Question

Consider a market where two factors arc sufficient to describe the returns on common stocks. For an asset i, the asset's expected return is given

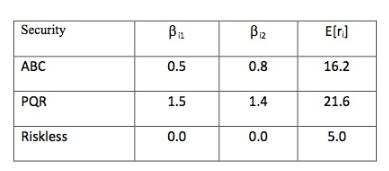

Consider a market where two factors arc sufficient to describe the returns on common stocks. For an asset i, the asset's expected return is given by E(rj) = rf + βi1 P1 + βi2 P2 where P1 and P2 arc the factor premiums (expected return of the factors in excess of the risk-free rate). Both factors are independent. The following tabic gives the sensitivities of the stocks ABC and PQR to the two factors, as well as the expected returns of each stock:

a. Consider a portfolio, C, made up by selling short $.50 of security PQR and purchasing $1.50 of ABC. How sensitive will this portfolio be to each of the two factors?

b. Consider a portfolio, D, made up by borrowing SI .00 at the risk free rate and investing $1.00 in portfolio C. How sensitive will this portfolio be to each of the factors?

c. What combination of securities ABC, PQR and the riskless security will move on a one-to-one basis with factor 1 and be insensitive to factor 2?

Security Bu Bz E[r] 0.5 0.8 16.2 PQR 1.5 1.4 21.6 Riskless 0.0 0.0 5.0

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 sensitive to the two factors c1 w ABC ABC1 w PQR PQR1 15051 05151 0 c2 w ABC ABC2 w PQR PQ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started