Answered step by step

Verified Expert Solution

Question

1 Approved Answer

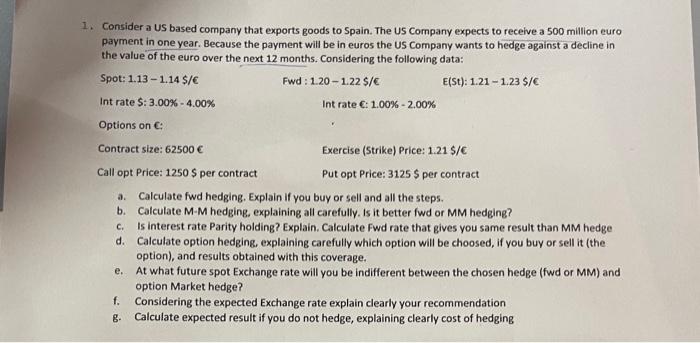

Consider a US based company that exports goods to Spain. The US Company expects to receive a 500 million euro payment in one year. Because

Consider a US based company that exports goods to Spain. The US Company expects to receive a 500 million euro payment in one year. Because the payment will be in euros the US Company wants to hedge against a decline in the value of the euro over the next 12 months. Considering the following data:

Spot: 1.13 - 1.14 S/

Fwd: 1.20 - 1.22 $/E

E(St): 1.21 -1.23 $/

Int rate $: 3.00% - 4.00%

Int rate : 1.00% - 2.00%

Options on :

Contract size: 62500

Exercise (Strike) Price: 1.21 $/

Call opt Price: 1250 $ per contract

Put opt Price: 3125 $ per contract

a. Calculate fwd hedging. Explain if you buy or sell and all the steps.

b. Calculate M-M hedging, explaining all carefully. Is it better fwd or MM hedging?

c. Is interest rate Parity holding? Explain. Calculate Fwd rate that gives you same result than MM hedge.

d. Calculate option hedging, explaining carefully which option will be choosed, if you buy or sell it (the option), and results obtained with this coverage.

e. At what future spot Exchange rate will you be indifferent between the chosen hedge (fwd or MM) and option Market hedge?

f. Considering the expected Exchange rate explain clearly your recommendation.

g. Calculate expected result if you do not hedge, explaining clearly cost of hedging.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started