Answered step by step

Verified Expert Solution

Question

1 Approved Answer

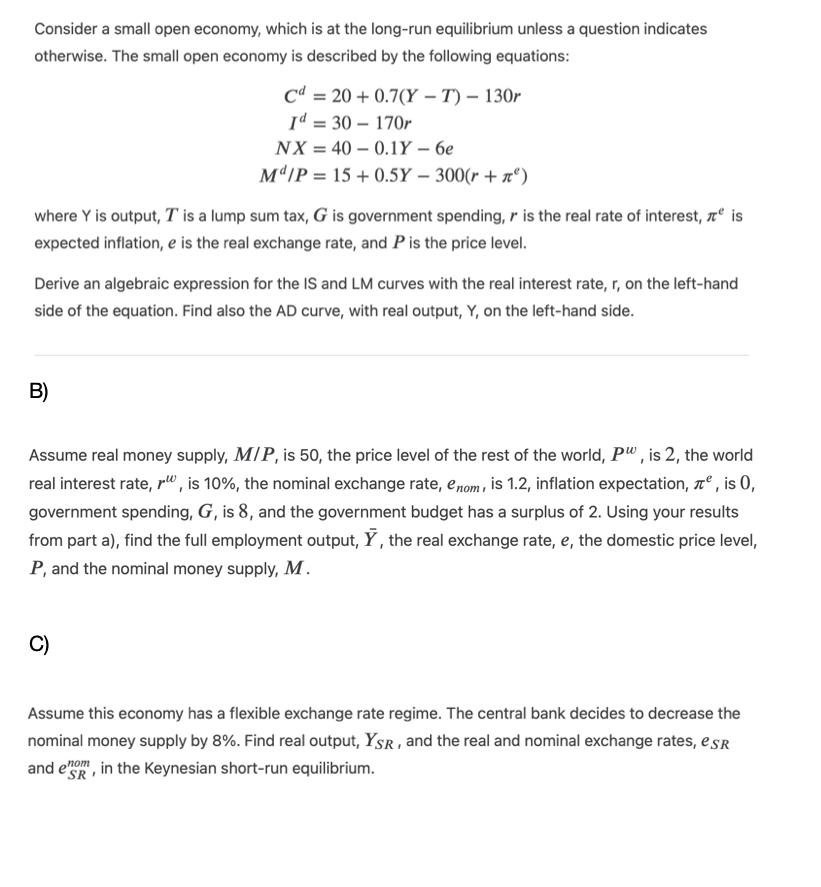

Consider a small open economy, which is at the long-run equilibrium unless a question indicates otherwise. The small open economy is described by the

