Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider an all-equity financed firm, with 1 million shares outstanding, a required return on equity of 10%, and expected earnings of $10 million/year, in

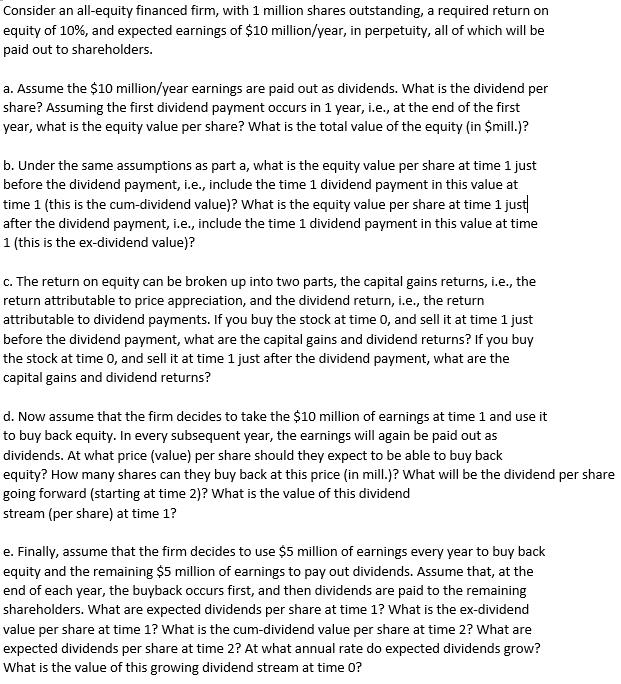

Consider an all-equity financed firm, with 1 million shares outstanding, a required return on equity of 10%, and expected earnings of $10 million/year, in perpetuity, all of which will be paid out to shareholders. a. Assume the $10 million/year earnings are paid out as dividends. What is the dividend per share? Assuming the first dividend payment occurs in 1 year, i.e., at the end of the first year, what is the equity value per share? What is the total value of the equity (in $mill.)? b. Under the same assumptions as part a, what is the equity value per share at time 1 just before the dividend payment, i.e., include the time 1 dividend payment in this value at time 1 (this is the cum-dividend value)? What is the equity value per share at time 1 just after the dividend payment, i.e., include the time 1 dividend payment in this value at time 1 (this is the ex-dividend value)? c. The return on equity can be broken up into two parts, the capital gains returns, i.e., the return attributable to price appreciation, and the dividend return, i.e., the return attributable to dividend payments. If you buy the stock at time 0, and sell it at time 1 just before the dividend payment, what are the capital gains and dividend returns? If you buy the stock at time 0, and sell it at time 1 just after the dividend payment, what are the capital gains and dividend returns? d. Now assume that the firm decides to take the $10 million of earnings at time 1 and use it to buy back equity. In every subsequent year, the earnings will again be paid out as dividends. At what price (value) per share should they expect to be able to buy back equity? How many shares can they buy back at this price (in mill.)? What will be the dividend per share going forward (starting at time 2)? What is the value of this dividend stream (per share) at time 1? e. Finally, assume that the firm decides to use $5 million of earnings every year to buy back equity and the remaining $5 million of earnings to pay out dividends. Assume that, at the end of each year, the buyback occurs first, and then dividends are paid to the remaining shareholders. What are expected dividends per share at time 1? What is the ex-dividend value per share at time 1? What is the cum-dividend value per share at time 2? What are expected dividends per share at time 2? At what annual rate do expected dividends grow? What is the value of this growing dividend stream at time 0?

Step by Step Solution

★★★★★

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION NUMBER OF SHARES 1 MILLION REQUIRED RETURN ON EQUITY 10 EXPECTED EARNING 10 MILLION YEAR PARTA ALL EARNING PAID AS DIVIDEND EARNING PER SHARE ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started