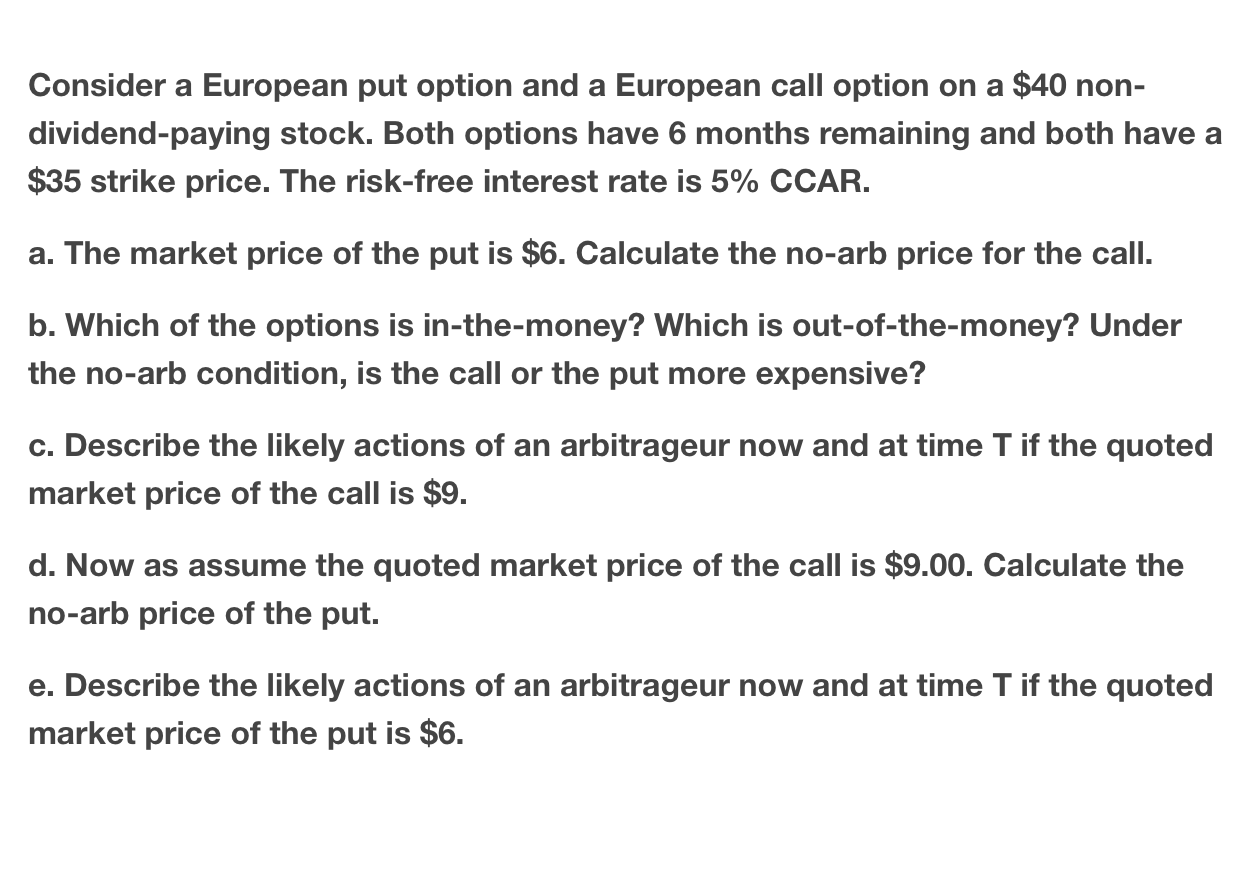

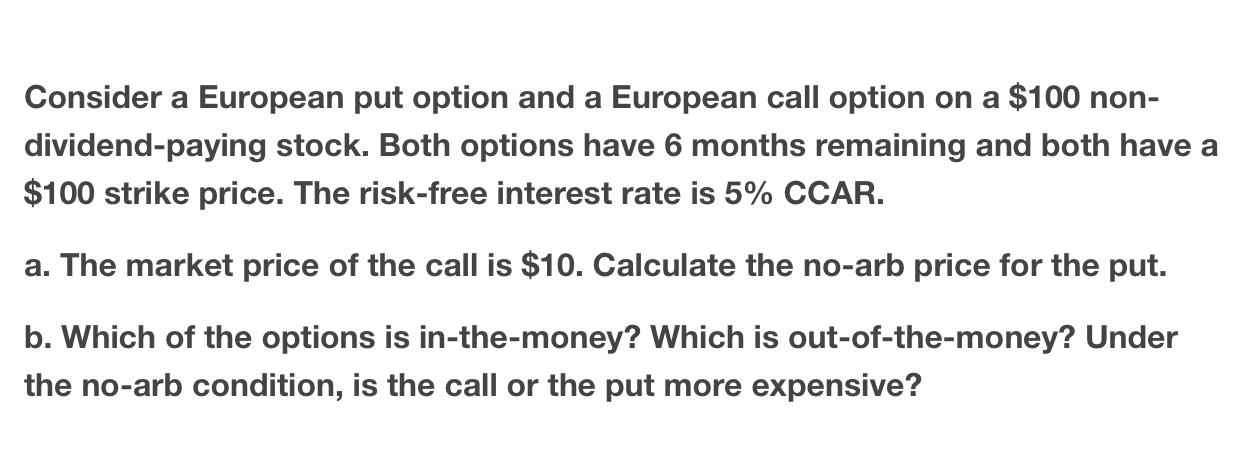

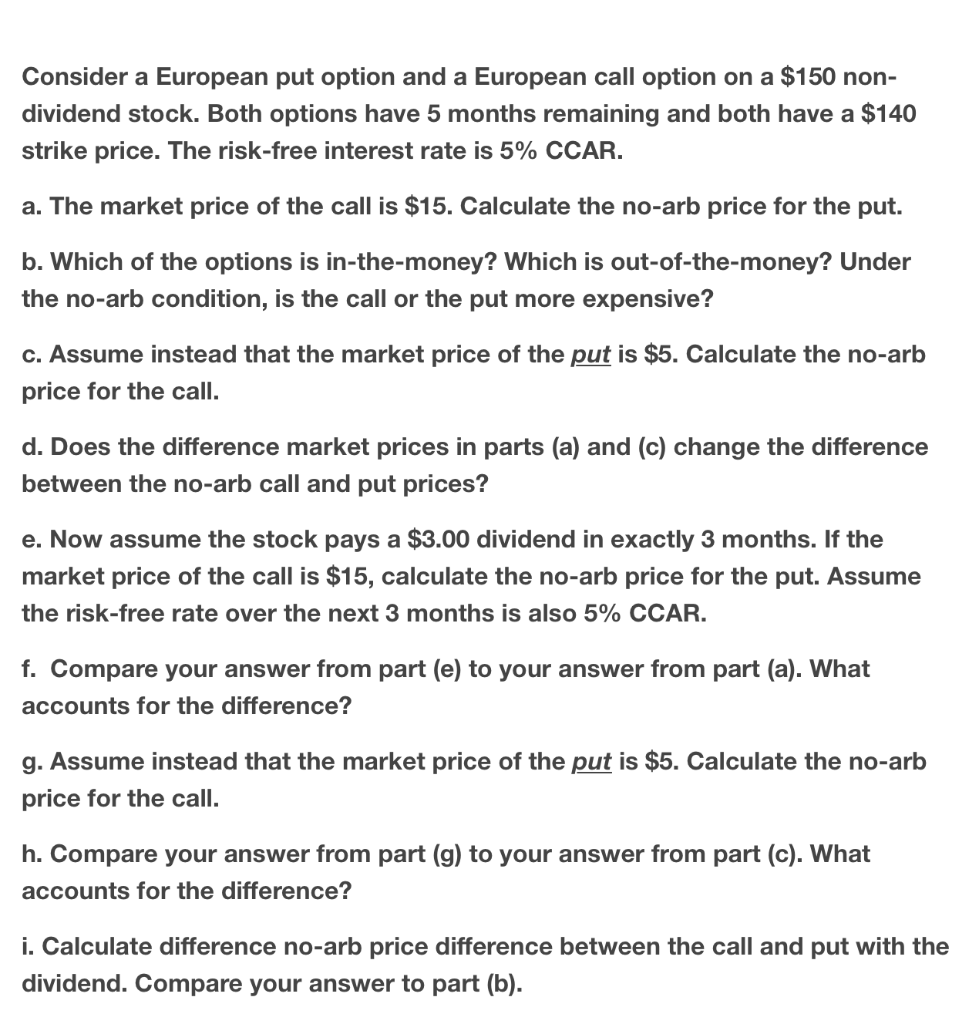

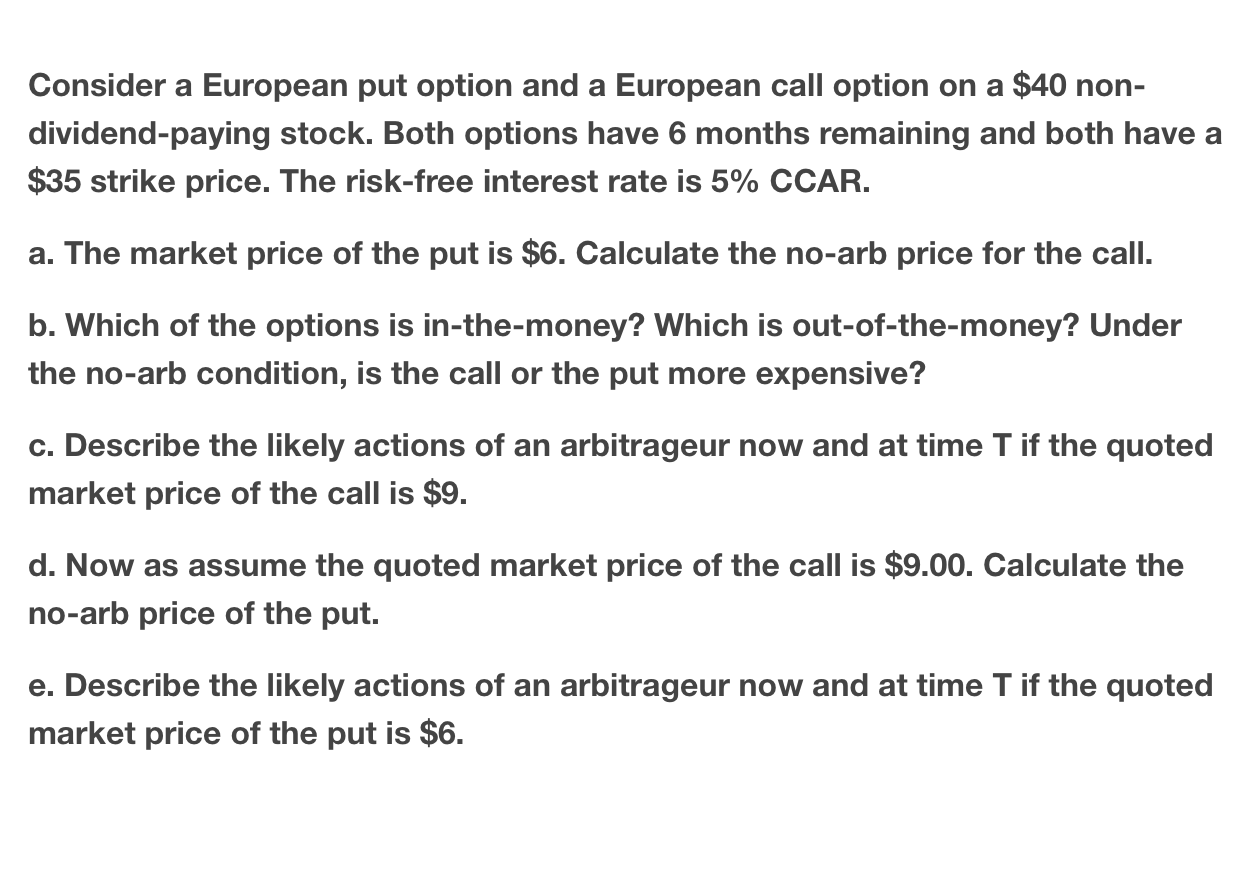

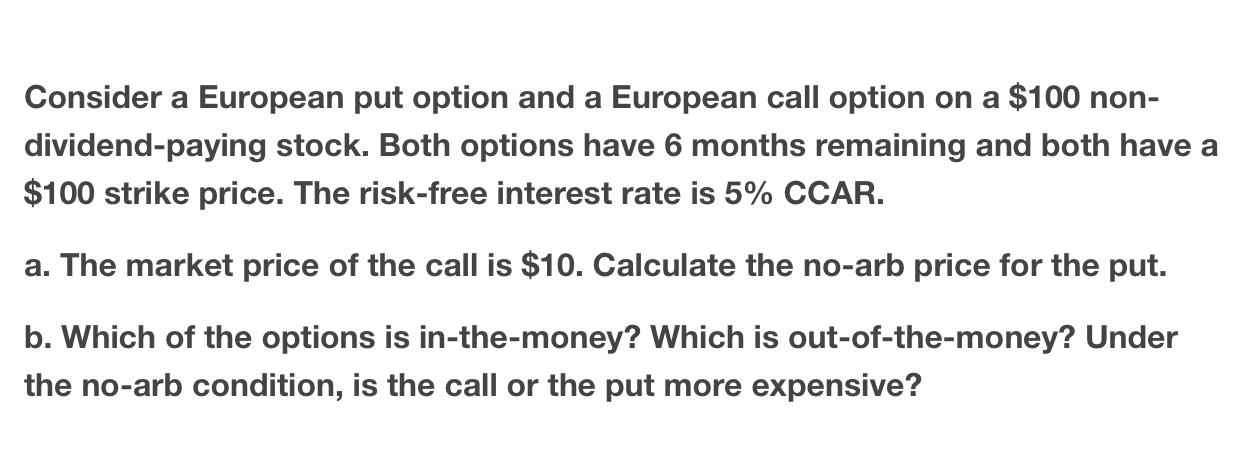

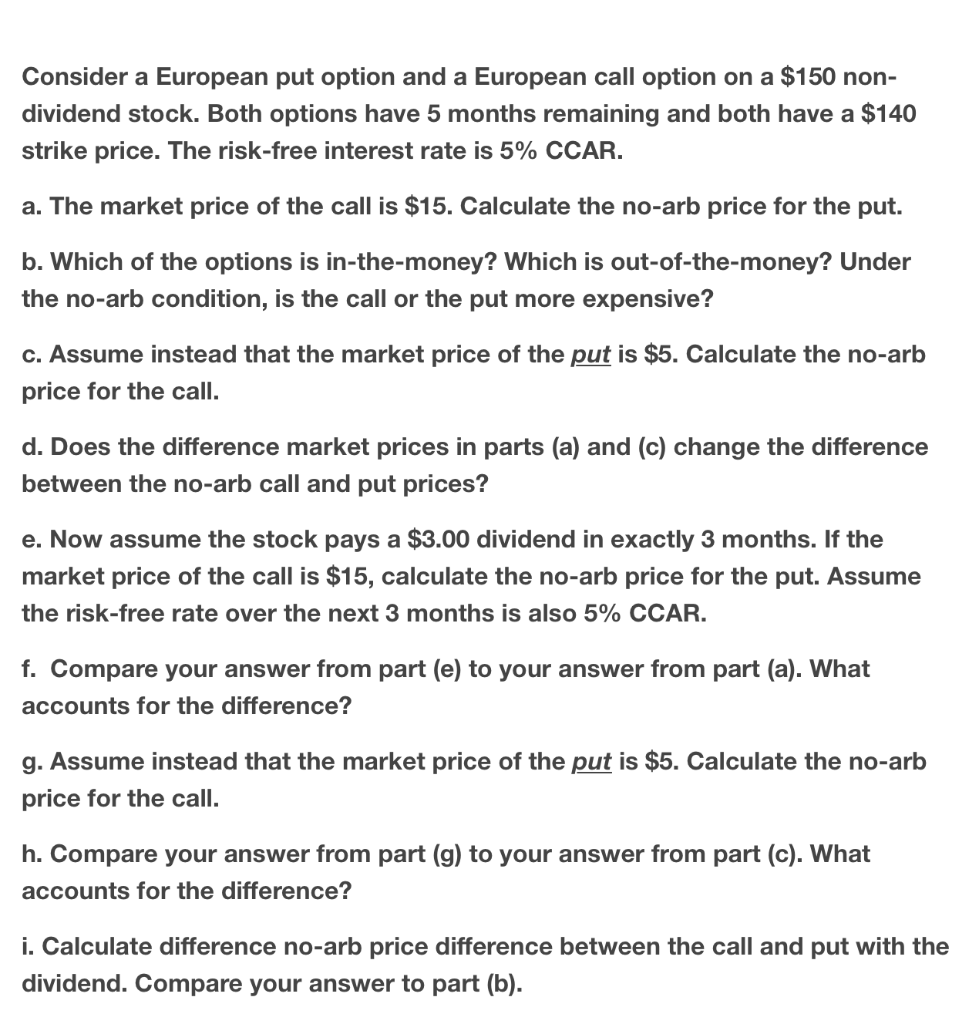

Consider a European put option and a European call option on a $40 nondividend-paying stock. Both options have 6 months remaining and both have a $35 strike price. The risk-free interest rate is 5% CCAR. a. The market price of the put is $6. Calculate the no-arb price for the call. b. Which of the options is in-the-money? Which is out-of-the-money? Under the no-arb condition, is the call or the put more expensive? c. Describe the likely actions of an arbitrageur now and at time T if the quoted market price of the call is $9. d. Now as assume the quoted market price of the call is $9.00. Calculate the no-arb price of the put. e. Describe the likely actions of an arbitrageur now and at time T if the quoted market price of the put is $6. Consider a European put option