Question

Consider a financial world in which there are only two risky assets. A and B, and a risk-free asset F. The value of the

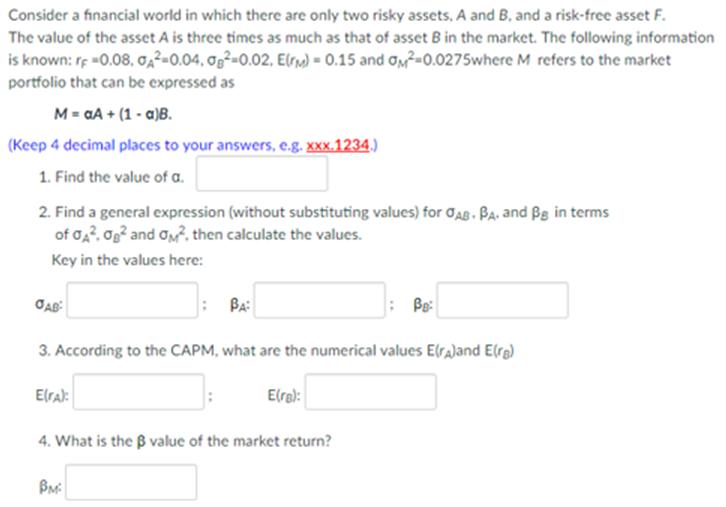

Consider a financial world in which there are only two risky assets. A and B, and a risk-free asset F. The value of the asset A is three times as much as that of asset B in the market. The following information is known: r -0.08, 022-0.04, og-0.02, Elrm) = 0.15 and OM-0.0275where M refers to the market portfolio that can be expressed as M= aA + (1 - a)B. (Keep 4 decimal places to your answers, e.g. XXx.1234.) 1. Find the value of a. 2. Find a general expression (without substituting values) for 0AB PA. and Bg in terms of 02?, og and On?. then calculate the values. Key in the values here: BA Be: 3. According to the CAPM, what are the numerical values Era)and E(re) Elral: Elra): 4. What is the B value of the market return?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Elementary Statisitcs

Authors: Barry Monk

2nd edition

1259345297, 978-0077836351, 77836359, 978-1259295911, 1259295915, 978-1259292484, 1259292487, 978-1259345296

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App