Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a stock with an initial price of $135 and suppose that the expected value and volatility (i.e. standard deviation) of the annual log-return

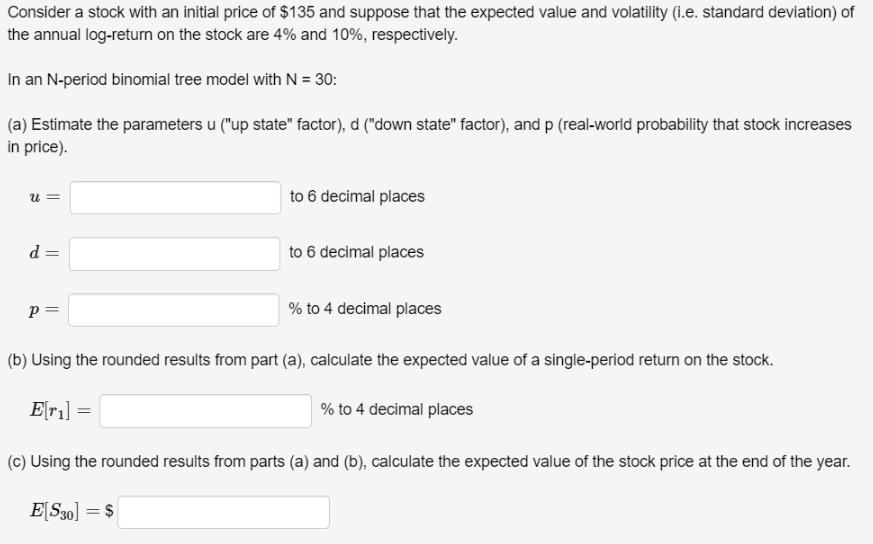

Consider a stock with an initial price of $135 and suppose that the expected value and volatility (i.e. standard deviation) of the annual log-return on the stock are 4% and 10%, respectively. In an N-period binomial tree model with N = 30: (a) Estimate the parameters u ("up state" factor), d ("down state" factor), and p (real-world probability that stock increases in price). U= d = P = to 6 decimal places to 6 decimal places % to 4 decimal places (b) Using the rounded results from part (a), calculate the expected value of a single-period return on the stock. E[r] = (c) Using the rounded results from parts (a) and (b), calculate the expected value of the stock price at the end of the year. E[S30] = $ % to 4 decimal places

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a To estimate the parameters u d and p in the binomial tree model we can use the following formulas ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started