and a European call option on a $100 nondividend-paying stock. Both options have 6 months remaining and both have a $100 strike price. The risk-free interest rate is 5% CCAR. a. The market price of the call is $10. Calculate the no-arb price for the put. b. Which of the options is in-the-money? Which is out-of-the-money? Under the no-arb condition, is the call or the put more expensive? Consider a European put option and a European call option on a $150 nondividend stock. Both options have 5 months remaining and both have a $140 strike price. The risk-free interest rate is 5% CCAR. a. The market price of the call is $15. Calculate the no-arb price for the put. b. Which of the options is in-the-money? Which is out-of-the-money? Under the no-arb condition, is the call or the put more expensive? c. Assume instead that the market price of the put is $5. Calculate the no-arb price for the call. d. Does the difference market prices in parts (a) and (c) change the difference between the no-arb call and put prices? e. Now assume the stock pays a $3.00 dividend in exactly 3 months. If the market price of the call is $15, calculate the no-arb price for the put. Assume the risk-free rate over the next 3 months is also 5% CCAR. f. Compare your answer from part (e) to your answer from part (a). What accounts for the difference? g. Assume instead that the market price of the put is $5. Calculate the no-arb price for the call. h. Compare your answer from part (g) to your answer from part (c). What accounts for the difference? i. Calculate difference no-arb price difference between the call and put with the dividend. Compare your answer to part (b). Consider a European put option and a European call option on a $40 nondividend-paying stock. Both options have 6 months remaining and both have a $35 strike price. The risk-free interest rate is 5% CCAR. a. The market price of the put is $6. Calculate the no-arb price for the call. b. Which of the options is in-the-money? Which is out-of-the-money? Under the no-arb condition, is the