Answered step by step

Verified Expert Solution

Question

1 Approved Answer

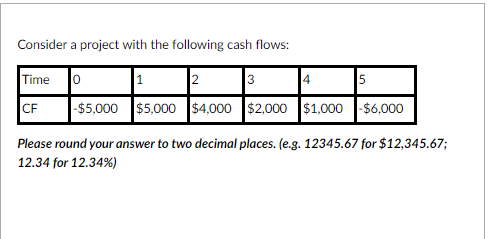

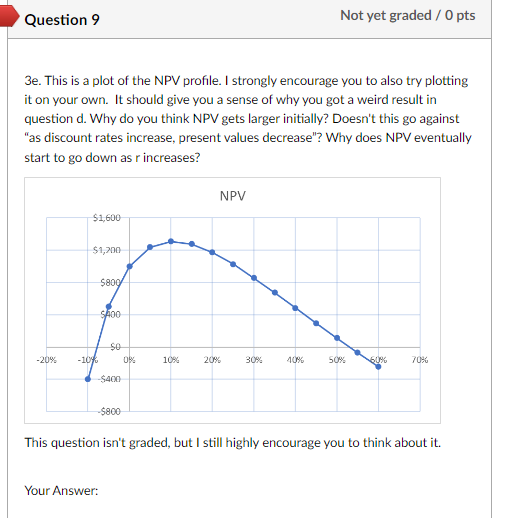

Consider a project with the following cash flows: Please round your answer to two decimal places. (e.g. 12345.67 for $12,345.67; 12.34 for 12.34%) 3e. This

Consider a project with the following cash flows: Please round your answer to two decimal places. (e.g. 12345.67 for $12,345.67; 12.34 for 12.34%) 3e. This is a plot of the NPV profile. I strongly encourage you to also try plotting it on your own. It should give you a sense of why you got a weird result in question d. Why do you think NPV gets larger initially? Doesn't this go against "as discount rates increase, present values decrease"? Why does NPV eventually start to go down as r increases? This question isn't graded, but I still highly encourage you to think about it. Your

Consider a project with the following cash flows: Please round your answer to two decimal places. (e.g. 12345.67 for $12,345.67; 12.34 for 12.34%) 3e. This is a plot of the NPV profile. I strongly encourage you to also try plotting it on your own. It should give you a sense of why you got a weird result in question d. Why do you think NPV gets larger initially? Doesn't this go against "as discount rates increase, present values decrease"? Why does NPV eventually start to go down as r increases? This question isn't graded, but I still highly encourage you to think about it. Your Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started