Question

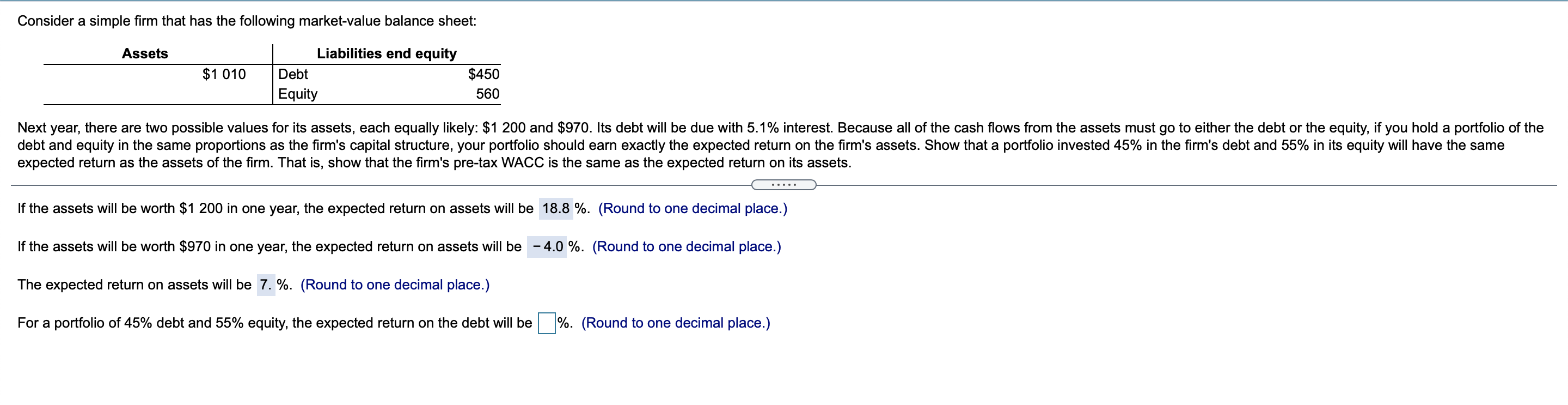

Consider a simple firm that has the following market-value balance sheet: Assets Liabilities end equity $1 010 Debt $450 Equity 560 Next year, there are

Consider a simple firm that has the following market-value balance sheet:

| Assets | Liabilities end equity | ||

| $1 010 | Debt | $450 | |

| Equity | 560 | ||

Next year, there are two possible values for its assets, each equally likely:

$1 200

and

$970.

Its debt will be due with

5.1%

interest. Because all of the cash flows from the assets must go to either the debt or the equity, if you hold a portfolio of the debt and equity in the same proportions as the firm's capital structure, your portfolio should earn exactly the expected return on the firm's assets. Show that a portfolio invested

45%

in the firm's debt and

55%

in its equity will have the same expected return as the assets of the firm. That is, show that the firm's pre-tax WACC is the same as the expected return on its assets.

If the assets will be worth

$1 200

in one year, the expected return on assets will be

18.818.8%.

(Round to one decimal place.)If the assets will be worth

$970

in one year, the expected return on assets will be

negative 4.04.0%.

(Round to one decimal place.)The expected return on assets will be

7.7.%. (Round to one decimal place.)

7.7.%. (Round to one decimal place.)

For a portfolio of 45% debt and 55% equity, the expected return on the debt will be______%. (Round to one decimal place.)

Consider a simple firm that has the following market value balance sheet: Assets $1 010 Liabilities end equity Debt Equity $450 560 Next year, there are two possible values for its assets, each equally likely: $1 200 and $970. Its debt will be due with 5.1% interest. Because all of the cash flows from the assets must go to either the debt or the equity, if you hold a portfolio of the debt and equity in the same proportions as the firm's capital structure, your portfolio should earn exactly the expected return on the firm's assets. Show that a portfolio invested 45% in the firm's debt and 55% in its equity will have the same expected return as the assets of the firm. That is, show that the firm's pre-tax WACC is the same as the expected return on its assets. If the assets will be worth $1 200 in one year, the expected return on assets will be 18.8 %. (Round to one decimal place.) If the assets will be worth $970 in one year, the expected return on assets will be - 4.0 %. (Round to one decimal place.) The expected return on assets will be 7. %. (Round to one decimal place.) For a portfolio of 45% debt and 55% equity, the expected return on the debt will be %. (Round to one decimal place.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started