call or the put more expensive? c. Describe the likely actions of an arbitrageur now and at time T if the quoted market price of the call is $9. d. Now as assume the quoted market price of the call is $9.00. Calculate the no-arb price of the put. e. Describe the likely actions of an arbitrageur now and at time T if the quoted market price of the put is $6. Consider a European put option and a European call option on a $100 nondividend-paying stock. Both options have 6 months remaining and both have a $100 strike price. The risk-free interest rate is 5% CCAR. a. The market price of the call is $10. Calculate the no-arb price for the put. b. Which of the options is in-the-money? Which is out-of-the-money? Under the no-arb condition, is the call or the put more expensive? Consider a European put option and a European call option on a $150 nondividend stock. Both options have 5 months remaining and both have a $140 strike price. The risk-free interest rate is 5% CCAR. a. The market price of the call is $15. Calculate the no-arb price for the put. b. Which of the options is in-the-money? Which is out-of-the-money? Under the no-arb condition, is the call or the put more expensive? c. Assume instead that the market price of the put is $5. Calculate the no-arb price for the call. d. Does the difference market prices in parts (a) and (c) change the difference between the no-arb call and put prices? e. Now assume the stock pays a $3.00 dividend in exactly 3 months. If the market price of the call is $15, calculate the no-arb price for the put. Assume the risk-free rate over the next 3 months is also 5% CCAR. f. Compare your answer from part (e) to your answer from part (a). What accounts for the difference? g. Assume instead that the market price of the put is $5. Calculate the no-arb price for the call. h. Compare your answer from part (g) to your answer from part (c). What accounts for the difference? i. Calculate difference no-arb price difference between the call and put with the dividend. Compare your answer to part (b)