Answered step by step

Verified Expert Solution

Question

1 Approved Answer

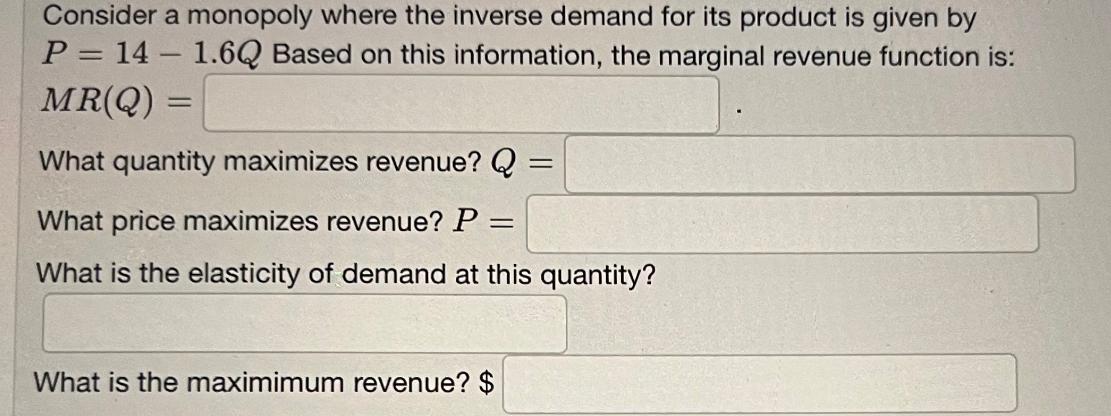

Consider a monopoly where the inverse demand for its product is given by P = 14 1.6Q Based on this information, the marginal revenue

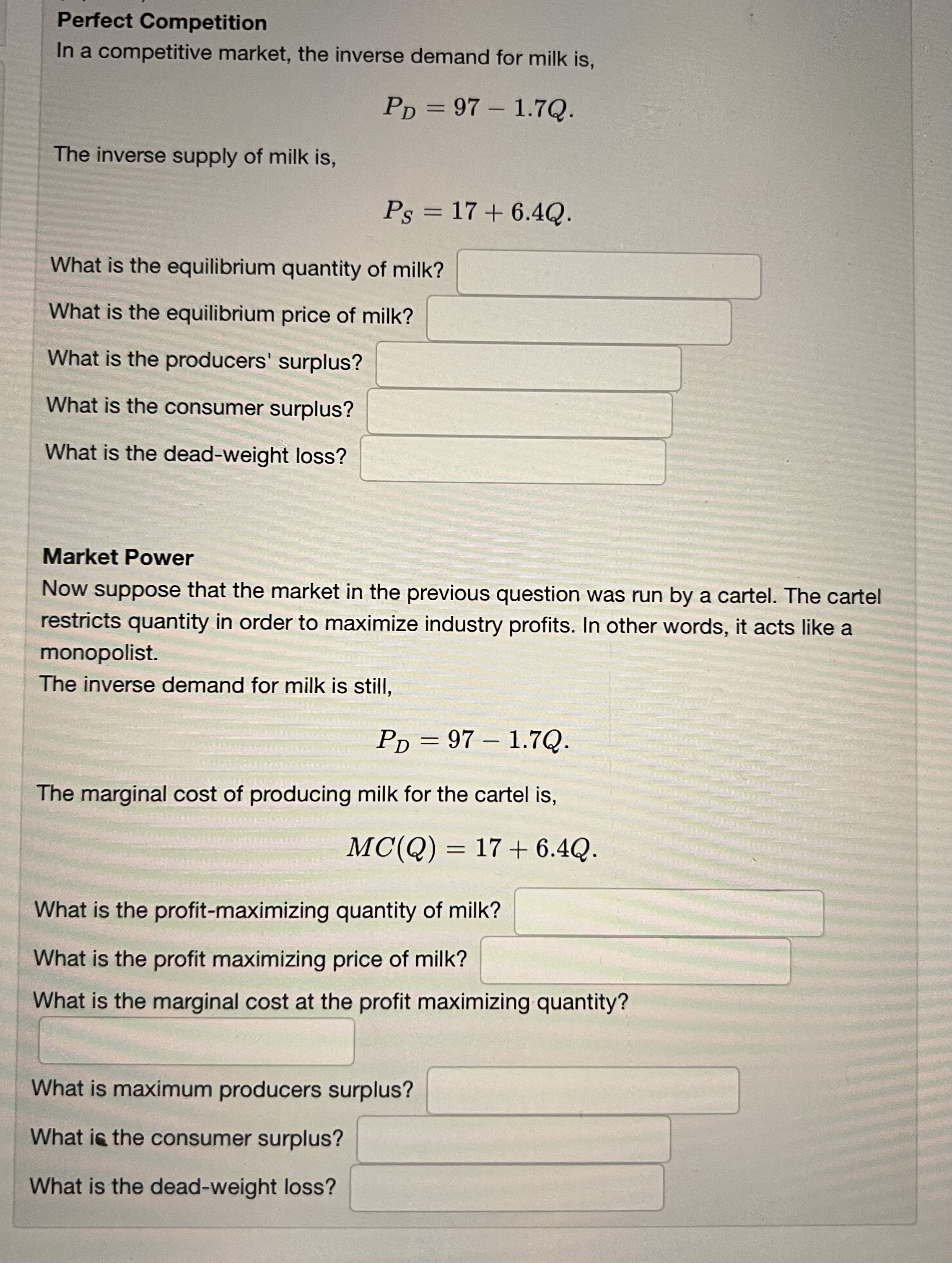

Consider a monopoly where the inverse demand for its product is given by P = 14 1.6Q Based on this information, the marginal revenue function is: MR(Q) = What quantity maximizes revenue? Q = What price maximizes revenue? P = = What is the elasticity of demand at this quantity? What is the maximimum revenue? $ Perfect Competition In a competitive market, the inverse demand for milk is, PD = 97 1.7Q. - The inverse supply of milk is, = Ps 17+ 6.4Q. What is the equilibrium quantity of milk? What is the equilibrium price of milk? What is the producers' surplus? What is the consumer surplus? What is the dead-weight loss? Market Power Now suppose that the market in the previous question was run by a cartel. The cartel restricts quantity in order to maximize industry profits. In other words, it acts like a monopolist. The inverse demand for milk is still, PD = 97 - 1.7Q. The marginal cost of producing milk for the cartel is, MC(Q) 17+ 6.4Q. = What is the profit-maximizing quantity of milk? What is the profit maximizing price of milk? What is the marginal cost at the profit maximizing quantity? What is maximum producers surplus? What is the consumer surplus? What is the dead-weight loss? (4 points) The following graph summarizes the demand and costs for a firm that operates in a monopolistically competitive market. Cost Curves 188 $ 98 88 HR 78 60 50 40 30 20 10 1 1 I L 1 I 1 I 1 Denand HC 2 3 5 6 7 8 9 18 11 12 Q What is the firm's optimal output? What is the firm's optimal price? What is the firm's maximum profits? What adjustments should the manager be anticipating? (3 points) In a monopoly where the marginal cost is $20 and profit maximizing price is $26.6666666666667, the price elasticity of demand is: (2 points) You are the manager of a Mom and Pop store that can buy milk from a supplier at $1.10 per gallon. If you believe the elasticity of demand for milk by customers at your store is -3.7, then your profit-maximizing price is: $ EA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started