Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider an all-equity financed company worth $100,000 today (in to). By the end of one year (in t1), the market value will have increased

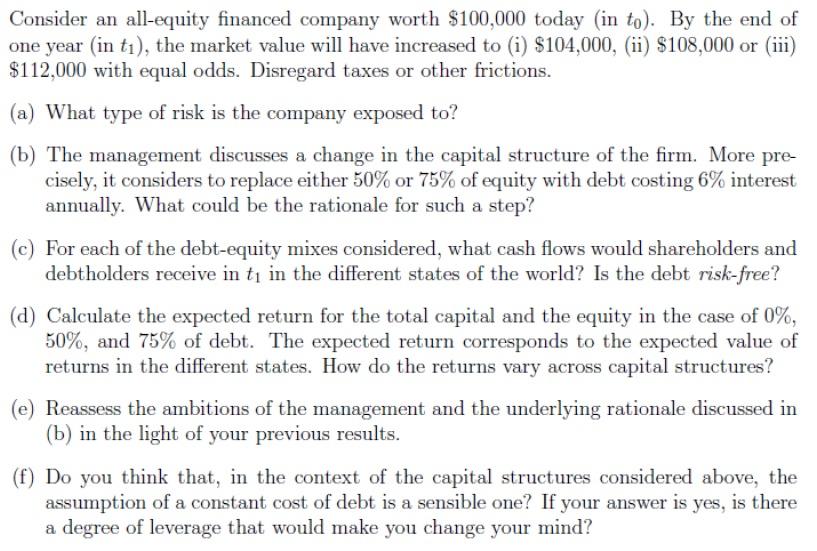

Consider an all-equity financed company worth $100,000 today (in to). By the end of one year (in t1), the market value will have increased to (i) $104,000, (ii) $108,000 or (iii) $112,000 with equal odds. Disregard taxes or other frictions. (a) What type of risk is the company exposed to? (b) The management discusses a change in the capital structure of the firm. More pre- cisely, it considers to replace either 50% or 75% of equity with debt costing 6% interest annually. What could be the rationale for such a step? (c) For each of the debt-equity mixes considered, what cash flows would shareholders and debtholders receive in ti in the different states of the world? Is the debt risk-free? (d) Calculate the expected return for the total capital and the equity in the case of 0%, 50%, and 75% of debt. The expected return corresponds to the expected value of returns in the different states. How do the returns vary across capital structures? (e) Reassess the ambitions of the management and the underlying rationale discussed in (b) in the light of your previous results. (f) Do you think that, in the context of the capital structures considered above, the assumption of a constant cost of debt is a sensible one? If your answer is yes, is there a degree of leverage that would make you change your mind?

Step by Step Solution

★★★★★

3.32 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Part a The company is exposed to market risk Its market value will differ across different states Pa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started