Answered step by step

Verified Expert Solution

Question

1 Approved Answer

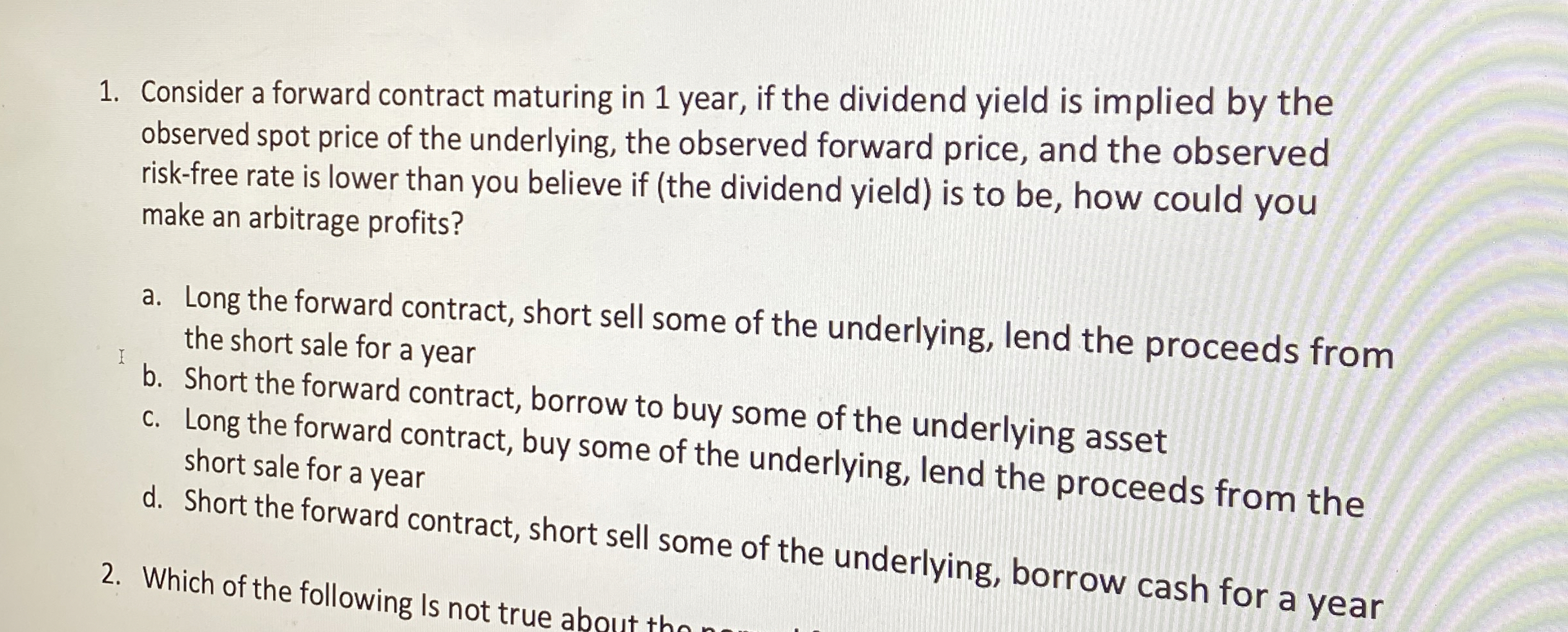

Consider a forward contract maturing in 1 year, if the dividend yield is implied by the observed spot price of the underlying, the observed forward

Consider a forward contract maturing in year, if the dividend yield is implied by the

observed spot price of the underlying, the observed forward price, and the observed

riskfree rate is lower than you believe if the dividend yield is to be how could you

make an arbitrage profits?

a Long the forward contract, short sell some of the underlying, lend the proceeds from

the short sale for a year

b Short the forward contract, borrow to buy some of the underlying asset

c Long the forward contract, buy some of the underlying, lend the proceeds from the

short sale for a year

d Short the forward contract, short sell some of the underlying, borrow cash for a year

Which of the following Is not true abo

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started