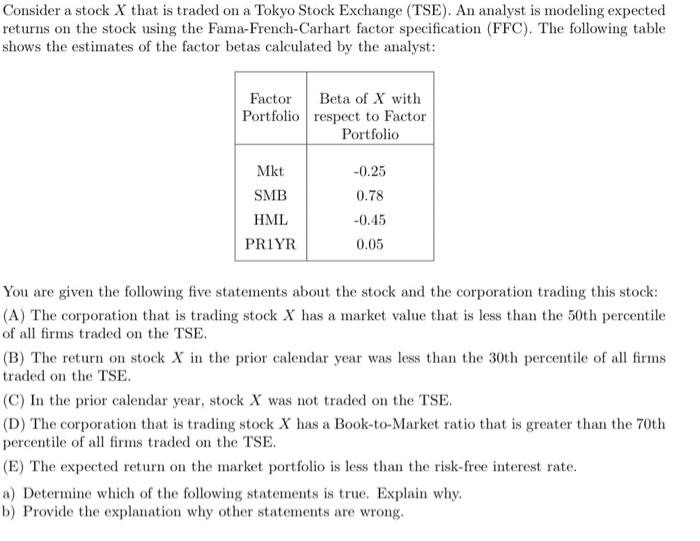

Consider a stock X that is traded on a Tokyo Stock Exchange (TSE). An analyst is modeling expected returns on the stock using the Fama-French-Carhart factor specification (FFC). The following table shows the estimates of the factor betas calculated by the analyst: Factor Beta of X with Portfolio respect to Factor Portfolio Mkt SMB HML PRIYR -0.25 0.78 -0.45 0.05 You are given the following five statements about the stock and the corporation trading this stock: (A) The corporation that is trading stock X has a market value that is less than the 50th percentile of all firms traded on the TSE. (B) The return on stock X in the prior calendar year was less than the 30th percentile of all firms traded on the TSE. (C) In the prior calendar year, stock X was not traded on the TSE. (D) The corporation that is trading stock X has a Book-to-Market ratio that is greater than the 70th percentile of all firms traded on the TSE. (E) The expected return on the market portfolio is less than the risk-free interest rate. a) Determine which of the following statements is true. Explain why, b) Provide the explanation why other statements are wrong. Consider a stock X that is traded on a Tokyo Stock Exchange (TSE). An analyst is modeling expected returns on the stock using the Fama-French-Carhart factor specification (FFC). The following table shows the estimates of the factor betas calculated by the analyst: Factor Beta of X with Portfolio respect to Factor Portfolio Mkt SMB HML PRIYR -0.25 0.78 -0.45 0.05 You are given the following five statements about the stock and the corporation trading this stock: (A) The corporation that is trading stock X has a market value that is less than the 50th percentile of all firms traded on the TSE. (B) The return on stock X in the prior calendar year was less than the 30th percentile of all firms traded on the TSE. (C) In the prior calendar year, stock X was not traded on the TSE. (D) The corporation that is trading stock X has a Book-to-Market ratio that is greater than the 70th percentile of all firms traded on the TSE. (E) The expected return on the market portfolio is less than the risk-free interest rate. a) Determine which of the following statements is true. Explain why, b) Provide the explanation why other statements are wrong