Answered step by step

Verified Expert Solution

Question

1 Approved Answer

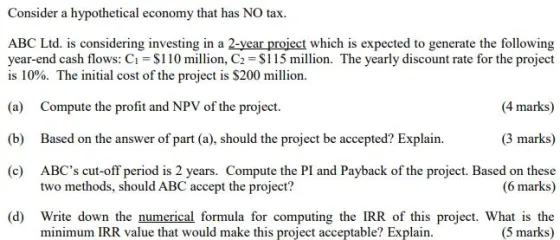

Consider a hypothetical economy that has NO tax. ABC Ltd. is considering investing in a 2-year project which is expected to generate the following

Consider a hypothetical economy that has NO tax. ABC Ltd. is considering investing in a 2-year project which is expected to generate the following year-end cash flows: C = $110 million, C=$115 million. The yearly discount rate for the project is 10%. The initial cost of the project is $200 million. (a) Compute the profit and NPV of the project. (4 marks) (b) Based on the answer of part (a), should the project be accepted? Explain. (3 marks) (c) ABC's cut-off period is 2 years. Compute the PI and Payback of the project. Based on these two methods, should ABC accept the project? (6 marks) (d) Write down the numerical formula for computing the IRR of this project. What is the minimum IRR value that would make this project acceptable? Explain. (5 marks)

Step by Step Solution

★★★★★

3.29 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a C1 110m C2 115m Discount rate 10 NPV C11r1 C21r2 110m11 115m121 100m 95m 19...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started