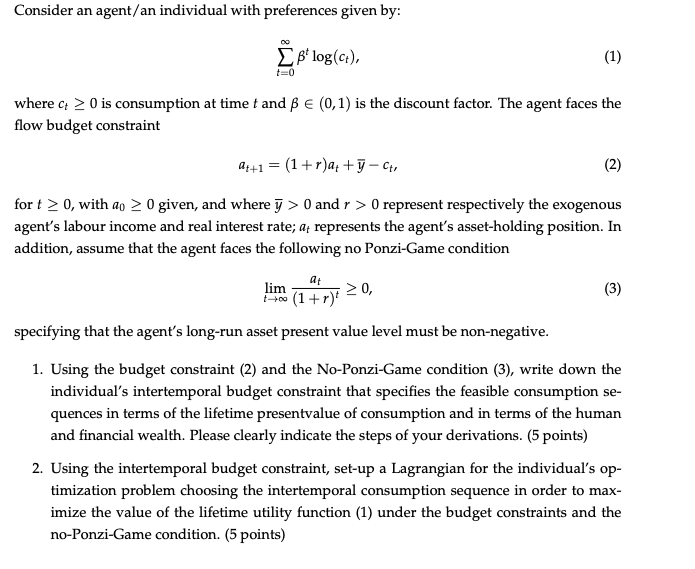

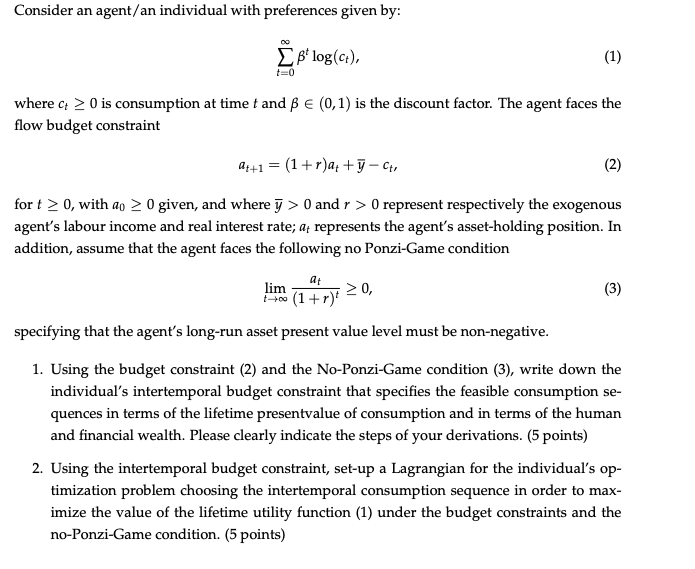

Consider an agent/an individual with preferences given by: * log(C:), (1) t=0 where ct > 0 is consumption at time t and B (0,1) is the discount factor. The agent faces the flow budget constraint +1 = (1+r)a: + y - (2) for t > 0, with ao 20 given, and where y > 0 and r > 0 represent respectively the exogenous agent's labour income and real interest rate; at represents the agent's asset-holding position. In addition, assume that the agent faces the following no Ponzi-Game condition lim (145): 20, , (3) +r specifying that the agent's long-run asset present value level must be non-negative. ) 1. Using the budget constraint (2) and the No-Ponzi-Game condition (3), write down the individual's intertemporal budget constraint that specifies the feasible consumption se- quences in terms of the lifetime presentvalue of consumption and in terms of the human and financial wealth. Please clearly indicate the steps of your derivations. (5 points) 2. Using the intertemporal budget constraint, set-up a Lagrangian for the individual's op- timization problem choosing the intertemporal consumption sequence in order to max- imize the value of the lifetime utility function (1) under the budget constraints and the no-Ponzi-Game condition. (5 points) Consider an agent/an individual with preferences given by: * log(C:), (1) t=0 where ct > 0 is consumption at time t and B (0,1) is the discount factor. The agent faces the flow budget constraint +1 = (1+r)a: + y - (2) for t > 0, with ao 20 given, and where y > 0 and r > 0 represent respectively the exogenous agent's labour income and real interest rate; at represents the agent's asset-holding position. In addition, assume that the agent faces the following no Ponzi-Game condition lim (145): 20, , (3) +r specifying that the agent's long-run asset present value level must be non-negative. ) 1. Using the budget constraint (2) and the No-Ponzi-Game condition (3), write down the individual's intertemporal budget constraint that specifies the feasible consumption se- quences in terms of the lifetime presentvalue of consumption and in terms of the human and financial wealth. Please clearly indicate the steps of your derivations. (5 points) 2. Using the intertemporal budget constraint, set-up a Lagrangian for the individual's op- timization problem choosing the intertemporal consumption sequence in order to max- imize the value of the lifetime utility function (1) under the budget constraints and the no-Ponzi-Game condition. (5 points)