Answered step by step

Verified Expert Solution

Question

1 Approved Answer

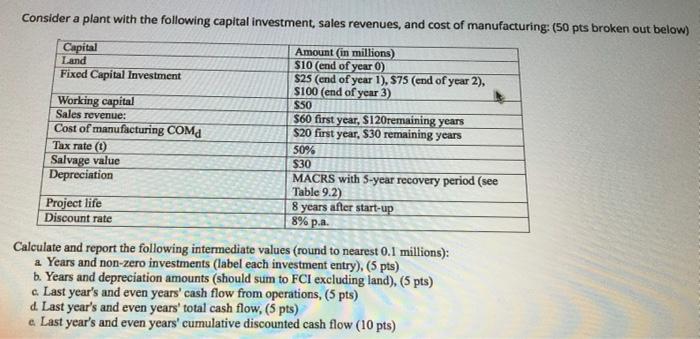

Consider a plant with the following capital investment, sales revenues, and cost of manufacturing: (50 pts broken out below) Capital Amount (in millions) Land

Consider a plant with the following capital investment, sales revenues, and cost of manufacturing: (50 pts broken out below) Capital Amount (in millions) Land $10 (end of year 0) Fixed Capital Investment $25 (end of year 1), $75 (end of year 2), $100 (end of year 3) Working capital $50 Sales revenue: $60 first year, $120remaining years $20 first year, $30 remaining years Cost of manufacturing COM 50% Tax rate (1) Salvage value $30 Depreciation MACRS with 5-year recovery period (see Table 9.2) Project life 8 years after start-up 8% p.a. Discount rate Calculate and report the following intermediate values (round to nearest 0.1 millions): a Years and non-zero investments (label each investment entry), (5 pts) b. Years and depreciation amounts (should sum to FCI excluding land), (5 pts) c. Last year's and even years' cash flow from operations, (5 pts) d. Last year's and even years' total cash flow, (5 pts) e. Last year's and even years' cumulative discounted cash flow (10 pts)

Step by Step Solution

★★★★★

3.54 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

a Years and nonzero investments label each investment entry 5 p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started