Donald is resident and domiciled in the UK. He is not a Scottish taxpayer. He has the

Question:

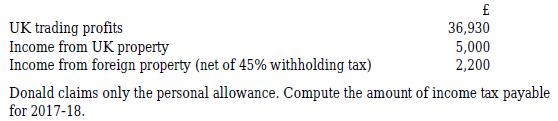

Donald is resident and domiciled in the UK. He is not a Scottish taxpayer. He has the following income in tax year 2017-18:

Transcribed Image Text:

UK trading profits Income from UK property Income from foreign property (net of 45% withholding tax) 36,930 5,000 2,200 Donald claims only the personal allowance. Compute the amount of income tax payable for 2017-18.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

In the tax year 201718 the personal allowance for an individual in the UK was 11500 This means the f...View the full answer

Answered By

Felix Mucee

I am a detailed and thorough professional writer with 5 years of administrative experience- the last 2 years in academic writing and virtual office environment. I specialize in delivering quality services with respect to strict deadlines and high expectations. I am equipped with a dedicated home office complete with a computer, copier/scanner/fax and color printer.

I provide creative and detailed administrative, web search, academic writing, data entry, Personal assistant, Content writing, Translation, Academic writing, editing and proofreading services. I excel at working under tight deadlines with strict expectations. I possess the self-discipline and time management skills necessary to have served as an academic writer for the past five years. I can bring value to your business and help solve your administrative assistant issues.

4.70+

13+ Reviews

33+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Donald is resident and domiciled in the UK. He is not a Scottish taxpayer. He has the following income in tax year 2021-22: Donald claims only the personal allowance. Compute the amount of income tax...

-

You received a schedule from Lucee, a new client of your firm. The schedule from your manager detailing the work he requires you to do are set out below. Schedule from Lucee dated 4 September 2018 I...

-

Derek's total income for 2017-18 is 63,310 (entirely non-savings) and he makes a gross deductible payment of 3,000 in the year. He is not a Scottish taxpayer and he makes no Gift Aid donations or...

-

Consider a property investment that you finance with 20% down payment. For the remaining, you borrow 2'300'000 at a 6% rate monthly amortized loan for 25 years. This property, with 2% of EBITDA as...

-

Do antibodies cause Multiple Sclerosis?

-

1. What factors are involved in team composition?

-

Make an ogive of the data set using six classes.

-

Compute the internal rate of return for the cash flows of the following twoprojects: Cash Flows ($) Year Project A Project B -$5,300 2.000 2,800 1,600 -$2,900 1,100 1,800 1,200 0

-

A firm wishes to borrow $91,000 The line of credit with its bank requires a 4% compensating balance requirement. What is the loan amount they have to borrow?

-

Brist Ltd is a UK resident company which prepares annual accounts to 31 March. In the year to 31 March 2018, the company had a UK trading profit of 2,120,000 and received overseas property income of...

-

In the year to 31 March 2018 , a UK company has UK trading profits of 4,800,000 and overseas property income (net of 45% withholding tax) of 2,750,000. Gift Aid donations of 100,000 are made in the...

-

Stress is a serious medical problem that costs businesses and government billions of dollars annually. As a result, it is important to determine the causes and possible cures. It would be helpful to...

-

How do you assess the managerial challenge posing the decision of having an organization-wide uniform package of compensation and benefits in the present context of organizations having diversity of...

-

what you have to do is make order decisions based on the sales, stock, and delivery cycle of each item. You are making decisions of marking orders from suppliers, and they will deliver the item next...

-

How do advanced relaxation techniques, such as progressive muscle relaxation or guided imagery, contribute to a comprehensive stress management plan ?

-

What role do intermediaries play in intermediation in the market? Do middlemen exist in the online market? How? Talk about the following ideas with examples from real life: (1) the issues with direct...

-

Identify and conduct a 5S project that you could do at home, school, or your place of employment. For each of the 5 steps, define what you would do to address the situation. Describe the outcome. .

-

Suppose that Elite Daycare provides two different services - full-time childcare for preschoolers and after-school care for older children. The director would like to estimate an annual cost per...

-

If the annual fixed costs are 54,000 dinars, the occupation expense represents 20%, the contribution margin is 25%, and the unit selling price is 40 dinars. Required: Calculate the closing point of...

-

FF Ltd acquired 80% of the ordinary share capital of GG Ltd on 1 April 2016. On that date, the retained earnings of GG Ltd were 18,260. There are no preference shares. The statements of comprehensive...

-

PP Ltd acquired 65% of the ordinary share capital of QQ Ltd on 1 January 2019. There are no preference shares. The statements of comprehensive income of the two companies for the year to 31 December...

-

(a) List the main indicators of a hyperinflationary economy, as specified by IAS29. (b) Explain why IAS29 takes the view that conventional financial statements are not useful in a hyperinflationary...

-

Ted and his partners have contracted to purchase the franchise nights worth 561 000 to open and operate a specialty pizza restaurant called Popper with a renewable agrement, the partners have agreed...

-

Your answer is partially correct. Martin Company's chief financial officer feels that it is important to have data for the entire quarter especially since their financial forecasts indicate some...

-

Kellog Corporation is considering a capital budgeting project that would have a useful life of 4 years and would love testing 5156.000 in equipment that would have zeto salvage value at the end of...

Study smarter with the SolutionInn App