Question

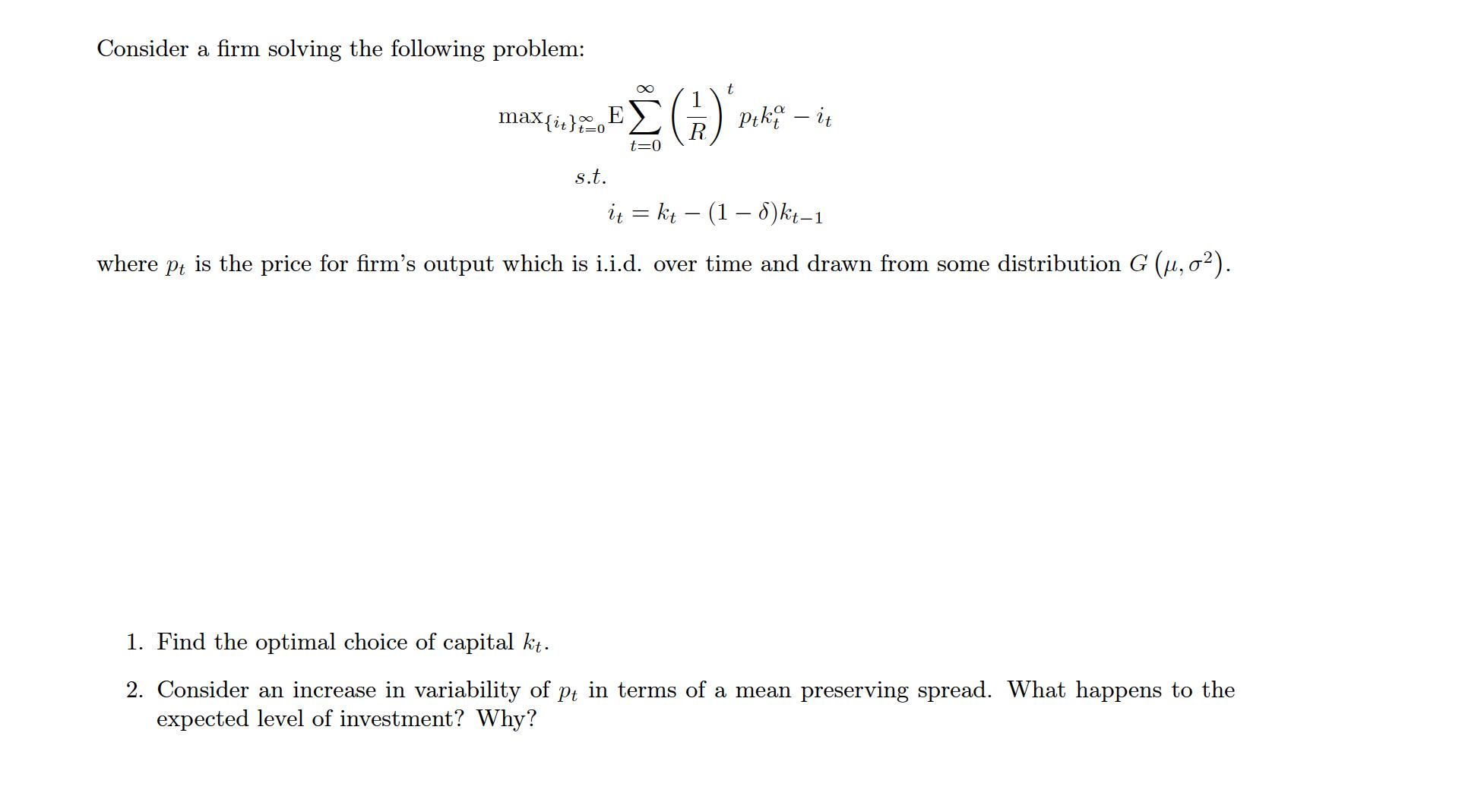

Consider a firm solving the following problem: max. X{it}_E s.t. t B(1) -in Ptk it R t=0 it = kt (1 8)kt1 where pt

Consider a firm solving the following problem: max. X{it}_E s.t. t B(1) -in Ptk it R t=0 it = kt (1 8)kt1 where pt is the price for firm's output which is i.i.d. over time and drawn from some distribution G (, 0). 1. Find the optimal choice of capital kt. 2. Consider an increase in variability of pt in terms of a mean preserving spread. What happens to the expected level of investment? Why?

Step by Step Solution

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

An...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Microeconomics An Intuitive Approach with Calculus

Authors: Thomas Nechyba

1st edition

538453257, 978-0538453257

Students also viewed these Chemical Engineering questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App