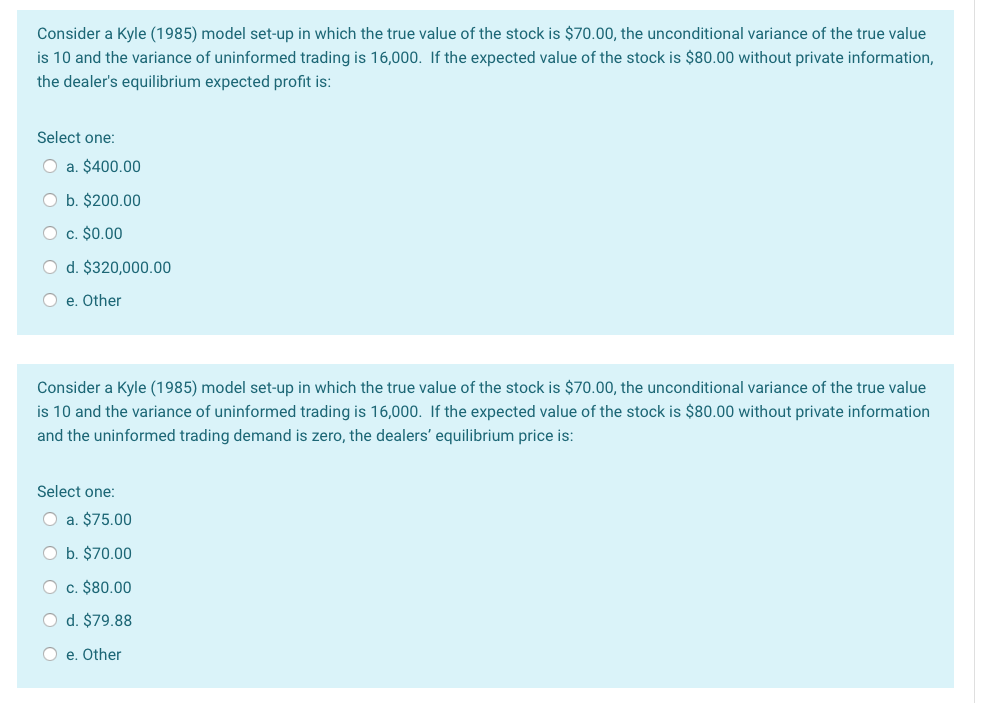

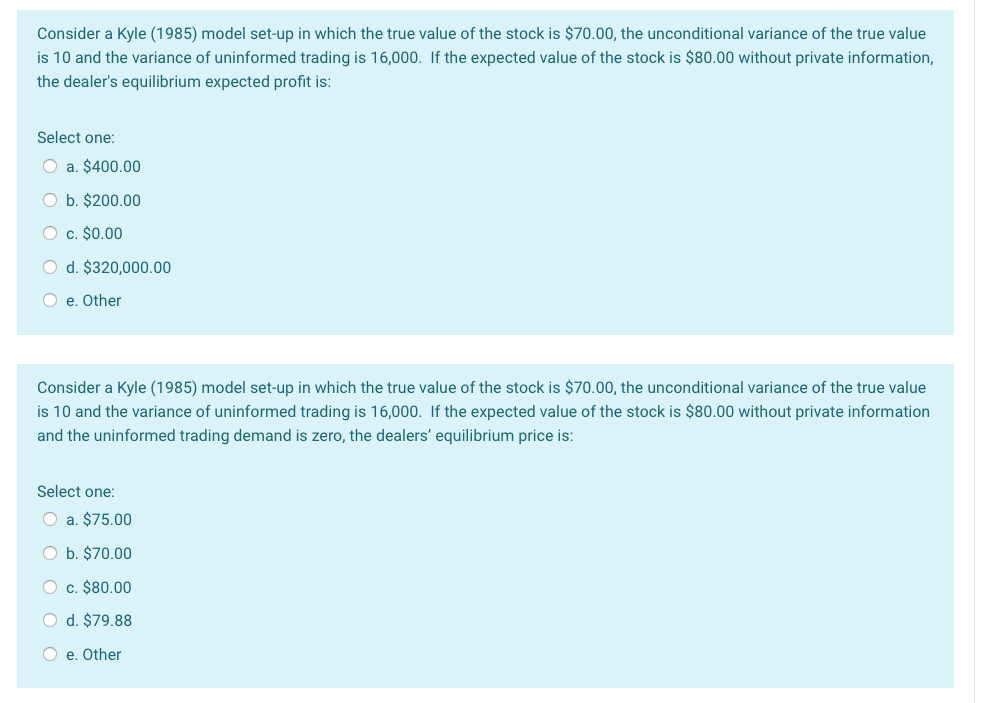

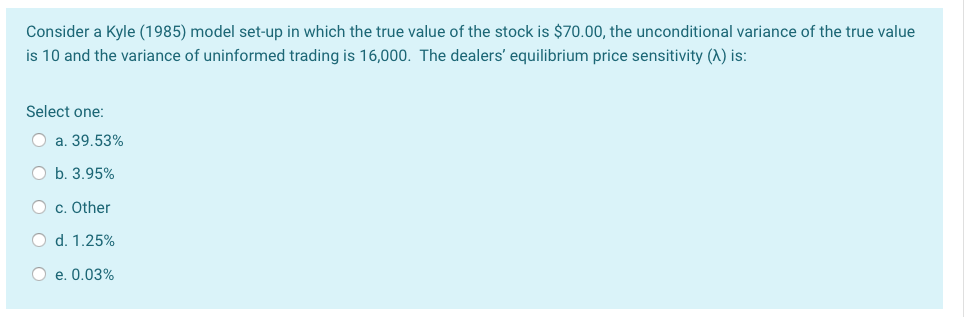

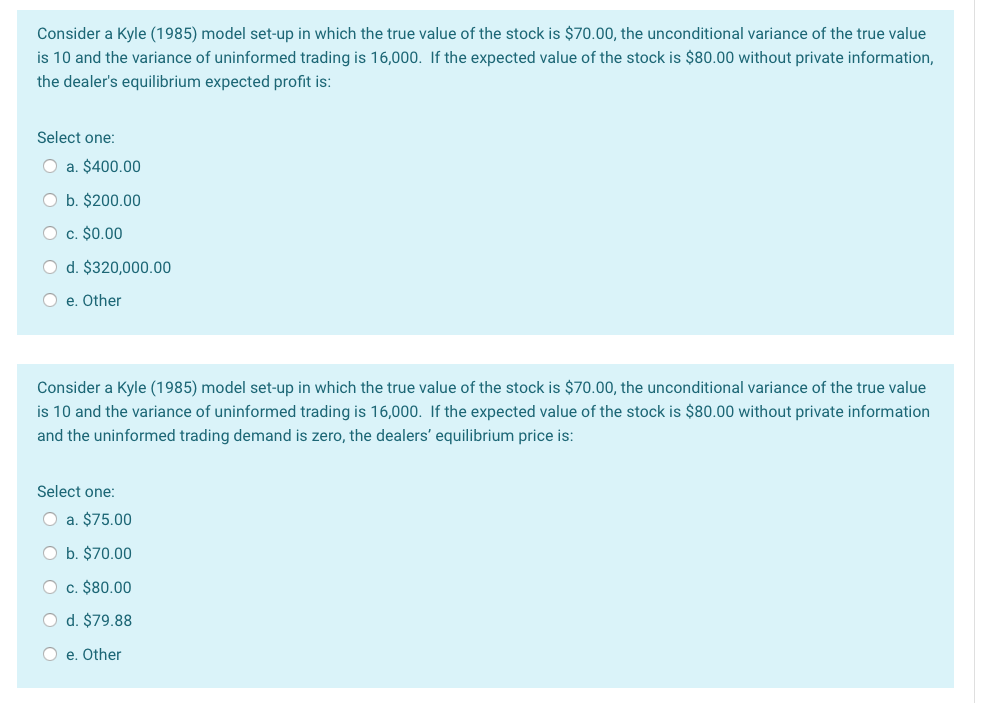

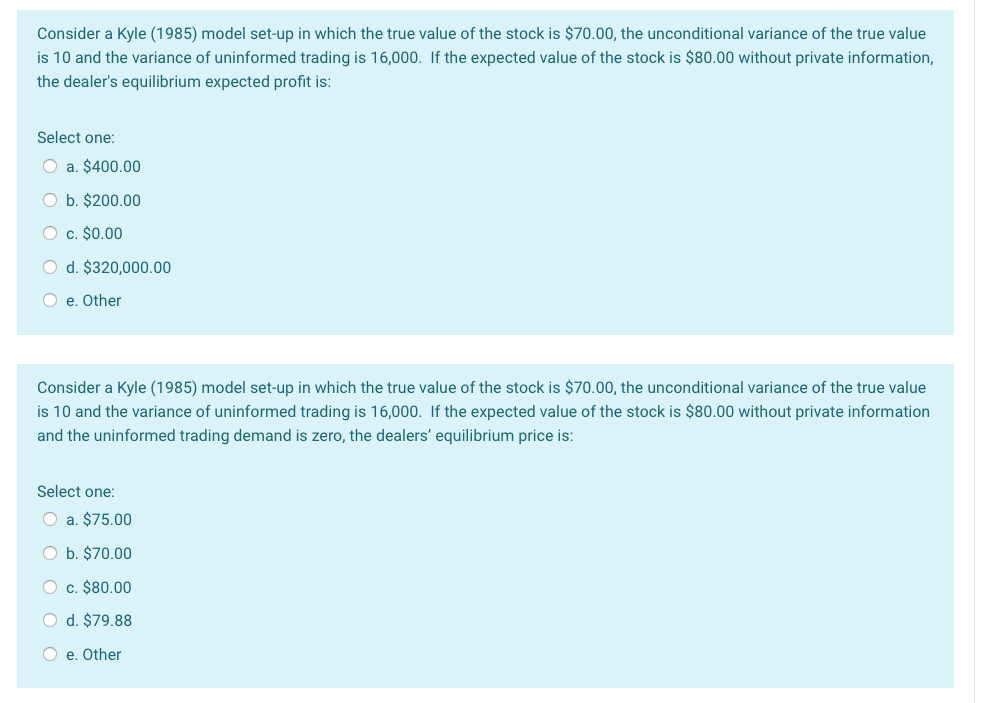

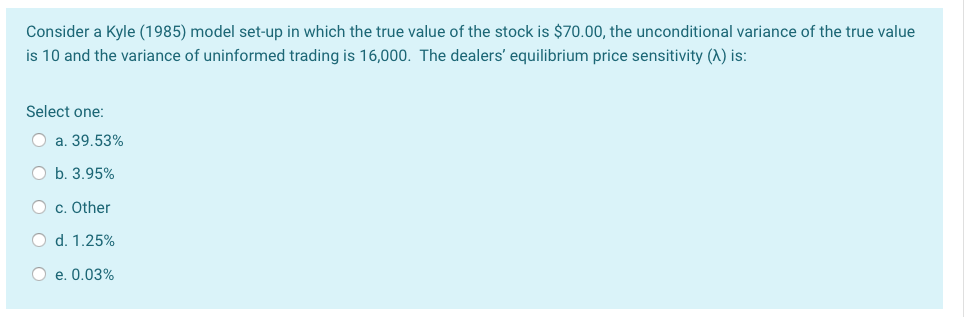

Consider a Kyle (1985) model set-up in which the true value of the stock is $70.00, the unconditional variance of the true value is 10 and the variance of uninformed trading is 16,000. If the expected value of the stock is $80.00 without private information, the dealer's equilibrium expected profit is: Select one: O a. $400.00 O b. $200.00 O c. $0.00 O d. $320,000.00 O e. Other Consider a Kyle (1985) model set-up in which the true value of the stock is $70.00, the unconditional variance of the true value is 10 and the variance of uninformed trading is 16,000. If the expected value of the stock is $80.00 without private information and the uninformed trading demand is zero, the dealers' equilibrium price is: Select one: O a. $75.00 O b. $70.00 O c. $80.00 O d. $79.88 e. Other Consider a Kyle (1985) model set-up in which the true value of the stock is $70.00, the unconditional variance of the true value is 10 and the variance of uninformed trading is 16,000. If the expected value of the stock is $80.00 without private information, the dealer's equilibrium expected