Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a six-month expiration European call option with exercise price $105. The underlying stock sells for $100 a share and pays no dividends. The risk-free

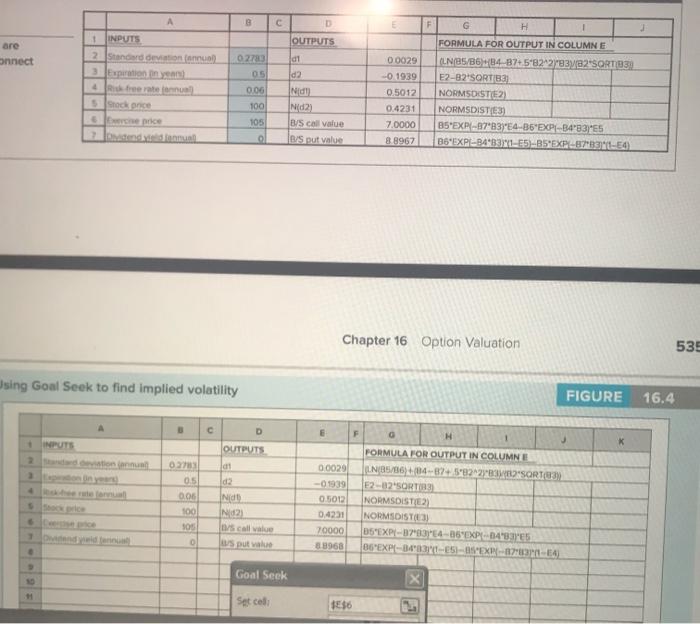

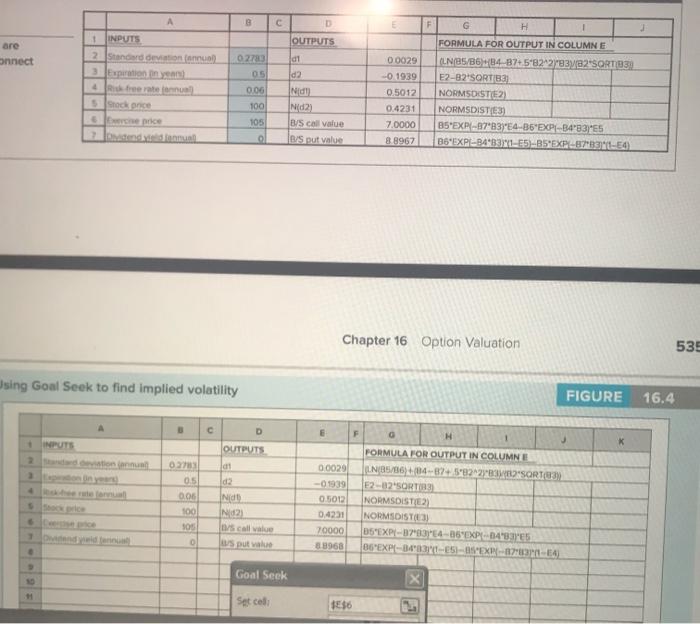

Consider a six-month expiration European call option with exercise price $105. The underlying stock sells for $100 a share and pays no dividends. The risk-free rate is 5%. What is the implied volatility of the option if the option currently sells for $8? Use Spreadsheet 16.1 to answer this question.

the spreadsheet is below

please solve without using excel sheet

B D OUTPUTS are onnect 1 INPUTS 2. Standard deviation d1 d2 beraternal socke e price 0273 05 0.00 100 F G H FORMULA FOR OUTPUT IN COLUMN E CLN(85/86+84-871.5*822)83782"SORT83) E2-82'SORT83 NORMSOSTE2) NORMSDISTE3) 85'EXR-8783) E4-36'EXP-34-83'ES B6'EXPL-BABY-ES-BS'EXP-BR-E0 00029 -0 1939 0.5012 0.4231 7.0000 8 8967 IND Nd2) B/S call value 105 0 B/Sout value Chapter 16 Option Valuation 535 Using Goal Seek to find implied volatility FIGURE 16.4 c D F OUTPUTS 0278 09 0.00 100 305 Nid Nd2 1/ calle Usput value 00029 -0.1939 05012 0.4231 70000 89968 FORMULA FOR OUTPUT IN COLUMNE LN/85/86 (04-025822BILO SORTE E2-32 SORT NORMSOSTE2) NORMSDISTES DS'EXPL-07934-85'EXPO-04'TES BS'EXPL-0431-5-SEX-0234 o . Goal Seek 11 Set celle $6 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started