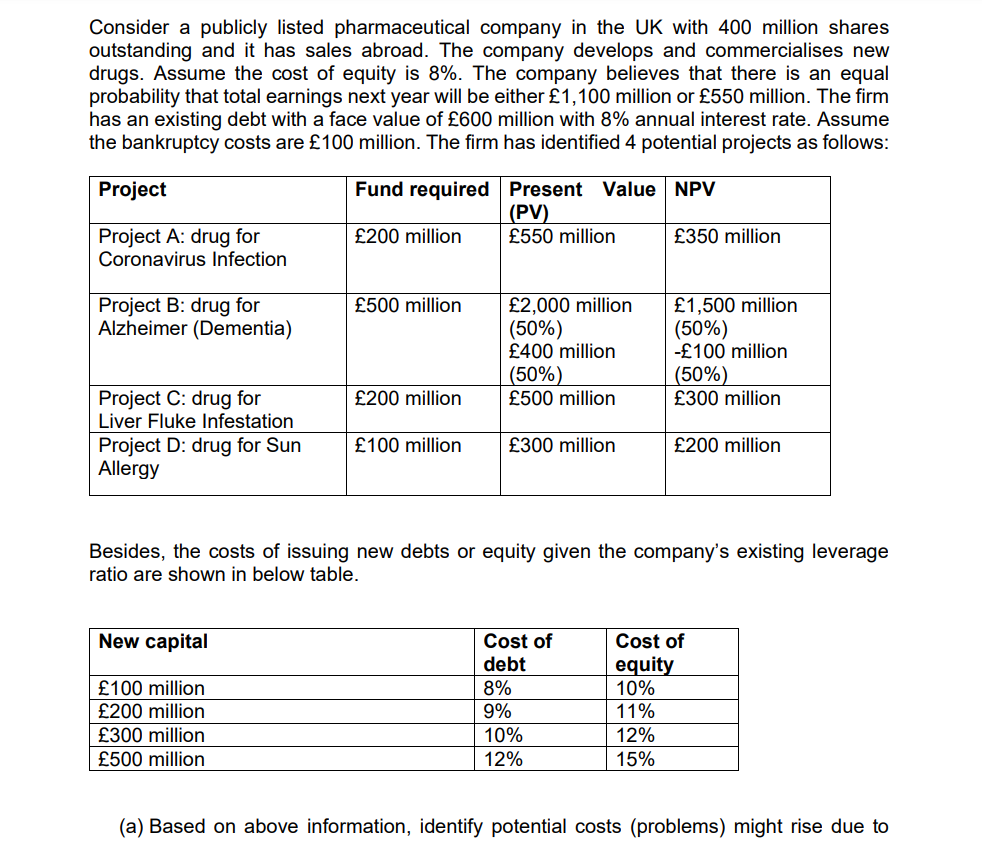

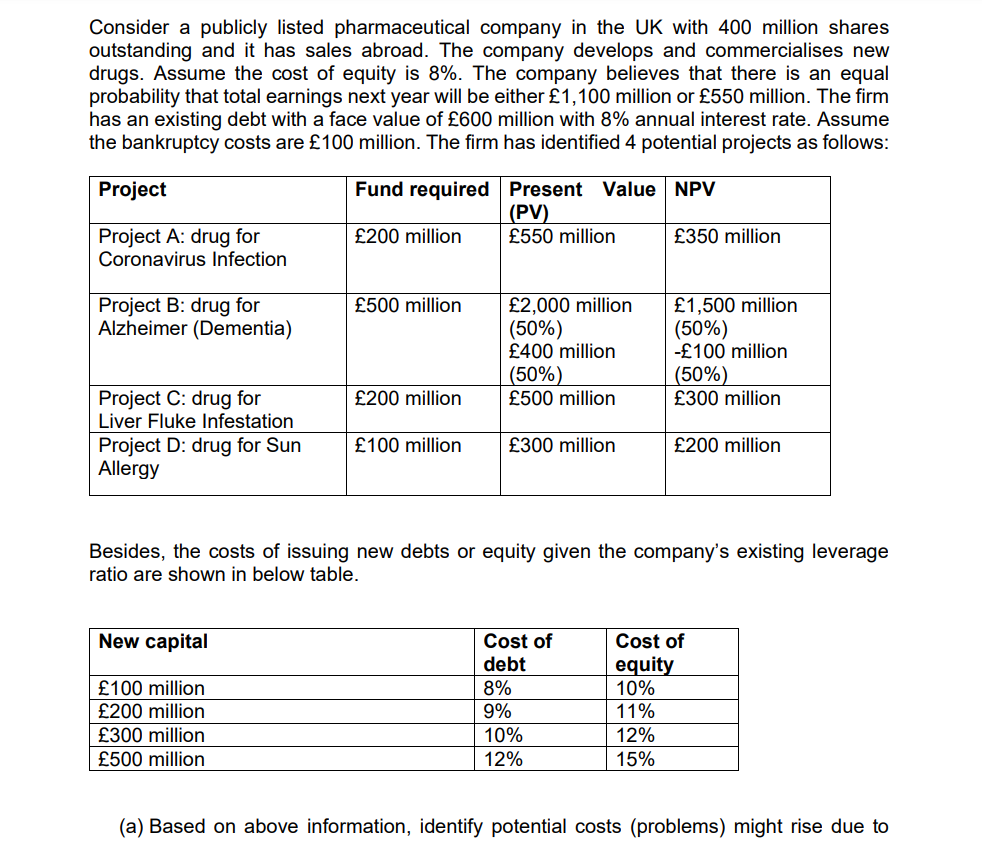

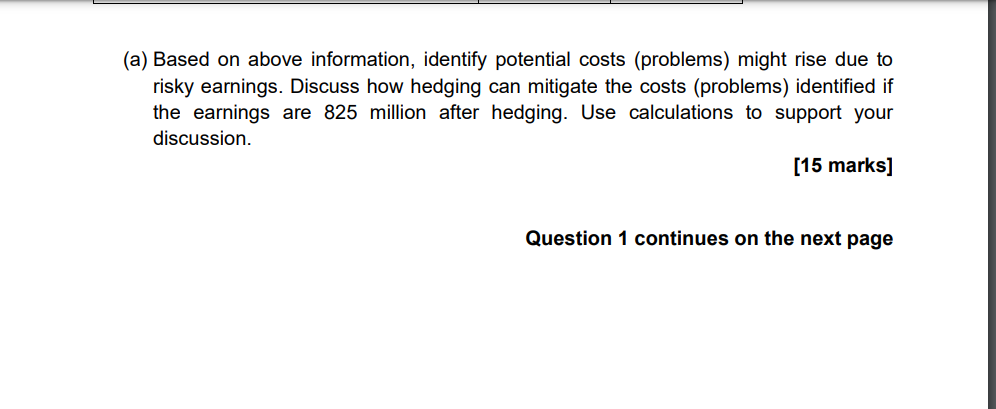

Consider a publicly listed pharmaceutical company in the UK with 400 million shares outstanding and it has sales abroad. The company develops and commercialises new drugs. Assume the cost of equity is 8%. The company believes that there is an equal probability that total earnings next year will be either 1,100 million or 550 million. The firm has an existing debt with a face value of 600 million with 8% annual interest rate. Assume the bankruptcy costs are 100 million. The firm has identified 4 potential projects as follows: Project Fund required Present Value NPV (PV) 200 million 550 million 350 million Project A: drug for Coronavirus Infection Project B: drug for 500 million Alzheimer (Dementia) 2,000 million (50%) 400 million (50%) 1,500 million (50%) -100 million (50%) 200 million 500 million 300 million Project C: drug for Liver Fluke Infestation 100 million 300 million 200 million Project D: drug for Sun Allergy Besides, the costs of issuing new debts or equity given the company's existing leverage ratio are shown in below table. New capital Cost of Cost of debt equity 100 million 8% 10% 200 million 9% 11% 300 million 10% 12% 500 million 12% 15% (a) Based on above information, identify potential costs (problems) might rise due to (a) Based on above information, identify potential costs (problems) might rise due to risky earnings. Discuss how hedging can mitigate the costs (problems) identified if the earnings are 825 million after hedging. Use calculations to support your discussion. [15 marks] Question 1 continues on the next page Page 3 Question 1 (continued) (b) Discuss alternative strategies for resolving the problems identified in (a). [5 marks] (c) Suppose the firm needs to redeem the existing debt (600 million) and the firm decides to borrow 500 million new debts to fund projects. (i) Explain the asset substitution problem. Use calculations to support your explanation. [8 marks] (ii) Discuss the value of hedging on mitigating the asset substitution problem. Use calculations to support your discussion, assuming hedging could replace the lottery of 1,500 million