Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a two-period binomial market model for an underlying asset with price process S, at each time t. Branching from t to t +

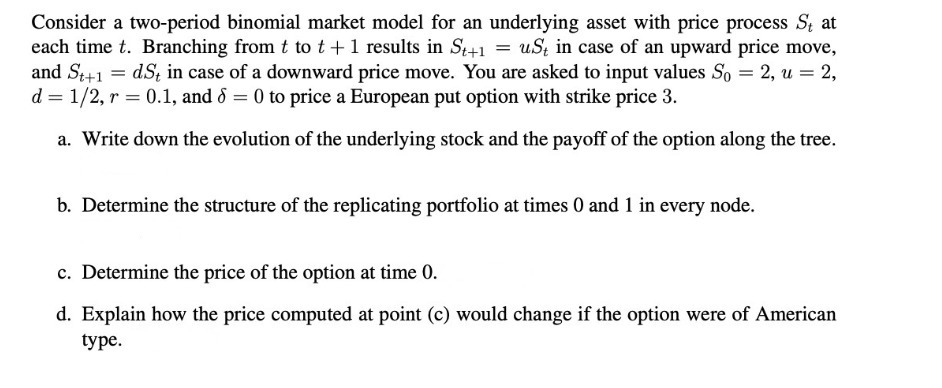

Consider a two-period binomial market model for an underlying asset with price process S, at each time t. Branching from t to t + 1 results in St+1 = ust in case of an upward price move, and St+1=dSt in case of a downward price move. You are asked to input values So = 2, u = 2, d = 1/2, r = 0.1, and 8 = 0 to price a European put option with strike price 3. a. Write down the evolution of the underlying stock and the payoff of the option along the tree. b. Determine the structure of the replicating portfolio at times 0 and 1 in every node. c. Determine the price of the option at time 0. d. Explain how the price computed at point (c) would change if the option were of American type.

Step by Step Solution

★★★★★

3.44 Rating (138 Votes )

There are 3 Steps involved in it

Step: 1

a Evolution of the underlying stock At time 0 S0 2 At time 1 upward move S1u 22 4 At time 1 downward ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started