Question

Consider a farmer who plans to sell a group of hogs this week but wonders whether feeding them another week before selling them would be

Consider a farmer who plans to sell a group of hogs this week but wonders whether feeding them another week before selling them would be more profitable. During this week, the hogs are expected to gain 7 pounds, going from 250 pounds to 257 pounds. The price for both weights is expected to be $55/cwt (100 lb) for both weeks, but next weeks price is uncertain. The change in the plan would mean that a 250 lb hog will not be sold this week, and the interest that could have been received on that hogs value for one week is lost. In your calculations, use an annual rate of 8%. Additional expenses due to the change are additional feed, labor, and other costs, and the chance of some hogs dying during the next week. The farmer does not estimate any reduced expenses for this change. The net effect of this change is estimated to be $0.40 per hog. Since the farmer thinks the hog markets are pointing toward a decreasing price, he decides to sell. Additional feed expense are for corn (28 lb at $0.07/lb), soybean meal (4 lb at $0.15/lb), and distillers dried grain (2 lb at $0.06/lb). Labor and other costs for one week are estimated to be $0.35. The potential death loss is estimated to be 0.1% of the value of the hog not sold this week. Using the partial budget format below, what is the net effect of the potential change? What do you think this farmer should do?

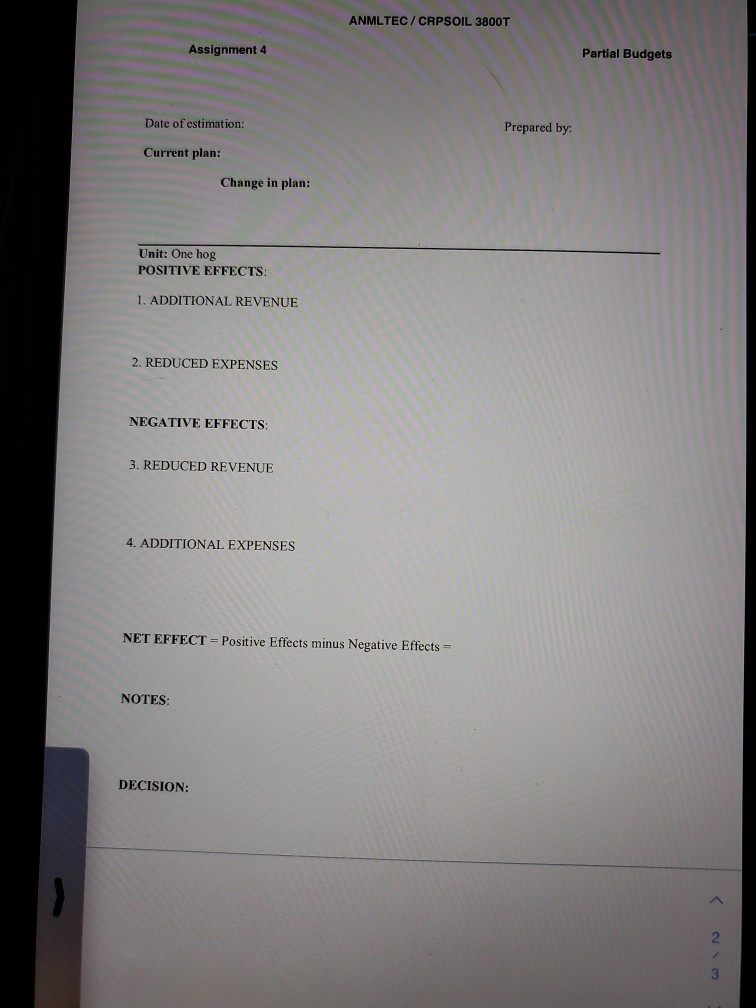

Unit: One hog POSITIVE EFFECTS: 1. ADDITIONAL REVENUE 2. REDUCED EXPENSES NEGATIVE EFFECTS: 3. REDUCED REVENUE 4. ADDITIONAL EXPENSES NET EFFECT = Positive Effects minus Negative Effects = NOTES: DECISION:

Assignment 4 Partial Budgets From the textbook: Question 3 on page 281 Consider a farmer who plans to sell a group of hogs this week but wonders whether feeding them another week before selling them would be more profitable. During this week, the hogs are expected to gain 7 pounds, going from 250 pounds to 257 pounds. The price for both weights is expected to be $5S/cwt (100 lb) for both weeks, but next week's price is uncertain The change in the plan would mean that a 250 lb hog will not be sold this week, and the interest that could have been received on that hog's value for one week is lost. In your calculations, use an annual rate of 8%. Additional expenses due to the change are additional feed, labor, and other costs, and the chance of some hogs dying during the next week. The farmer does not estimate any reduced expenses for this change. The net effect of this change is estimated to be $0.40 per hog. Since the farmer thinks the hog markets are pointing toward a decreasing price, he decides to sell. Additional feed expense are for com (28 lb at $0.07/b), soybean meal (4 lb at $0.15/1b), and distillers dried grain (2 lb at $0.06/16). Labor and other costs for one week are estimated to be $0.35. The potential death loss is estimated to be 0.1% of the value of the hog not sold this week. Using the partial budget format below, what is the net effect of the potential change? What do you think this farmer should do? ANMLTEC/ CRPSOIL 3800T Assignment 4 Partial Budgets ANMLTEC / CRPSOIL 3800T Assignment 4 Partial Budgets Date of estimation: Prepared by: Current plan: Change in plan: Unit: One hog POSITIVE EFFECTS: 1. ADDITIONAL REVENUE 2. REDUCED EXPENSES NEGATIVE EFFECTS: 3. REDUCED REVENUE 4. ADDITIONAL EXPENSES NET EFFECT - Positive Effects minus Negative Effects = NOTES: DECISION

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started