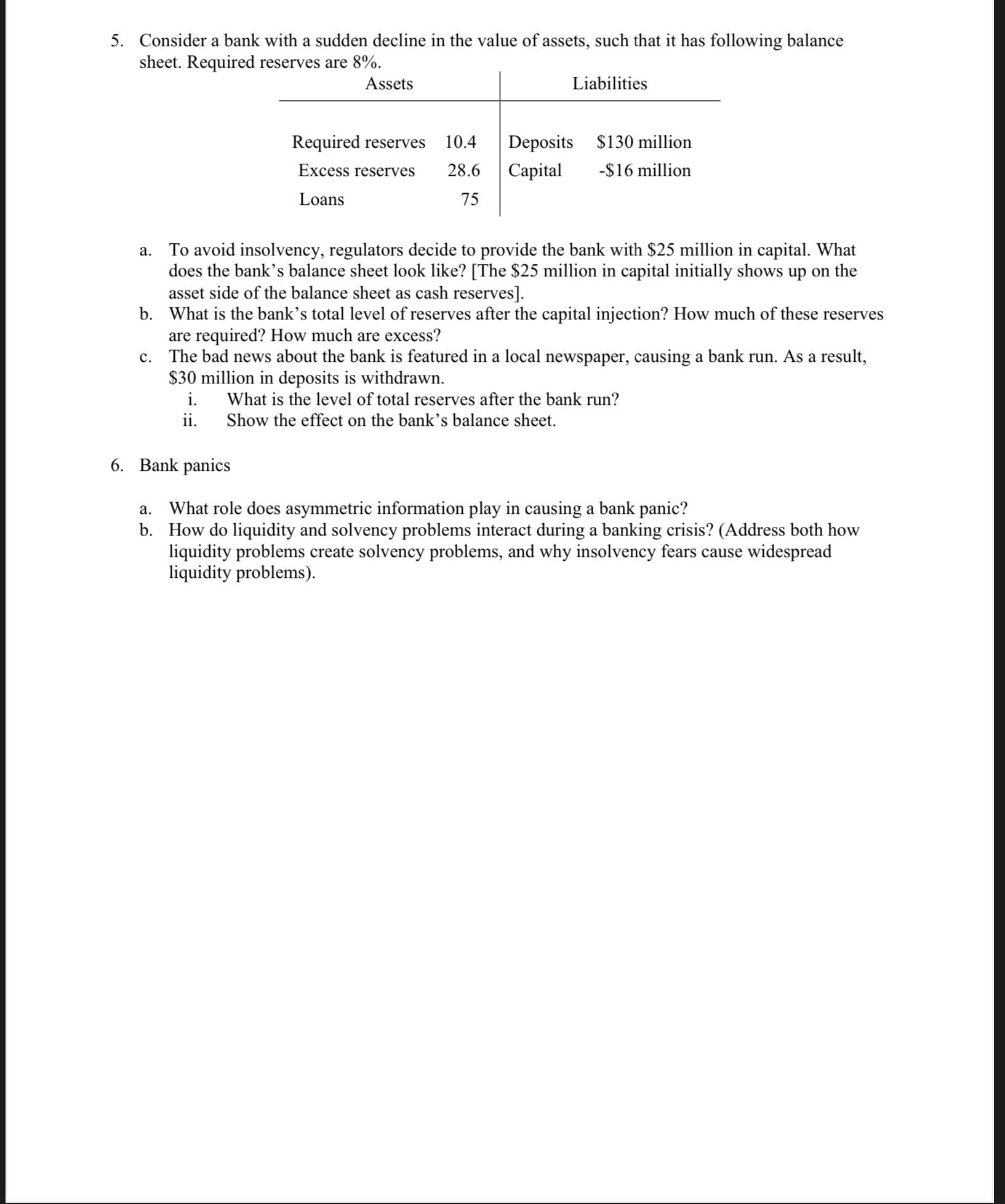

Consider a bank with a sudden decline in the value of assets, such that it has following balance sheet. Required reserves are 8 % .

Consider a bank with a sudden decline in the value of assets, such that it has following balance sheet. Required reserves are

tableAssetsLiabilitiesRequired reserves,Deposits,$ millionExcess reserves,Capital,$ millionLoans

a To avoid insolvency, regulators decide to provide the bank with $ million in capital. What does the bank's balance sheet look like? The $ million in capital initially shows up on the asset side of the balance sheet as cash reserves

b What is the bank's total level of reserves after the capital injection? How much of these reserves are required? How much are excess?

c The bad news about the bank is featured in a local newspaper, causing a bank run. As a result, $ million in deposits is withdrawn.

i What is the level of total reserves after the bank run?

ii Show the effect on the bank's balance sheet.

Bank panics

a What role does asymmetric information play in causing a bank panic?

b How do liquidity and solvency problems interact during a banking crisis? Address both how liquidity problems create solvency problems, and why insolvency fears cause widespread liquidity problems

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started