Answered step by step

Verified Expert Solution

Question

1 Approved Answer

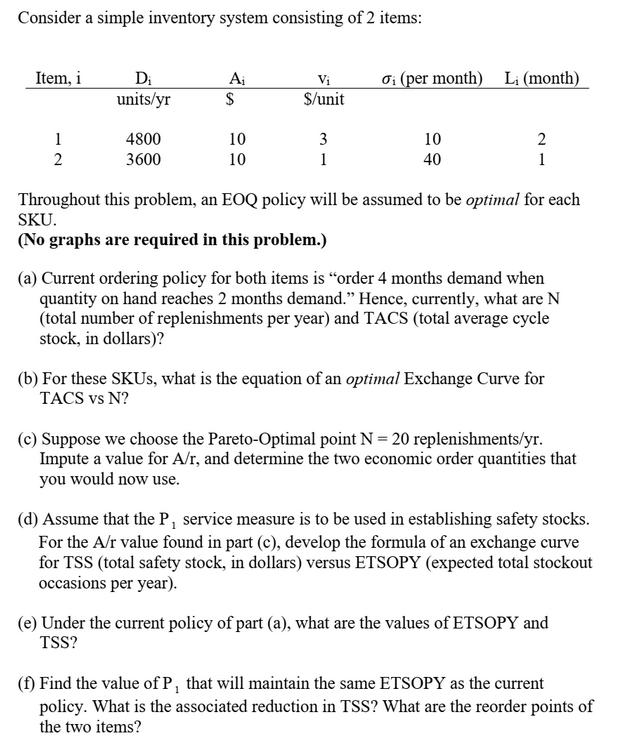

Consider a simple inventory system consisting of 2 items: Item, i 1 2 D units/yr 4800 3600 Ai $ 10 10 Vi $/unit 3

Consider a simple inventory system consisting of 2 items: Item, i 1 2 D units/yr 4800 3600 Ai $ 10 10 Vi $/unit 3 1 0 (per month) Li (month) 10 40 21 2 1 Throughout this problem, an EOQ policy will be assumed to be optimal for each SKU. (No graphs are required in this problem.) (a) Current ordering policy for both items is "order 4 months demand when quantity on hand reaches 2 months demand." Hence, currently, what are N (total number of replenishments per year) and TACS (total average cycle stock, in dollars)? (b) For these SKUs, what is the equation of an optimal Exchange Curve for TACS vs N? (c) Suppose we choose the Pareto-Optimal point N = 20 replenishments/yr. Impute a value for A/r, and determine the two economic order quantities that you would now use. (d) Assume that the P service measure is to be used in establishing safety stocks. For the A/r value found in part (c), develop the formula of an exchange curve for TSS (total safety stock, in dollars) versus ETSOPY (expected total stockout occasions per year). (e) Under the current policy of part (a), what are the values of ETSOPY and TSS? (f) Find the value of P, that will maintain the same ETSOPY as the current policy. What is the associated reduction in TSS? What are the reorder points of the two items?

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a N 2 for both items T AC S 3 600 for both items b EO Q 2 DS h where EO Q optimal order quantity D d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started