Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a ten-year coupon bond with a maturity value of $1000 that was issued eight years ago by Acme Corporation with a coupon rate

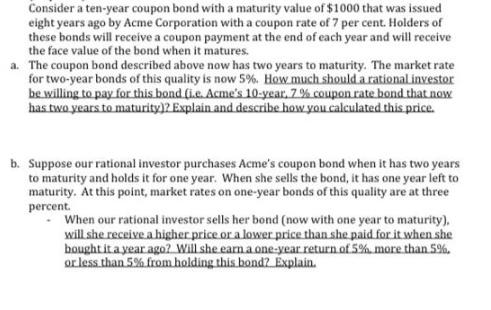

Consider a ten-year coupon bond with a maturity value of $1000 that was issued eight years ago by Acme Corporation with a coupon rate of 7 per cent. Holders of these bonds will receive a coupon payment at the end of each year and will receive the face value of the bond when it matures. a. The coupon bond described above now has two years to maturity. The market rate for two-year bonds of this quality is now 5%. How much should a rational investor be willing to pay for this bond (ie. Acme's 10-year, 7% coupon rate bond that now has two years to maturity)? Explain and describe how you calculated this price. b. Suppose our rational investor purchases Acme's coupon bond when it has two years to maturity and holds it for one year. When she sells the bond, it has one year left to maturity. At this point, market rates on one-year bonds of this quality are at three percent. - When our rational investor sells her bond (now with one year to maturity), will she receive a higher price or a lower price than she paid for it when she bought it a year ago? Will she earn a one-year return of 5% more than 5%. or less than 5% from holding this bond? Explain.

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Answer Sautions 4 Amount that a sational lovestor be wi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started