Question

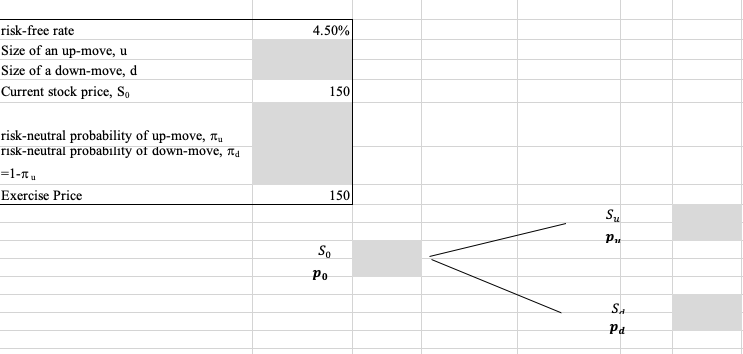

Consider a stock currently priced at $150. In the next period, the stock can either increase by 33 percent or decrease by 15 percent. Assume

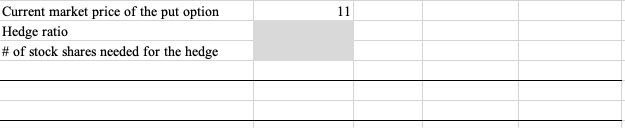

Consider a stock currently priced at $150. In the next period, the stock can either increase by 33 percent or decrease by 15 percent. Assume a European put option with an exercise price of $150 and the risk-free rate of 4.5 percent. Suppose the call option is currently trading at $11. Assume that you can long and short US Treasury securities (equivalently, you can lend and borrow money at the risk-free interest rate). Also, the stock does not pay any dividend over the life of the option.

1) (10pts) Use a one period binomial model to calculate the price of the put option (X=150). You may solve this problem by completing the cells in gray.

2) (25pts) Is it currently overpriced, underpriced, or correctly priced in the market? If mispriced, calculate the hedge ratio (5pts), tell how to execute an arbitrage trading stategy (5pts), demonstrate (tabulate all trading transactions as discussed in class) how to implement the starategy (10pts), and clealy indicate the amount of risk-free profit (5pts). Use 1,000 put options (i.e., two contracts).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started