Answered step by step

Verified Expert Solution

Question

1 Approved Answer

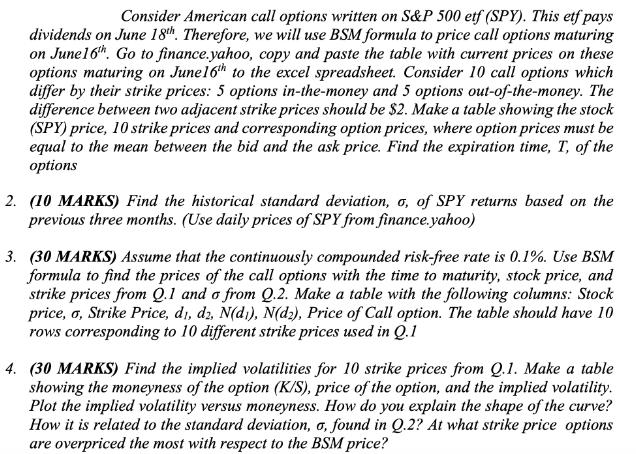

Consider American call options written on S&P 500 etf (SPY). This etf pays dividends on June 18th. Therefore, we will use BSM formula to

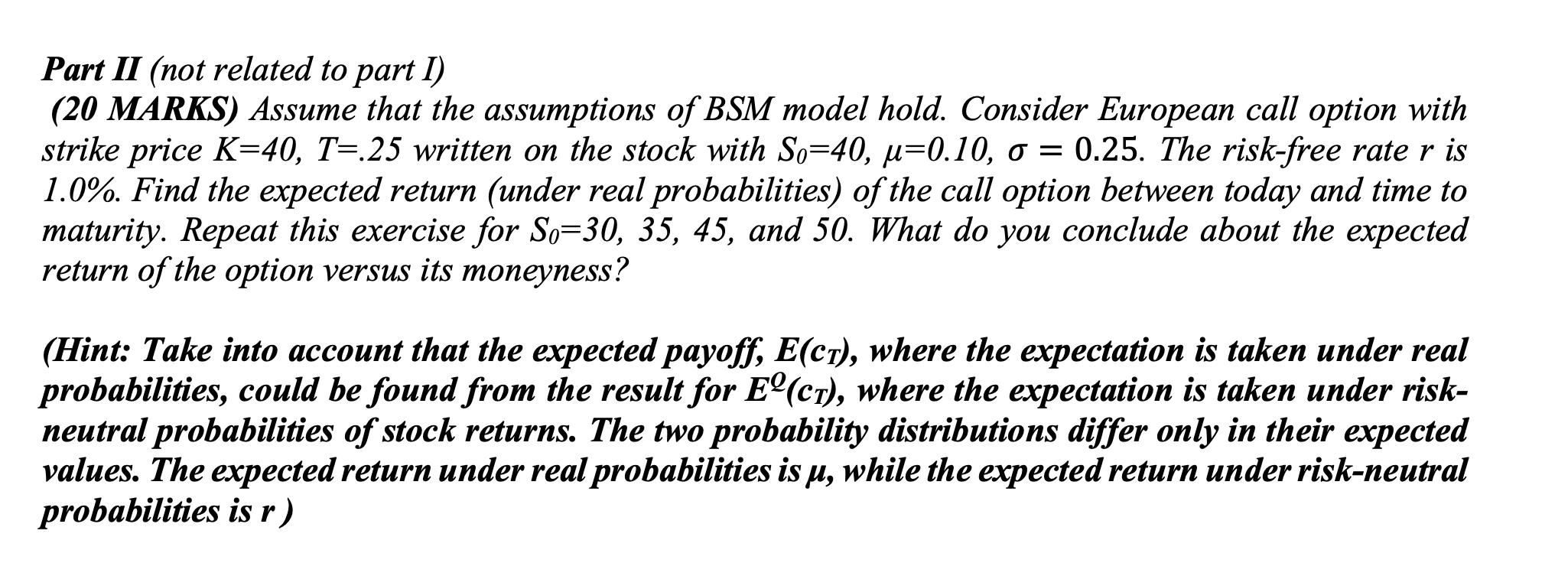

Consider American call options written on S&P 500 etf (SPY). This etf pays dividends on June 18th. Therefore, we will use BSM formula to price call options maturing on June 16h. Go to finance.yahoo, copy and paste the table with current prices on these options maturing on June 16th to the excel spreadsheet. Consider 10 call options which differ by their strike prices: 5 options in-the-money and 5 options out-of-the-money. The difference between two adjacent strike prices should be $2. Make a table showing the stock (SPY) price, 10 strike prices and corresponding option prices, where option prices must be equal to the mean between the bid and the ask price. Find the expiration time, T, of the options 2. (10 MARKS) Find the historical standard deviation, o, of SPY returns based on the previous three months. (Use daily prices of SPY from finance.yahoo) 3. (30 MARKS) Assume that the continuously compounded risk-free rate is 0.1%. Use BSM formula to find the prices of the call options with the time to maturity, stock price, and strike prices from Q.1 and a from Q.2. Make a table with the following columns: Stock price, o, Strike Price, di, d2, N(d), N(d2), Price of Call option. The table should have 10 rows corresponding to 10 different strike prices used in Q.1 4. (30 MARKS) Find the implied volatilities for 10 strike prices from Q.1. Make a table showing the moneyness of the option (K/S), price of the option, and the implied volatility. Plot the implied volatility versus moneyness. How do you explain the shape of the curve? How it is related to the standard deviation, o, found in Q.2? At what strike price options are overpriced the most with respect to the BSM price? Part II (not related to part I) (20 MARKS) Assume that the assumptions of BSM model hold. Consider European call option with strike price K-40, T=.25 written on the stock with So=40, =0.10, o = 0.25. The risk-free rate r is 1.0%. Find the expected return (under real probabilities) of the call option between today and time to maturity. Repeat this exercise for So=30, 35, 45, and 50. What do you conclude about the expected return of the option versus its moneyness? (Hint: Take into account that the expected payoff, E(Cr), where the expectation is taken under real probabilities, could be found from the result for E(CT), where the expectation is taken under risk- neutral probabilities of stock returns. The two probability distributions differ only in their expected values. The expected return under real probabilities is u, while the expected return under risk-neutral probabilities is r)

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Here are the detailed steps and calculations for each part of the question 1 SPY option prices from Yahoo Finance on 6102022 Strike Price Option Price ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started