profit is: Select one: O a. $400.00 O b. $200.00 O c. $0.00 O d. $320,000.00 O e. Other Consider a Kyle (1985) model set-up in which the true value of the stock is $70.00, the unconditional variance of the true value is 10 and the variance of uninformed trading is 16,000. If the expected value of the stock is $80.00 without private information and the uninformed trading demand is zero, the dealers' equilibrium price is: Select one: O a. $75.00 O b. $70.00 O c. $80.00 O d. $79.88 e. Other Consider a Kyle (1985) model set-up in which the true value of the stock is $70.00, the unconditional variance of the true value is 10 and the variance of uninformed trading is 16,000. The dealers' equilibrium price sensitivity (a) is: Select one: O a. 39.53% O b. 3.95% O c. Other O d. 1.25% e. 0.03% Consider a Kyle (1985) model set-up in which the true value of the stock is $70.00, the unconditional variance of the true value is 10 and the variance of uninformed trading is 16,000. If the expected value of the stock is $80.00 without private information, the dealer's equilibrium expected profit is: Select one: O a. $400.00 O b. $200.00 O c. $0.00 O d. $320,000.00 O e. Other Consider a Kyle (1985) model set-up in which the true value of the stock is $70.00, the unconditional variance of the true value is 10 and the variance of uninformed trading is 16,000. If the expected value of the stock is $80.00 without private information and the uninformed trading demand is zero, the dealers' equilibrium price is: Select one: O a. $75.00 O b. $70.00 O c. $80.00 O d. $79.88 e. Other Consider a Kyle (1985) model set-up in which the true value of the stock is $70.00, the unconditional variance of the true value is 10 and the variance of uninformed trading is 16,000. If the expected value of the stock is $80.00 without private information, the dealer's equilibrium expected profit is: Select one: O a. $400.00 O b. $200.00 O c. $0.00 O d. $320,000.00 O e. Other Consider a Kyle (1985) model set-up in which the true value of the stock is $70.00, the unconditional variance of the true value is 10 and the variance of uninformed trading is 16,000. If the expected value of the stock is $80.00 without private information and the uninformed trading demand is zero, the dealers' equilibrium price is: Select one: O a. $75.00 O b. $70.00 O c. $80.00 O d. $79.88 e. Other Consider a Kyle (1985) model set-up in which the true value of the stock is $70.00, the unconditional variance of the true value is 10 and the variance of uninformed trading is 16,000. The dealers' equilibrium price sensitivity (a) is: Select one: O a. 39.53% O b. 3.95% O c. Other O d. 1.25% e. 0.03%