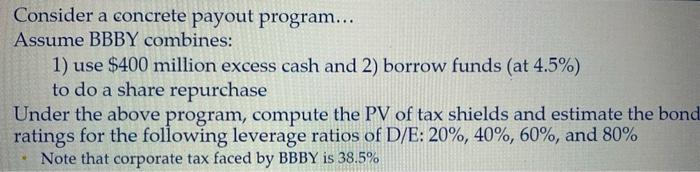

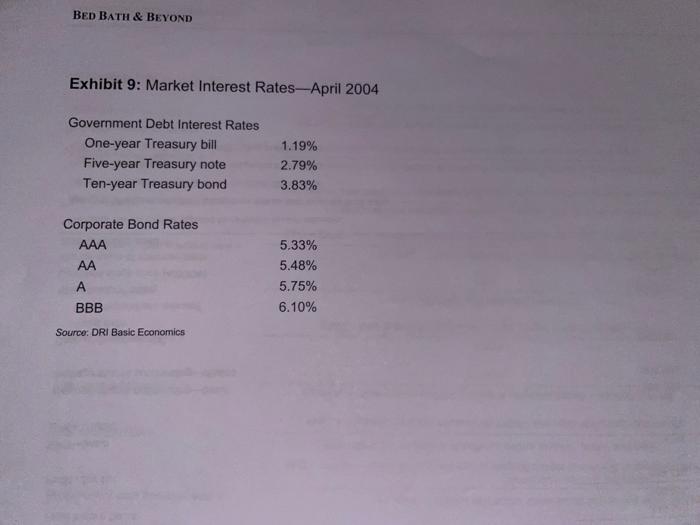

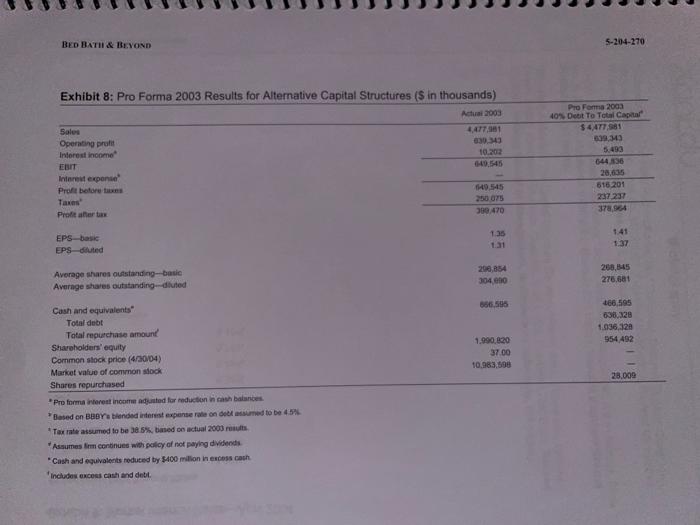

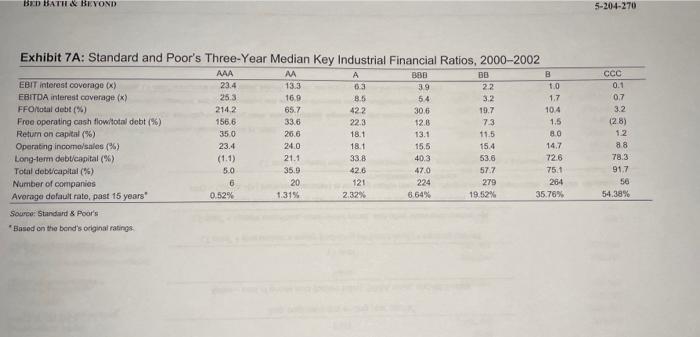

Consider a concrete payout program... Assume BBBY combines: 1) use $400 million excess cash and 2) borrow funds (at 4.5%) to do a share repurchase Under the above program, compute the PV of tax shields and estimate the bond ratings for the following leverage ratios of D/E: 20%, 40%, 60%, and 80% Note that corporate tax faced by BBBY is 38.5% BED BATH & BEYOND Exhibit 9: Market Interest Rates-April 2004 Government Debt Interest Rates One-year Treasury bill Five-year Treasury note Ten-year Treasury bond 1.19% 2.79% 3.83% Corporate Bond Rates AAA 5.33% 5.48% 5.75% 6.10% BBB Source: DRI Basic Economics BED BATH & BEYOND 5-204-270 Exhibit 8: Pro Forma 2003 Results for Alternative Capital Structures (S in thousands) Actual 2003 30,349 10.202 Sales Operating profil Interest income EBIT Interest expense Profit before the Taxes Profit after Pro Foma 2003 40% Debt To Total Capital $4477881 39.33 5.490 64436 20,635 616 201 237 237 378,964 149.545 250 075 399 470 1.35 EPS basic EPS duted 141 1.37 Average shares outstanding-basic Average shares outstanding duted 200,854 304 en 268,145 276,681 556.505 466,595 630,320 1.936, 120 954 492 1.990,320 37.00 10.983,898 28.009 Cash and equivalents Total debt Total repurchase amount Shareholders' equity Common stock price (4/2004) Market value of connon stock Shares repurchased Proforma interest income adjusted for reduction inch balances Based on Barande interest expense rate on dessumed to be 45% Tax rate assumed to be 38.8%, based on actual 2000 results Assumes em continues with policy of not paying dividends Cash and equivalents reduced by $400 million in excess cash Includes excess cash and debt. BED BATH & BEYOND 5-204-270 Exhibit 7A: Standard and Poor's Three-Year Median Key Industrial Financial Ratios, 2000-2002 AAA MA BBB BB EBIT interest coverage (x) 23.4 13.3 03 39 22 1.0 EBITDA interest coverage (x) 25.3 16.9 8.5 5.4 3.2 1.7 FFOotal debt (%) 214.2 65.7 422 30.6 19.7 10.4 Free operating cash flow total debt (%) 156.6 33.6 223 128 7.3 1.5 Return on capital (%) 350 26.6 18.1 13.1 11.5 80 Operating income sales (%) 23.4 24.0 18.1 15.5 15.4 14,7 Long-term debt capital (%) (1.1) 21.1 338 40.3 536 72.6 Total debt/capital (%) 5.0 35.9 42.6 47.0 57.7 75.1 Number of companies 6 20 121 224 279 284 Average default rato, post 15 years' 0.52% 1.31% 2.32% 6.64% 19.52% 35.76% Source: Standard & Poor's *Based on the band's original ratings CCC 0.1 0.7 3.2 12.8) 12 88 78.3 91.7 50 54,38% Consider a concrete payout program... Assume BBBY combines: 1) use $400 million excess cash and 2) borrow funds (at 4.5%) to do a share repurchase Under the above program, compute the PV of tax shields and estimate the bond ratings for the following leverage ratios of D/E: 20%, 40%, 60%, and 80% Note that corporate tax faced by BBBY is 38.5% BED BATH & BEYOND Exhibit 9: Market Interest Rates-April 2004 Government Debt Interest Rates One-year Treasury bill Five-year Treasury note Ten-year Treasury bond 1.19% 2.79% 3.83% Corporate Bond Rates AAA 5.33% 5.48% 5.75% 6.10% BBB Source: DRI Basic Economics BED BATH & BEYOND 5-204-270 Exhibit 8: Pro Forma 2003 Results for Alternative Capital Structures (S in thousands) Actual 2003 30,349 10.202 Sales Operating profil Interest income EBIT Interest expense Profit before the Taxes Profit after Pro Foma 2003 40% Debt To Total Capital $4477881 39.33 5.490 64436 20,635 616 201 237 237 378,964 149.545 250 075 399 470 1.35 EPS basic EPS duted 141 1.37 Average shares outstanding-basic Average shares outstanding duted 200,854 304 en 268,145 276,681 556.505 466,595 630,320 1.936, 120 954 492 1.990,320 37.00 10.983,898 28.009 Cash and equivalents Total debt Total repurchase amount Shareholders' equity Common stock price (4/2004) Market value of connon stock Shares repurchased Proforma interest income adjusted for reduction inch balances Based on Barande interest expense rate on dessumed to be 45% Tax rate assumed to be 38.8%, based on actual 2000 results Assumes em continues with policy of not paying dividends Cash and equivalents reduced by $400 million in excess cash Includes excess cash and debt. BED BATH & BEYOND 5-204-270 Exhibit 7A: Standard and Poor's Three-Year Median Key Industrial Financial Ratios, 2000-2002 AAA MA BBB BB EBIT interest coverage (x) 23.4 13.3 03 39 22 1.0 EBITDA interest coverage (x) 25.3 16.9 8.5 5.4 3.2 1.7 FFOotal debt (%) 214.2 65.7 422 30.6 19.7 10.4 Free operating cash flow total debt (%) 156.6 33.6 223 128 7.3 1.5 Return on capital (%) 350 26.6 18.1 13.1 11.5 80 Operating income sales (%) 23.4 24.0 18.1 15.5 15.4 14,7 Long-term debt capital (%) (1.1) 21.1 338 40.3 536 72.6 Total debt/capital (%) 5.0 35.9 42.6 47.0 57.7 75.1 Number of companies 6 20 121 224 279 284 Average default rato, post 15 years' 0.52% 1.31% 2.32% 6.64% 19.52% 35.76% Source: Standard & Poor's *Based on the band's original ratings CCC 0.1 0.7 3.2 12.8) 12 88 78.3 91.7 50 54,38%