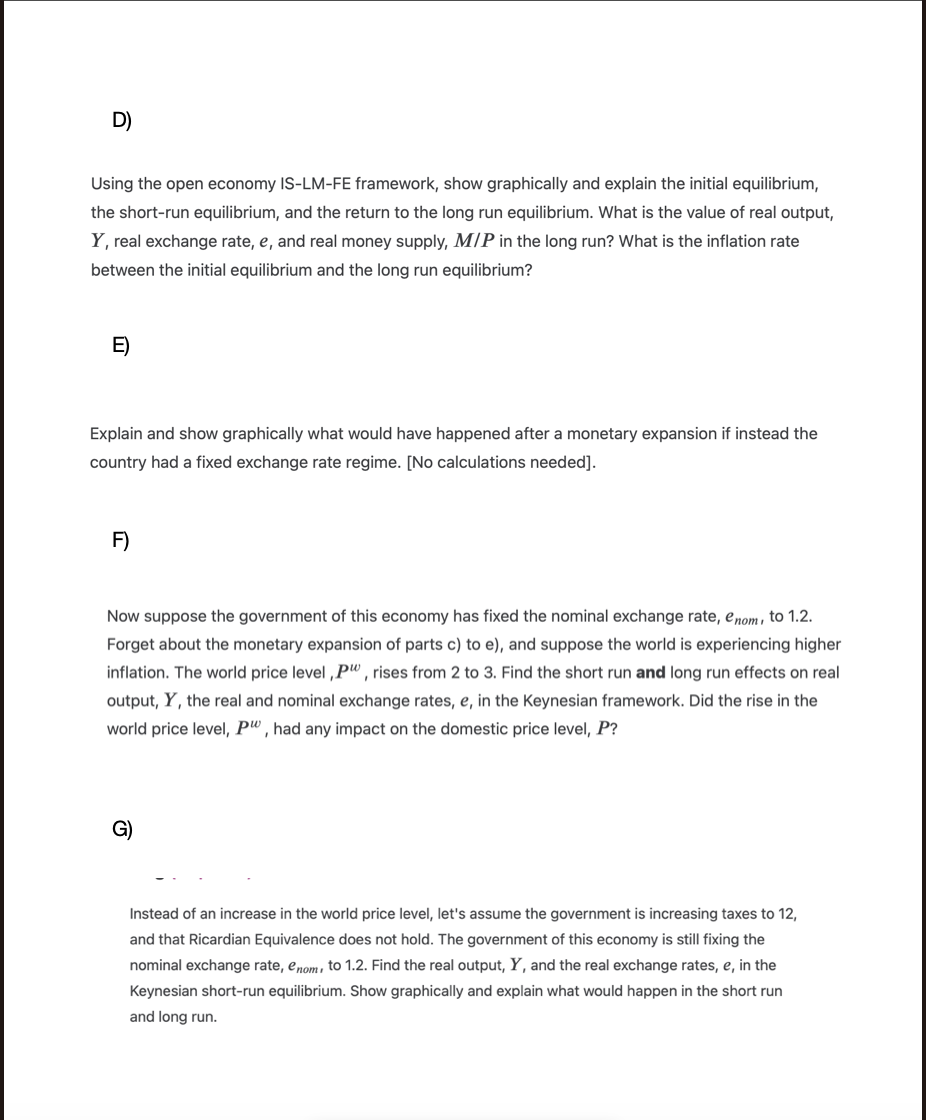

Consider a small open economy, which is at the long-run equilibrium unless a question indicates otherwise. The small open economy is described by the following equations: Cd20+0.7(YT) - 130r Id=30-170r NX 40 0.1Y - 6e Md/P 15+0.5Y - 300(r+) where Y is output, T is a lump sum tax, G is government spending, r is the real rate of interest, is expected inflation, e is the real exchange rate, and P is the price level. Derive an algebraic expression for the IS and LM curves with the real interest rate, r, on the left-hand side of the equation. Find also the AD curve, with real output, Y, on the left-hand side. B) Assume real money supply, MIP, is 50, the price level of the rest of the world, PW, is 2, the world real interest rate, r", is 10%, the nominal exchange rate, enom, is 1.2, inflation expectation, e, is 0, government spending, G, is 8, and the government budget has a surplus of 2. Using your results from part a), find the full employment output, Y, the real exchange rate, e, the domestic price level, P, and the nominal money supply, M. C) Assume this economy has a flexible exchange rate regime. The central bank decides to decrease the nominal money supply by 8%. Find real output, YSR, and the real and nominal exchange rates, esR and e, in the Keynesian short-run equilibrium. SR D) Using the open economy IS-LM-FE framework, show graphically and explain the initial equilibrium, the short-run equilibrium, and the return to the long run equilibrium. What is the value of real output, Y, real exchange rate, e, and real money supply, MIP in the long run? What is the inflation rate between the initial equilibrium and the long run equilibrium? E) Explain and show graphically what would have happened after a monetary expansion if instead the country had a fixed exchange rate regime. [No calculations needed]. F) Now suppose the government of this economy has fixed the nominal exchange rate, enom, to 1.2. Forget about the monetary expansion of parts c) to e), and suppose the world is experiencing higher inflation. The world price level, Pw, rises from 2 to 3. Find the short run and long run effects on real output, Y, the real and nominal exchange rates, e, in the Keynesian framework. Did the rise in the world price level, pw, had any impact on the domestic price level, P? G) Instead of an increase in the world price level, let's assume the government is increasing taxes to 12, and that Ricardian Equivalence does not hold. The government of this economy is still fixing the nominal exchange rate, enom, to 1.2. Find the real output, Y, and the real exchange rates, e, in the Keynesian short-run equilibrium. Show graphically and explain what would happen in the short run and long run.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started