Question

Consider an all-equity firm CBA. The company's market value is $2,500,000 (2.5m). It is expected to earn EBIT of $250,000 (250k) forever. Assume further

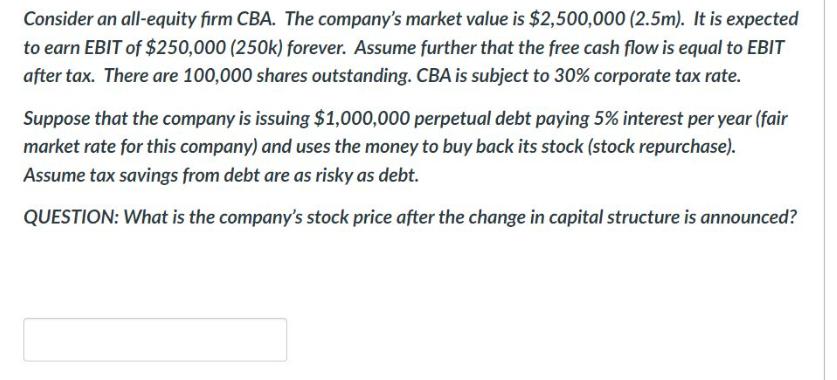

Consider an all-equity firm CBA. The company's market value is $2,500,000 (2.5m). It is expected to earn EBIT of $250,000 (250k) forever. Assume further that the free cash flow is equal to EBIT after tax. There are 100,000 shares outstanding. CBA is subject to 30% corporate tax rate. Suppose that the company is issuing $1,000,000 perpetual debt paying 5% interest per year (fair market rate for this company) and uses the money to buy back its stock (stock repurchase). Assume tax savings from debt are as risky as debt. QUESTION: What is the company's stock price after the change in capital structure is announced?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the companys stock price after the change in capital structure is announced we need to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Management

Authors: Eugene F. Brigham, Joel F. Houston

12th edition

978-0324597714, 324597711, 324597703, 978-8131518571, 8131518574, 978-0324597707

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App