Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a bond that pays a annual coupon of 14% (compounded annually) on a face value of $4500. Suppose that the bond was purchased

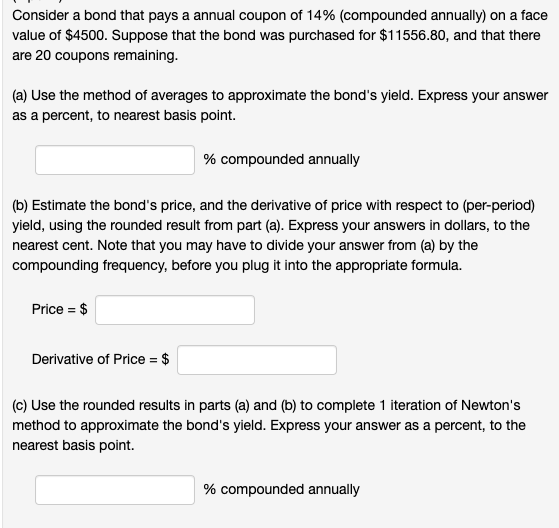

Consider a bond that pays a annual coupon of 14% (compounded annually) on a face value of $4500. Suppose that the bond was purchased for $11556.80, and that there are 20 coupons remaining. (a) Use the method of averages to approximate the bond's yield. Express your answer as a percent, to nearest basis point. % compounded annually (b) Estimate the bond's price, and the derivative of price with respect to (per-period) yield, using the rounded result from part (a). Express your answers in dollars, to the nearest cent. Note that you may have to divide your answer from (a) by the compounding frequency, before you plug it into the appropriate formula. Price = $ Derivative of Price = $ (c) Use the rounded results in parts (a) and (b) to complete 1 iteration of Newton's method to approximate the bond's yield. Express your answer as a percent, to the nearest basis point. % compounded annually

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Another bond problem Lets break it down step by step a Use the method of averages to approximate the bonds yield We can use the method of averages to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started