Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a two-period model with no discounting. A firm is com- posed of a main division (parent) and a fully-owned subsidiary division (subsidiary). The

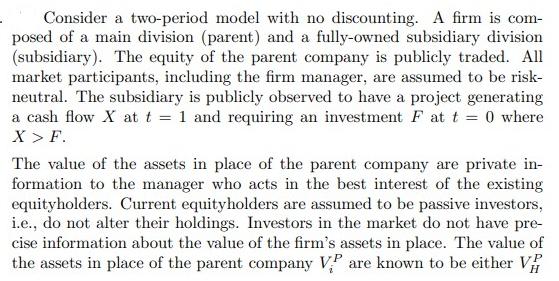

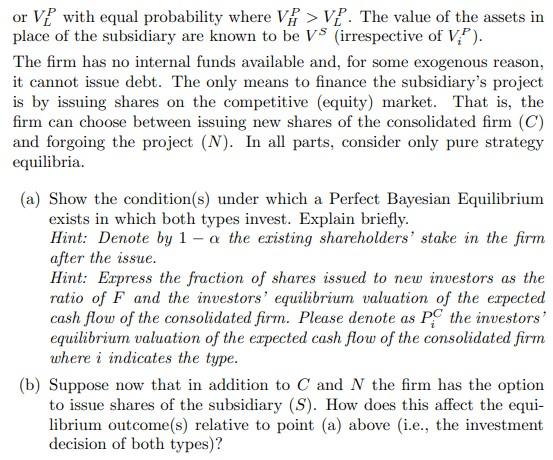

Consider a two-period model with no discounting. A firm is com- posed of a main division (parent) and a fully-owned subsidiary division (subsidiary). The equity of the parent company is publicly traded. All market participants, including the firm manager, are assumed to be risk- neutral. The subsidiary is publicly observed to have a project generating a cash flow X at t = 1 and requiring an investment F at t = 0 where X > F. The value of the assets in place of the parent company are private in- formation to the manager who acts in the best interest of the existing equityholders. Current equityholders are assumed to be passive investors, i.e., do not alter their holdings. Investors in the market do not have pre- cise information about the value of the firm's assets in place. The value of the assets in place of the parent company VP are known to be either V or V with equal probability where V>VP. The value of the assets in place of the subsidiary are known to be VS (irrespective of VP). The firm has no internal funds available and, for some exogenous reason, it cannot issue debt. The only means to finance the subsidiary's project is by issuing shares on the competitive (equity) market. That is, the firm can choose between issuing new shares of the consolidated firm (C) and forgoing the project (N). In all parts, consider only pure strategy equilibria. (a) Show the condition(s) under which a Perfect Bayesian Equilibrium exists in which both types invest. Explain briefly. Hint: Denote by 1-a the existing shareholders' stake in the firm after the issue. Hint: Express the fraction of shares issued to new investors as the ratio of F and the investors' equilibrium valuation of the expected cash flow of the consolidated firm. Please denote as PC the investors' equilibrium valuation of the expected cash flow of the consolidated firm where i indicates the type. (b) Suppose now that in addition to C and N the firm has the option to issue shares of the subsidiary (S). How does this affect the equi- librium outcome(s) relative to point (a) above (i.e., the investment decision of both types)?

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

In order to determine the conditions under which a Perfect Bayesian Equilibrium PBE exists in which both types invest we need to analyze the decisionm...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started