and -100 million NPV of project B with 700 million. [5 marks] Consider a publicly listed pharmaceutical company in the UK with 400 million shares outstanding and it has sales abroad. The company develops and commercialises new drugs. Assume the cost of equity is 8%. The company believes that there is an equal probability that total earnings next year will be either 1,100 million or 550 million. The firm has an existing debt with a face value of 600 million with 8% annual interest rate. Assume the bankruptcy costs are 100 million. The firm has identified 4 potential projects as follows: Project Fund required Present Value NPV (PV) 200 million 550 million 350 million Project A: drug for Coronavirus Infection Project B: drug for 500 million Alzheimer (Dementia) 2,000 million (50%) 400 million (50%) 1,500 million (50%) -100 million (50%) 200 million 500 million 300 million Project C: drug for Liver Fluke Infestation 100 million 300 million 200 million Project D: drug for Sun Allergy Besides, the costs of issuing new debts or equity given the company's existing leverage ratio are shown in below table. New capital Cost of Cost of debt equity 100 million 8% 10% 200 million 9% 11% 300 million 10% 12% 500 million 12% 15% (a) Based on above information, identify potential costs (problems) might rise due to (a) Based on above information, identify potential costs (problems) might rise due to risky earnings. Discuss how hedging can mitigate the costs (problems) identified if the earnings are 825 million after hedging. Use calculations to support your discussion. [15 marks] Question 1 continues on the next page Page 3 Question 1 (continued) (b) Discuss alternative strategies for resolving the problems identified in (a). [5 marks] (c) Suppose the firm needs to redeem the existing debt (600 million) and the firm decides to borrow 500 million new debts to fund projects. (i) Explain the asset substitution problem. Use calculations to support your explanation. [8 marks] (ii) Discuss the value of hedging on mitigating the asset substitution problem. Use calculations to support your discussion, assuming hedging could replace the lottery of 1,500 million and -100 million NPV of project B with 700 million. [5 marks]