Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a bond that has a par value of 20 points $1,000, pays $50 at the end of each year in coupon payments, and

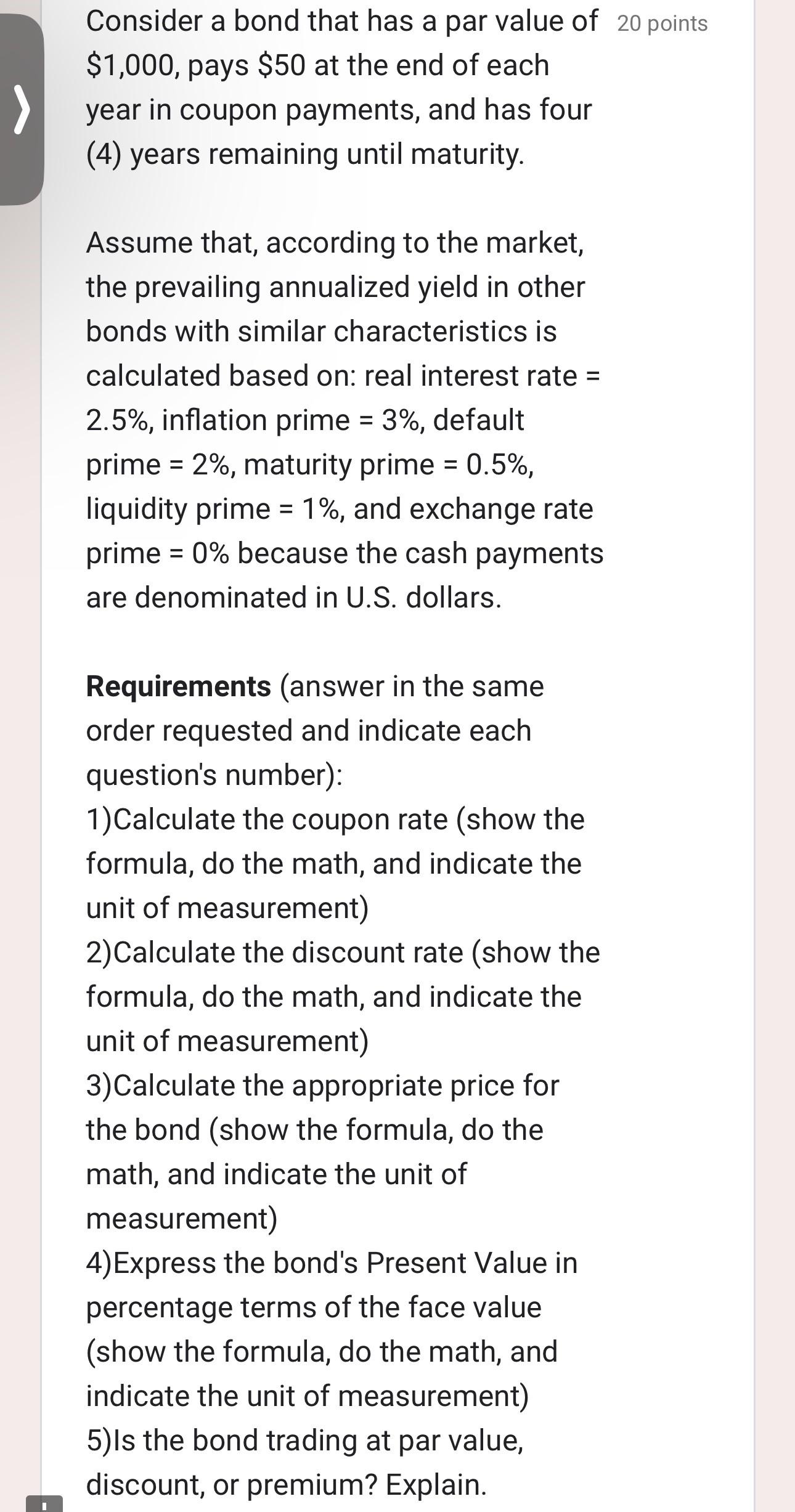

Consider a bond that has a par value of 20 points $1,000, pays $50 at the end of each year in coupon payments, and has four (4) years remaining until maturity. Assume that, according to the market, the prevailing annualized yield in other bonds with similar characteristics is calculated based on: real interest rate = 2.5%, inflation prime = 3%, default prime = 2%, maturity prime = 0.5%, liquidity prime = 1%, and exchange rate prime 0% because the cash payments are denominated in U.S. dollars. Requirements (answer in the same order requested and indicate each question's number): 1)Calculate the coupon rate (show the formula, do the math, and indicate the unit of measurement) 2) Calculate the discount rate (show the formula, do the math, and indicate the unit of measurement) 3) Calculate the appropriate price for the bond (show the formula, do the math, and indicate the unit of measurement) 4) Express the bond's Present Value in percentage terms of the face value (show the formula, do the math, and indicate the unit of measurement) 5)Is the bond trading at par value, discount, or premium? Explain.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Bond Calculations 1 Coupon Rate Formula Coupon rate Annual coupon payment Par value 100 Calculation Coupon rate 50 1000 100 5 2 Discount Rate This que...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started