Consider a two-period model in which an individual needs to decide how much to consume in the present, c, and how much to consume

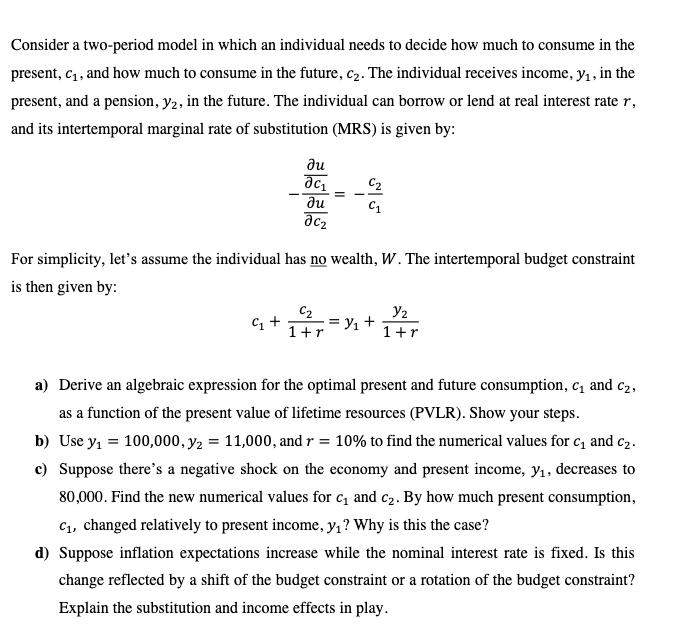

Consider a two-period model in which an individual needs to decide how much to consume in the present, c, and how much to consume in the future, c. The individual receives income, y, in the present, and a pension, y2, in the future. The individual can borrow or lend at real interest rate r, and its intertemporal marginal rate of substitution (MRS) is given by: = C2 -- C1 For simplicity, let's assume the individual has no wealth, W. The intertemporal budget constraint is then given by: C2 Y2 1+r 1+r a) Derive an algebraic expression for the optimal present and future consumption, c and c, as a function of the present value of lifetime resources (PVLR). Show your steps. b) Use y = 100,000, y = 11,000, and r = 10% to find the numerical values for c and c. c) Suppose there's a negative shock on the economy and present income, y, decreases to 80,000. Find the new numerical values for c and c. By how much present consumption, C, changed relatively to present income, y? Why is this the case? d) Suppose inflation expectations increase while the nominal interest rate is fixed. Is this change reflected by a shift of the budget constraint or a rotation of the budget constraint? Explain the substitution and income effects in play.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Ill address each part of this question stepbystep a To derive an algebraic expression for optimal c ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started