Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a project to supply Detroit with 30,000 tons of machine screws annually fc automobile production. You will need an initial $4,600,000 investment in threadin

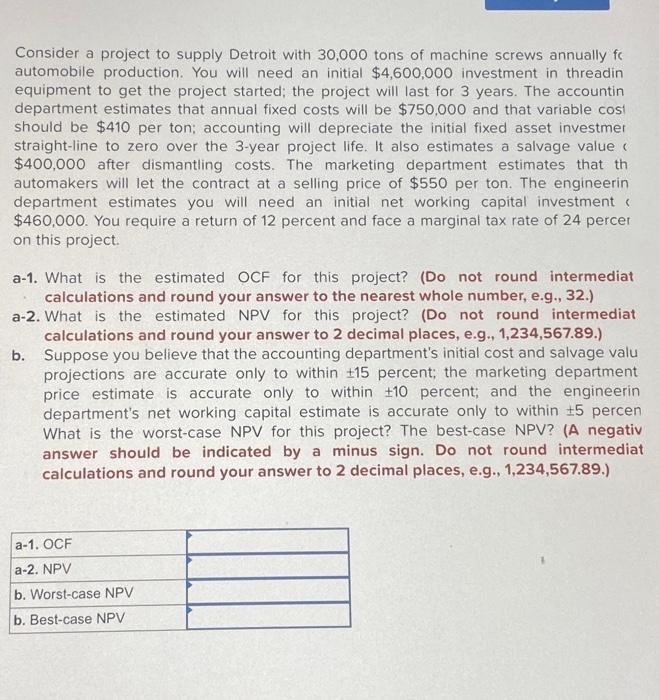

Consider a project to supply Detroit with 30,000 tons of machine screws annually fc automobile production. You will need an initial $4,600,000 investment in threadin equipment to get the project started; the project will last for 3 years. The accountin department estimates that annual fixed costs will be $750,000 and that variable cost should be $410 per ton; accounting will depreciate the initial fixed asset investmer straight-line to zero over the 3-year project life. It also estimates a salvage value ( $400,000 after dismantling costs. The marketing department estimates that th automakers will let the contract at a selling price of $550 per ton. The engineerin department estimates you will need an initial net working capital investment ( $460,000. You require a return of 12 percent and face a marginal tax rate of 24 percer on this project. a-1. What is the estimated OCF for this project? (Do not round intermediat calculations and round your answer to the nearest whole number, e.g., 32.) a-2. What is the estimated NPV for this project? (Do not round intermediat calculations and round your answer to 2 decimal places, e.g., 1,234,567.89.) b. Suppose you believe that the accounting department's initial cost and salvage valu projections are accurate only to within 15 percent; the marketing department price estimate is accurate only to within 10 percent; and the engineerin department's net working capital estimate is accurate only to within 15 percen What is the worst-case NPV for this project? The best-case NPV? (A negativ answer should be indicated by a minus sign. Do not round intermediat calculations and round your answer to 2 decimal places, e.g., 1,234,567.89.) a-1. OCF a-2. NPV b. Worst-case NPV b. Best-case NPV 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started