Answered step by step

Verified Expert Solution

Question

1 Approved Answer

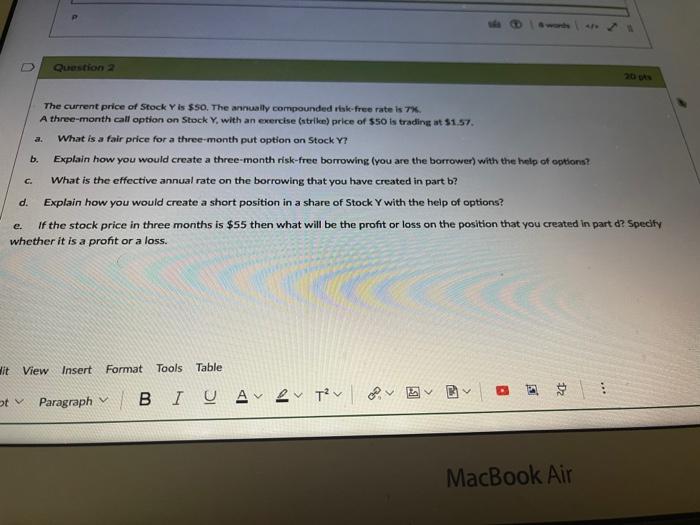

Question 2 a. b. The current price of Stock Y is $50. The annually compounded sk-free rate is 7 A three month call option on

Question 2 a. b. The current price of Stock Y is $50. The annually compounded sk-free rate is 7 A three month call option on Stock y, with an exercise (strike) price of $50 is trading st 51.57 What is a fair price for a three-month put option on Stock Y? Explain how you would create a three-month risk-free borrowing (you are the borrower) with the help of options? What is the effective annual rate on the borrowing that you have created in part b? Explain how you would create a short position in a share of Stock Y with the help of options? of the stock price in three months is $55 then what will be the profit or loss on the position that you created in part d? Specity whether it is a profit or a loss. d. e. it View Insert Format Tools Table % . ot Paragraph Y BI U ALTY MacBook Air

Question 2 a. b. The current price of Stock Y is $50. The annually compounded sk-free rate is 7 A three month call option on Stock y, with an exercise (strike) price of $50 is trading st 51.57 What is a fair price for a three-month put option on Stock Y? Explain how you would create a three-month risk-free borrowing (you are the borrower) with the help of options? What is the effective annual rate on the borrowing that you have created in part b? Explain how you would create a short position in a share of Stock Y with the help of options? of the stock price in three months is $55 then what will be the profit or loss on the position that you created in part d? Specity whether it is a profit or a loss. d. e. it View Insert Format Tools Table % . ot Paragraph Y BI U ALTY MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started