Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a standard Arrow - Debreu model in which the representative firm is the owner of capital. The consumption good is produced by means of

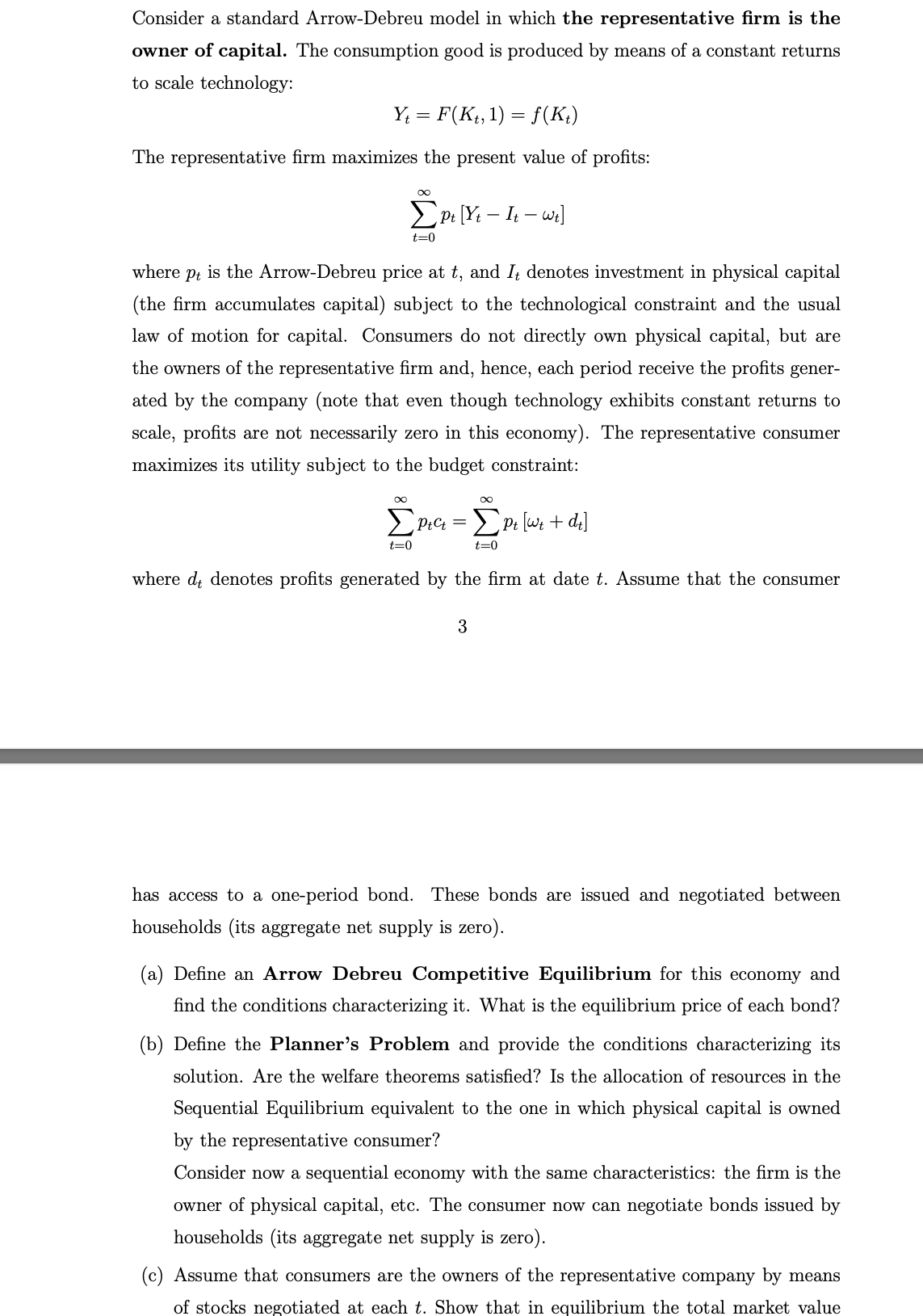

Consider a standard ArrowDebreu model in which the representative firm is the

owner of capital. The consumption good is produced by means of a constant returns

to scale technology:

The representative firm maximizes the present value of profits:

where is the ArrowDebreu price at and denotes investment in physical capital

the firm accumulates capital subject to the technological constraint and the usual

law of motion for capital. Consumers do not directly own physical capital, but are

the owners of the representative firm and, hence, each period receive the profits gener

ated by the company note that even though technology exhibits constant returns to

scale, profits are not necessarily zero in this economy The representative consumer

maximizes its utility subject to the budget constraint:

where denotes profits generated by the firm at date Assume that the consumer

has access to a oneperiod bond. These bonds are issued and negotiated between

households its aggregate net supply is zero

a Define an Arrow Debreu Competitive Equilibrium for this economy and

find the conditions characterizing it What is the equilibrium price of each bond?

b Define the Planner's Problem and provide the conditions characterizing its

solution. Are the welfare theorems satisfied? Is the allocation of resources in the

Sequential Equilibrium equivalent to the one in which physical capital is owned

by the representative consumer?

Consider now a sequential economy with the same characteristics: the firm is the

owner of physical capital, etc. The consumer now can negotiate bonds issued by

households its aggregate net supply is zero

c Assume that consumers are the owners of the representative company by means

of stocks negotiated at each Show that in equilibrium the total market value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started