Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a stock with a price with S=90 and pays no dividends. The annual risk-free rate is 4%. A European call option on the stock

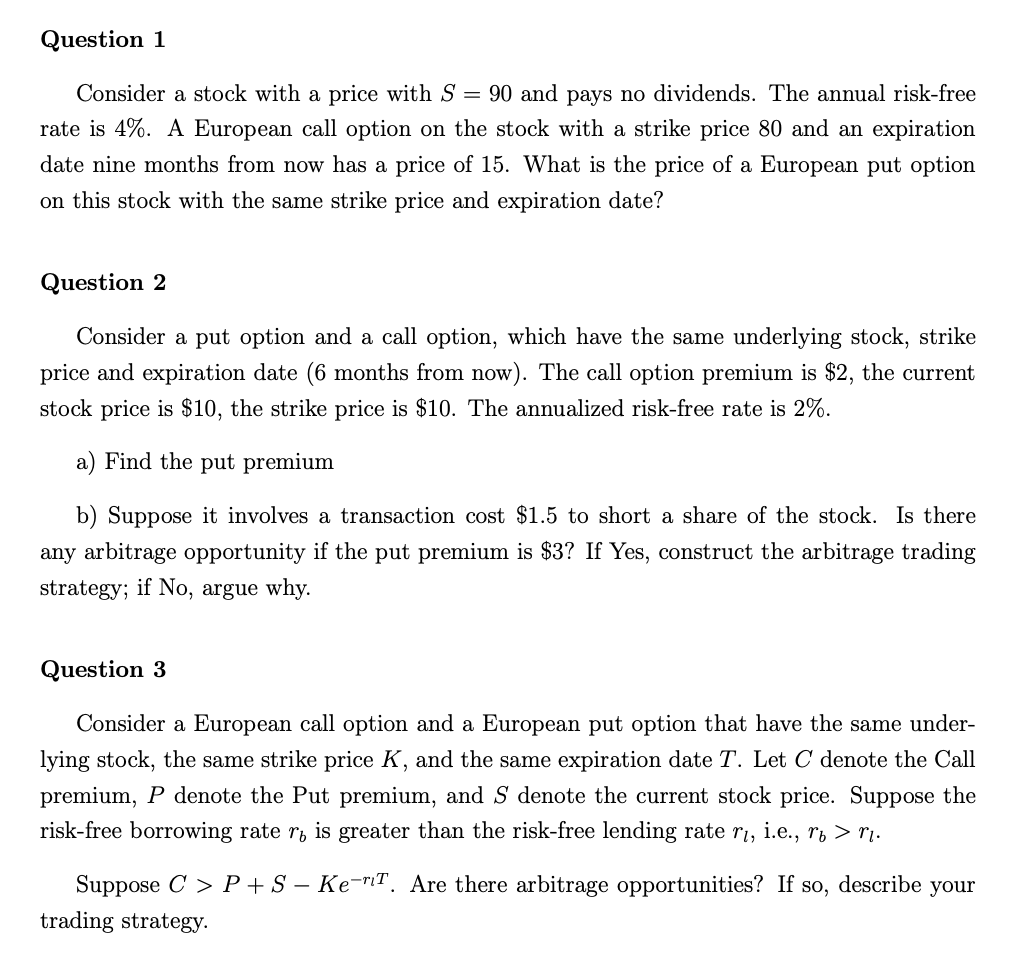

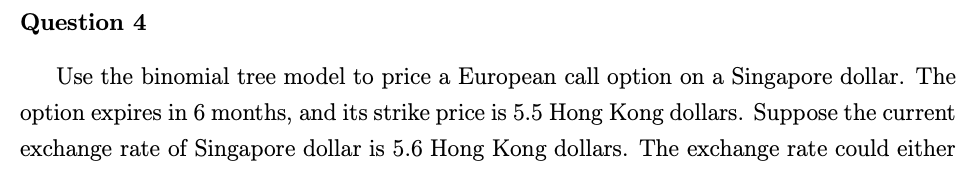

Consider a stock with a price with S=90 and pays no dividends. The annual risk-free rate is 4%. A European call option on the stock with a strike price 80 and an expiration date nine months from now has a price of 15 . What is the price of a European put option on this stock with the same strike price and expiration date? Question 2 Consider a put option and a call option, which have the same underlying stock, strike price and expiration date ( 6 months from now). The call option premium is $2, the current stock price is $10, the strike price is $10. The annualized risk-free rate is 2%. a) Find the put premium b) Suppose it involves a transaction cost $1.5 to short a share of the stock. Is there any arbitrage opportunity if the put premium is $3 ? If Yes, construct the arbitrage trading strategy; if No, argue why. Question 3 Consider a European call option and a European put option that have the same underlying stock, the same strike price K, and the same expiration date T. Let C denote the Call premium, P denote the Put premium, and S denote the current stock price. Suppose the risk-free borrowing rate rb is greater than the risk-free lending rate rl, i.e., rb>rl. Suppose C>P+SKerlT. Are there arbitrage opportunities? If so, describe your trading strategy. Use the binomial tree model to price a European call option on a Singapore dollar. The option expires in 6 months, and its strike price is 5.5 Hong Kong dollars. Suppose the current exchange rate of Singapore dollar is 5.6 Hong Kong dollars. The exchange rate could either rise to 5.8 in the up state, or drop to 5.3 in the down state. The annual risk-free rate in Hong Kong is 2%, the annual risk-free rate in Singapore is 1%. a) Find the current price of the call option in Hong Kong dollar. b) Suppose 1% is the annual risk-free lending rate in Singapore, and the annual risk-free borrowing rate is 1.5% in Singapore. Find the minimum upper bound and the maximum lower bound for the call premium in Hong Kong dollar such that there is no arbitrage opportunity

Consider a stock with a price with S=90 and pays no dividends. The annual risk-free rate is 4%. A European call option on the stock with a strike price 80 and an expiration date nine months from now has a price of 15 . What is the price of a European put option on this stock with the same strike price and expiration date? Question 2 Consider a put option and a call option, which have the same underlying stock, strike price and expiration date ( 6 months from now). The call option premium is $2, the current stock price is $10, the strike price is $10. The annualized risk-free rate is 2%. a) Find the put premium b) Suppose it involves a transaction cost $1.5 to short a share of the stock. Is there any arbitrage opportunity if the put premium is $3 ? If Yes, construct the arbitrage trading strategy; if No, argue why. Question 3 Consider a European call option and a European put option that have the same underlying stock, the same strike price K, and the same expiration date T. Let C denote the Call premium, P denote the Put premium, and S denote the current stock price. Suppose the risk-free borrowing rate rb is greater than the risk-free lending rate rl, i.e., rb>rl. Suppose C>P+SKerlT. Are there arbitrage opportunities? If so, describe your trading strategy. Use the binomial tree model to price a European call option on a Singapore dollar. The option expires in 6 months, and its strike price is 5.5 Hong Kong dollars. Suppose the current exchange rate of Singapore dollar is 5.6 Hong Kong dollars. The exchange rate could either rise to 5.8 in the up state, or drop to 5.3 in the down state. The annual risk-free rate in Hong Kong is 2%, the annual risk-free rate in Singapore is 1%. a) Find the current price of the call option in Hong Kong dollar. b) Suppose 1% is the annual risk-free lending rate in Singapore, and the annual risk-free borrowing rate is 1.5% in Singapore. Find the minimum upper bound and the maximum lower bound for the call premium in Hong Kong dollar such that there is no arbitrage opportunity Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started