Answered step by step

Verified Expert Solution

Question

1 Approved Answer

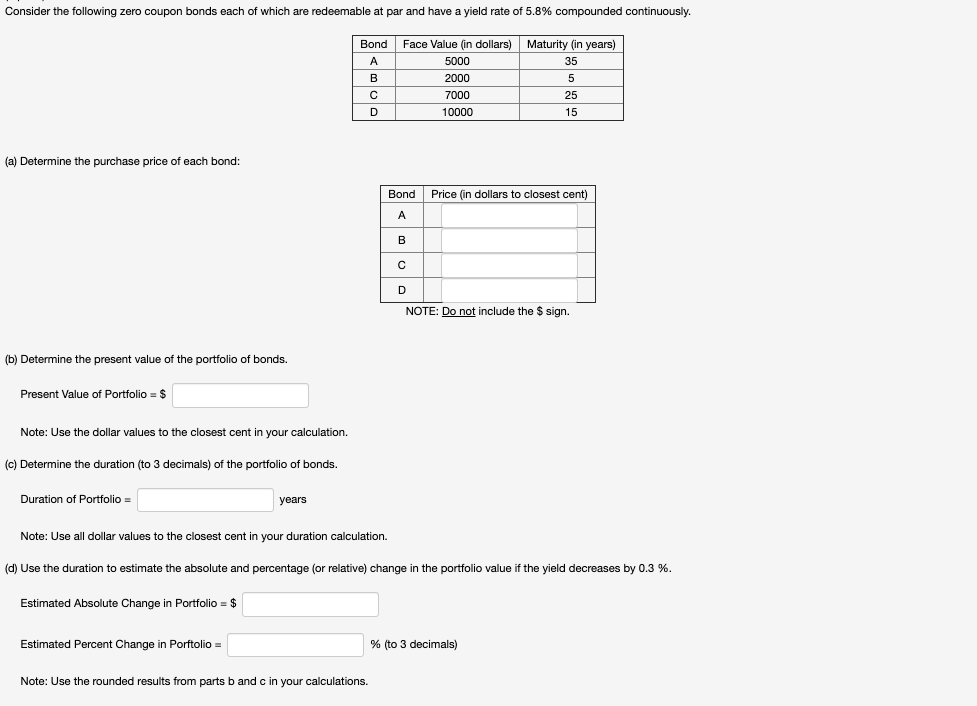

Consider the following zero coupon bonds each of which are redeemable at par and have a yield rate of 5.8% compounded continuously. Bond Face

Consider the following zero coupon bonds each of which are redeemable at par and have a yield rate of 5.8% compounded continuously. Bond Face Value (in dollars) Maturity (in years) A 5000 35 B 2000 5 C 7000 25 D 10000 15 (a) Determine the purchase price of each bond: Bond A Price (in dollars to closest cent) B D NOTE: Do not include the $ sign. (b) Determine the present value of the portfolio of bonds. Present Value of Portfolio = $ Note: Use the dollar values to the closest cent in your calculation. (c) Determine the duration (to 3 decimals) of the portfolio of bonds. Duration of Portfolio = years Note: Use all dollar values to the closest cent in your duration calculation. (d) Use the duration to estimate the absolute and percentage (or relative) change in the portfolio value if the yield decreases by 0.3 %. Estimated Absolute Change in Portfolio = $ Estimated Percent Change in Porftolio = Note: Use the rounded results from parts b and c in your calculations. % (to 3 decimals)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started