Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a European Put on underlying S with expiration T = 120 days and strike K = 92. We assume that the underlying asset

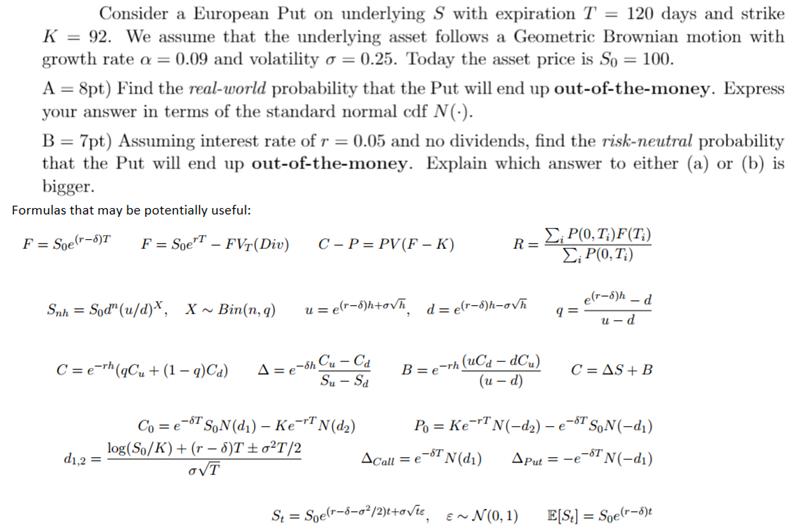

Consider a European Put on underlying S with expiration T = 120 days and strike K = 92. We assume that the underlying asset follows a Geometric Brownian motion with growth rate a = 0.09 and volatility o = 0.25. Today the asset price is So = 100. A = 8pt) Find the real-world probability that the Put will end up out-of-the-money. Express your answer in terms of the standard normal cdf N(-). B = 7pt) Assuming interest rate of r = 0.05 and no dividends, find the risk-neutral probability that the Put will end up out-of-the-money. Explain which answer to either (a) or (b) is bigger. Formulas that may be potentially useful: F = SoeT FVr(Div) E, P(0, T;)F(T;) E P(0, T;) F = Soe(r-5)T C - P = PV(F - K) R = e(r-8)h d Snh = Sod" (u/d)*, X - Bin(n, q) u = elr-6)h+ovh d= e(r-6)h-ovh P-n C = e-rh (qCu + (1 q)Ca) A = e-5h Cu - Ca Su - Sa B =e-rh (uC4 dC,) C = AS + B (p -n) Co = e-ST SoN (d1) Ke-rTN(d2) log(So/K)+ (r 6)T 0T/2 oVT Po = Ke-rT N(-d2) - -ST SoN(-d1) d1.2 = ACall = e =e-ST N(d1) APut = = -e-" N(-di) S, = Soe(r-5-o/2)t+oVie, en N(0, 1) E[S.] = Soe(r-5)t %3D

Step by Step Solution

★★★★★

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution a We know that geometric brownian moti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started