Donald is resident and domiciled in the UK. He is not a Scottish taxpayer. He has the

Question:

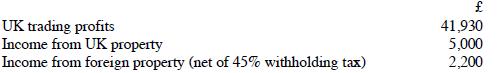

Donald is resident and domiciled in the UK. He is not a Scottish taxpayer. He has the following income in tax year 2020-21:

Donald claims only the personal allowance. Compute the amount of income tax payable for 2010-21.

Transcribed Image Text:

UK trading profits Income from UK property Income from foreign property (net of 45% withholding tax) 41,930 5,000 2,200

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 33% (3 reviews)

To compute the amount of income tax payable for the tax year 202021 for Donald we first need to calc...View the full answer

Answered By

VIKAS KUMAR

hello everyone I am vikas kumar i have done my masters from motilal nehru national institute of technology allahabad. currently i am teaching in Gate preparation coaching classes in bhopal.

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Donald is resident and domiciled in the UK. He is not a Scottish taxpayer. He has the following income in tax year 2017-18: UK trading profits Income from UK property Income from foreign property...

-

Donald is resident and domiciled in the UK. He is not a Scottish taxpayer. He has the following income in tax year 2021-22: Donald claims only the personal allowance. Compute the amount of income tax...

-

You received a schedule from Lucee, a new client of your firm. The schedule from your manager detailing the work he requires you to do are set out below. Schedule from Lucee dated 4 September 2018 I...

-

Since the early 2000s, there has been a significant increase in the price of corn-based ethanol. a. A key input in the production of corn-based ethanol is corn. Use an appropriate diagram to explain...

-

In year 1, Sharon loaned her friend, Christina, $10,000 to start a new business. The loan was documented by a signed note, at market interest rate, and required repayment in two years. Christina...

-

Article:...

-

Identify one new-product idea you would suggest that X-1 evaluate.

-

With five production facilities, the company produces cardboard boxes, plastic and steel drums, aluminum bottles, and absorbent pouches and bags. Companies using their products ship everything from...

-

URGENT* Kindly answer this question at the earliest possible. Thanks :) he following data for November have been provided by Hunn Corporation, a producer of precision drills for oll exploration:...

-

A UK resident company has 19 subsidiaries, five of which are situated abroad. In the year to 31 March 2021, the company had the following results: None of the dividends received were from any of the...

-

Brist Ltd is a UK resident company which prepares annual accounts to 31 March. In the year to 31 March 2021, the company had a UK trading profit of 2,120,000 and received overseas property income of...

-

I:15-22 Which official publication(s) contain(s) the following: a. Transcripts of Senate floor debates b. IRS announcements c. Tax Court regular opinions d. Treasury decisions e. U.S. district court...

-

Suggest at least 3 touchpoints for each stage of the decision-making process that SEDO can use. Search and find in which of the touchpoints for information search stage suggested by you, can you see...

-

How do modern database management systems address the challenges posed by Big Data, including storage, processing, and analysis of massive volumes of heterogeneous data, while maintaining performance...

-

Describe how the various and sometimes seemingly unrelated topic areas work together toward managing healthcare quality

-

find Fourier series of the following functions (a) f1(x) = sinh(x), (b) f2(x) = cosh(x), (c) f3(x) = x + |x|, (d) f4(x) = x|x|.

-

Explore the realm of database transaction processing, elucidating the nuances of ACID (Atomicity, Consistency, Isolation, Durability) properties and their manifestation in ensuring transactional...

-

Androx Chemicals manufactures a powdered compound that is used to coat gunite swimming pools. An important measure is the Dry Brightness (DB) Number, and customers will not accept product that has a...

-

(a) How far away can a human eye distinguish two ear headlights 2.0 m apart? Consider only diffraction effects and assume an eye pupil diameter of 5.0 mm and a wavelength of 550 nm. (b) What is the...

-

Cerulean Corporation has two equal shareholders, Eloise and Olivia. Eloise acquired her Cerulean stock three years ago by transferring property worth $700,000, basis of $300,000, for 70 shares of the...

-

Petrel Corporation has accumulated E & P of $85,000 at the beginning of the year. Its current-year taxable income is $320,000. On December 31, Petrel distributed business property (worth $140,000,...

-

Parrot Corporation is a closely held company with accumulated E & P of $300,000 and current E & P of $350,000. Tom and Jerry are brothers; each owns a 50% share in Parrot, and they share management...

-

1,600 Balance Sheet The following is a list (in random order) of KIP International Products Company's December 31, 2019, balance sheet accounts: Additional Paid-In Capital on Preferred Stock $2,000...

-

Question 3 4 pts 9 x + 3 x 9 if x 0 Find a) lim f(x), b) lim, f(x), C), lim , f(x) if they exist. 3 Edit View Insert Format Tools Table : 12pt M Paragraph B IV A2 Tv

-

Mr. Geoffrey Guo had a variety of transactions during the 2019 year. Determine the total taxable capital gains included in Mr. Guo's division B income. The transactions included: 1. On January 1,...

Study smarter with the SolutionInn App