Answered step by step

Verified Expert Solution

Question

1 Approved Answer

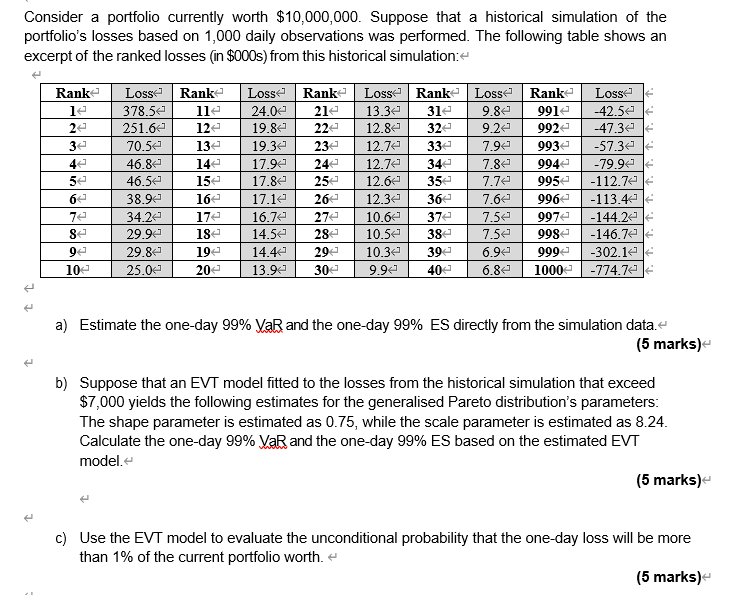

Consider a portfolio currently worth $10,000,000. Suppose that a historical simulation of the portfolio's losses based on 1,000 daily observations was performed. The following

Consider a portfolio currently worth $10,000,000. Suppose that a historical simulation of the portfolio's losses based on 1,000 daily observations was performed. The following table shows an excerpt of the ranked losses (in $000s) from this historical simulation: Rank 14 24 34 4 54 6 74 8 9 10 Loss Rank Loss Rank 378.5 24.0 251.6 19.8 70.5 19.3 46.8 17.9 46.5 17.8 38.9 17.1 34.2 16.7 29.9 14.5 29.8 14.4 25.0 13.9 114 124 134 14 15 16 174 18 19 20 214 224 234 24 25 26 27 28 29 30 Loss Rank Loss Rank Loss 13.3 314 9.8 991 12.8 32 9.2 992 12.7 33 993 12.7 < 34 994 12.6 35 995 12.3 36 10.6 374 10.5 38 10.3 9.9 39 40 7.9 7.8 7.7 7.6 7.5 7.5 -42.5 -47.3 -57.3 -79.9 -112.7 -113.4 -144.2 -146.7 996 997 998 6.9 999 -302.1 6.8 1000 -774.7 a) Estimate the one-day 99% VaR and the one-day 99% ES directly from the simulation data. < (5 marks) b) Suppose that an EVT model fitted to the losses from the historical simulation that exceed $7,000 yields the following estimates for the generalised Pareto distribution's parameters: The shape parameter is estimated as 0.75, while the scale parameter is estimated as 8.24. Calculate the one-day 99% VaR and the one-day 99% ES based on the estimated EVT model. (5 marks) c) Use the EVT model to evaluate the unconditional probability that the one-day loss will be more than 1% of the current portfolio worth. < (5 marks)

Step by Step Solution

★★★★★

3.44 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

a To estimate the oneday 99 VaR Value at Risk from the simulation data we need to find the loss amou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started